EUR/USD Price Forecast: Climbs beyond 1.0500, eyes 100-day SMA on German election results

- EUR/USD attracts fresh buyers and climbs to a nearly one-month high amid a bearish USD.

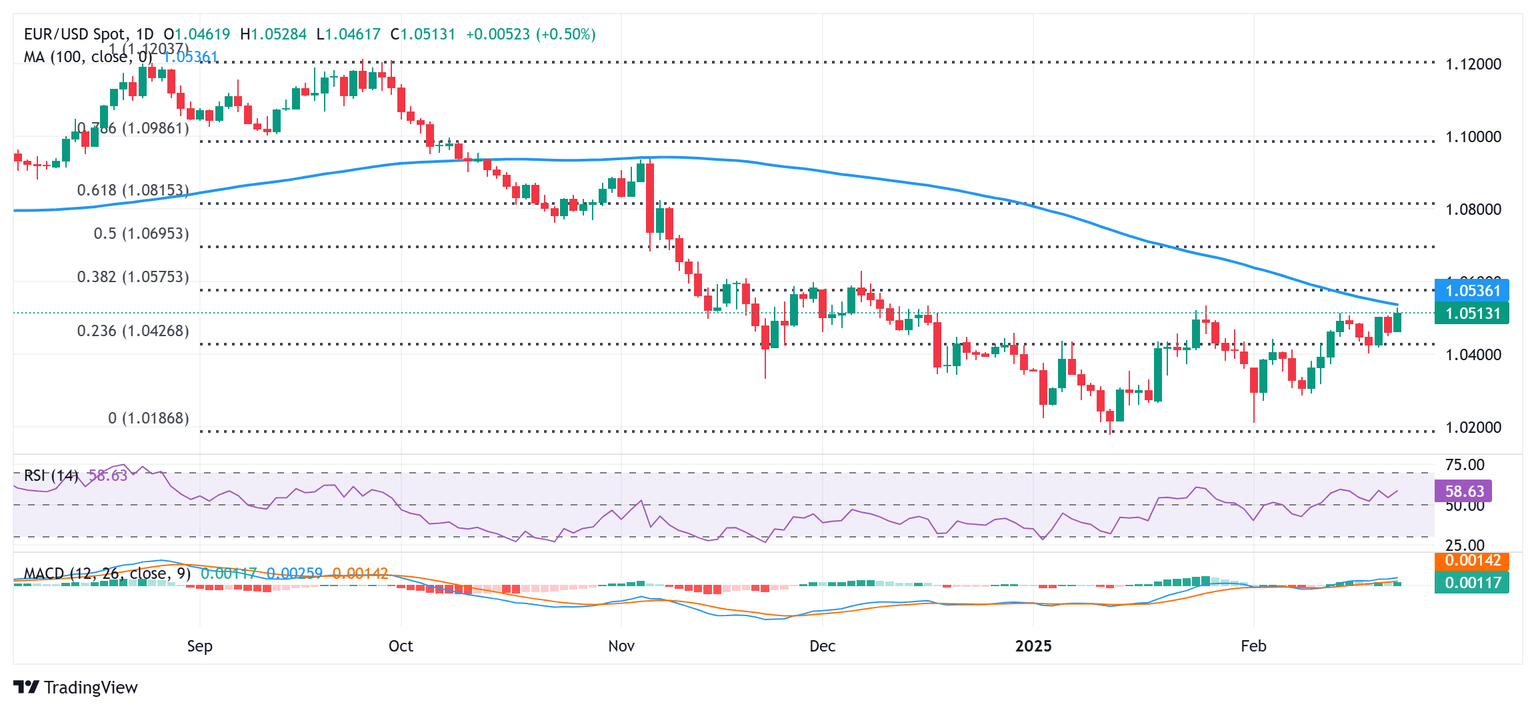

- The technical setup favors bullish traders and supports prospects for further appreciation.

- It will be prudent to wait for a break above the 100-day SMA before placing fresh bullish bets.

The EUR/USD pair regains positive traction at the start of a new week and hits a near one-month top, around the 1.0525-1.0530 area during the Asian session amid renewed US Dollar (USD) selling bias. Moreover, conservatives' victory in the German election boosts the shared currency and further lends support to spot prices, with bulls awaiting a move beyond the 100-day Simple Moving Average (SMA) before placing fresh bets.

Given that oscillators on the daily chart have just started gaining positive traction, a sustained break through the said barrier, currently pegged near the 1.0535-1.0540 region, will be seen as a fresh trigger for bulls. The subsequent move up could lift the EUR/USD pair to the 38.2% Fibonacci retracement level of the September-January downfall, around the 1.0600 neighborhood en route to the December swing high, around the 1.0620 area.

Some follow-through should pave the way for additional gains toward reclaiming the 1.0700 mark, which coincides with the 50% retracement level. The momentum could extend further to the 1.0750-1.0755 hurdle before the EUR/USD pair aims to surpass the 1.0800 round figure and test the 61.8% Fibo. level, around the 1.0815 region.

On the flip side, weakness back below the 1.0500 psychological mark might continue to attract dip-buyers near the 1.0465-1.0460 area. This should help limit the downside for the EUR/USD pair near the 1.0420-1.0415 region, or the 23.6% Fibo. level. That said, some follow-through selling, leading to a subsequent break below the 1.0400 round figure, could drag spot prices to the 1.0340 intermediate support en route to the 1.0300 mark.

A convincing break below the latter would shift the near-term bias in favor of bearish traders and make the EUR/USD pair vulnerable to accelerate the fall towards the 1.0265-1.0260 region. Spot prices could eventually weaken below the 1.0200 mark and test the 1.0180-1.0175 area, or the lowest level since November 2022 touched last month.

Economic Indicator

Core Harmonized Index of Consumer Prices (YoY)

The Core Harmonized Index of Consumer Prices (HICP) measures changes in the prices of a representative basket of goods and services in the European Monetary Union. The HICP, – released by Eurostat on a monthly basis, is harmonized because the same methodology is used across all member states and their contribution is weighted. The YoY reading compares prices in the reference month to a year earlier. Core HICP excludes volatile components like food, energy, alcohol, and tobacco. The Core HICP is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as bullish for the Euro (EUR), while a low reading is seen as bearish.

Read more.Next release: Mon Feb 24, 2025 10:00

Frequency: Monthly

Consensus: 2.7%

Previous: 2.7%

Source: Eurostat

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.