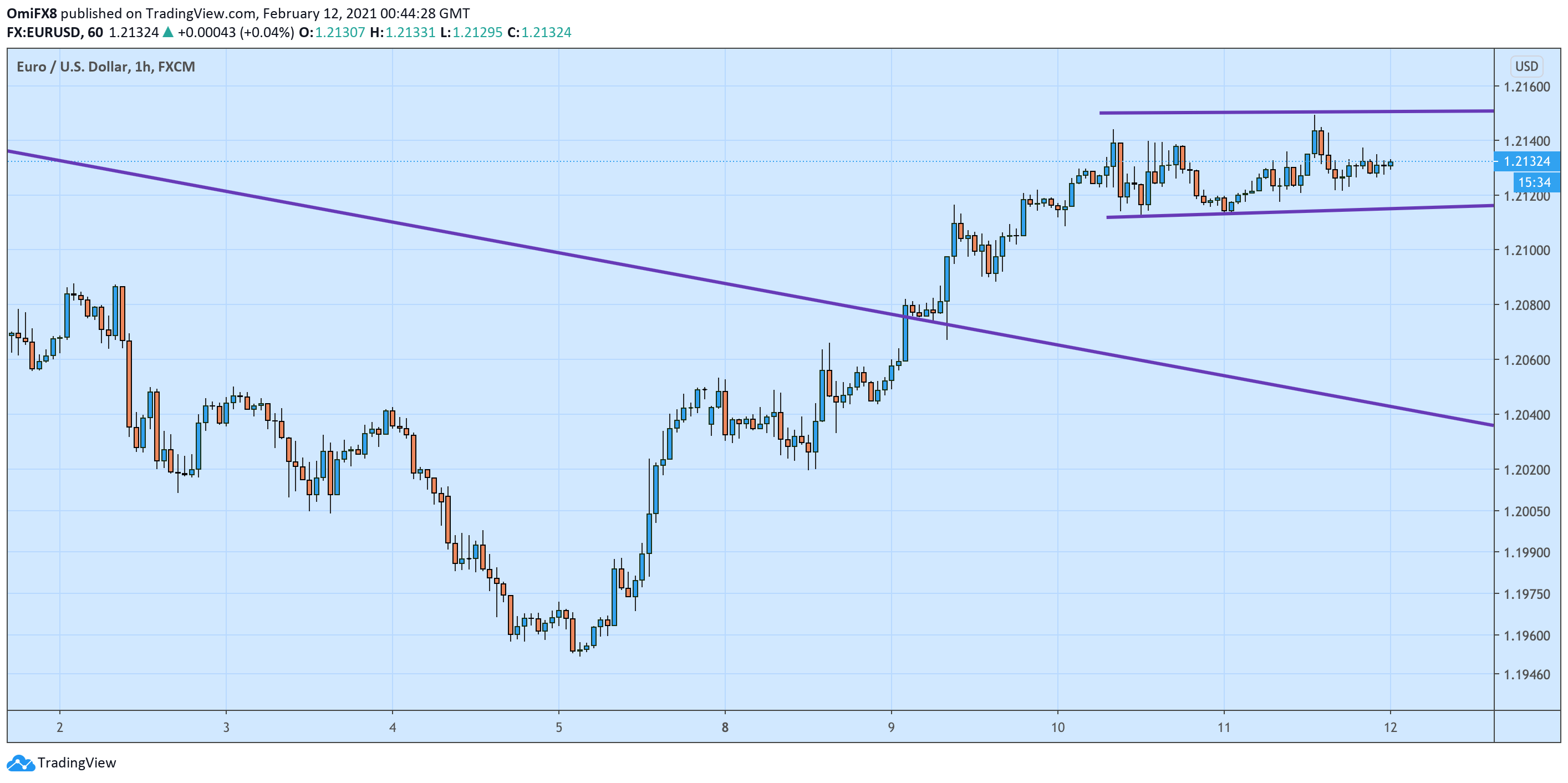

EUR/USD is being squeeze in a narrow range since Wednesday's early European trading hours.

While the upside has been capped around 1.2150, the bears have failed to push the pair below 1.2110. A breakout/breakdown from the newfound range would open the doors for at least a 40-pip bullish/bearish move.

A range breakout looks likely as the MACD histogram has turned bullish for first since December. Further, the 40-pip looks like a bullish continuation pattern when viewed against the backdrop of Tuesday's upward break of the descending trendline connecting Jan. 6 and Jan. 29 highs.

A move above 1.2150 would expose resistance at the Jan. 22 high of 1.2191. On the flip side, a break below 1.2110 would shift risk in favor of a drop toward 1.2050.

Hourly chart

Trend: Bullish

Technical levels

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD regains traction toward 0.6300 after RBA Governor Bullock's presser

AUD/USD is marching back toward 0.6300 in Tuesday's Asian trading, capitalizing on RBA Governor Bullock's prudence amid global uncertainties. The Australian central bank warranted caution on the inflation outlook while maintaining the key rate at 4.1% earleir in the session.

Gold price extends bullish trend amid rising trade tensions; fresh record high and counting

Gold price continues to scale new record highs for the fourth straight day on Tuesday. Worries about the widening global trade war and geopolitical risks boost the commodity. Fed rate cut bets weigh on the USD and further benefit the non-yielding yellow metal.

USD/JPY trades on the backfoot below 150.00 amid trade war fears

USD/JPY edges lower in the Asian session on Tuesday as hawkish BoJ expectations continue to offer some support to the Japanese Yen. Subdued US Dollar price action weighs on the pair. Concerns over Trump's tariffs and its impact on the global economic growth remain a drag on the pair.

Ethereum: Short-term holders spark $400 million in realized losses, staking flows surge

Ethereum bounced off the $1,800 support on Monday following increased selling pressure from short-term holders and tensions surrounding President Donald Trump's reciprocal tariff kick-off on April 2.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.