EUR/USD Price Analysis: Tuesday’s Doji prods Euro bears around 1.0900 ahead of Fed Minutes

- EUR/USD remains depressed around intraday low after failing to stop sellers the previous day.

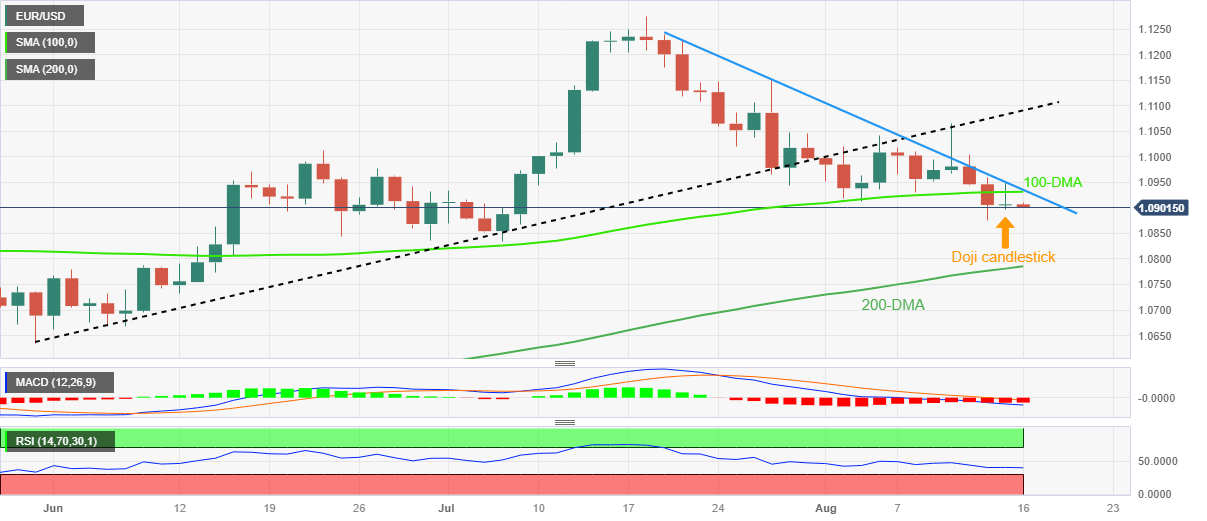

- Doji candlestick, nearly oversold RSI test Euro bears as the key FOMC Minutes loom.

- Bearish MACD signals, 1.0930-352 resistance confluence challenge recovery moves.

- Fed Minutes need to ring hawkish bells to direct Euro bears toward 200-DMA.

EUR/USD holds lower grounds near 1.0900, poking the intraday bottom amid early Wednesday in Asia. In doing so, the Euro pair struggles for clear directions amid the cautious mood ahead of the Federal Open Market Committee’s (FOMC) Monetary Policy Meeting Minutes. Also likely to challenge the Euro bears is the Doji candlestick marked the previous day, as well as the nearly oversold RSI (14) line. As a result, the Euro bears need a strong hawkish tone from the Fed Minutes to defend the one-month-old downside trend.

Also read: EUR/USD Forecast: Continued bearish pressure persists amid Dollar strength

It’s worth noting that the bearish MACD signals and the quote’s sustained trading below the 100-DMA, as well as a one-month-old falling trend line, joins the early month’s downside break of an ascending trend line from late May to keep the EUR/USD sellers hopeful.

That said, a seven-week-old horizontal support region around 1.0845–35 restricts immediate downside of the EUR/USD pair, a break of which will direct the south-run towards the 200-DMA support of 1.0785.

On the flip side, a convergence of the 100-DMA and a downward-sloping trend line from July 19 guards the EUR/USD pair’s recovery around 1.0930-35 zone.

Following that, the support-turned-resistance line of around 1.1095 and the 1.1100 round figure will lure the EUR/USD bulls.

EUR/USD: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.