- For the Fed minutes and sessions ahead, the pair could be based here and result in a higher correction from support.

- Anything uber hawkish from the Fed minutes is likely to support the greenback and potentially send the euro below 1.0640 towards a daily 61.8% ratio down at 1.0615.

The US dollar is higher vs. major trading partners early Wednesday ahead of Federal Reserve minutes that are released at the top of the hour. The board members that have spoken this week have been less hawkish if not slightly dovish in terms of how fast rates should be increased later in the year. However, an increase of 50 basis points remains the expected outcome at the June 14-15 meeting and the minutes will be important for central bank observers seeking confirmation of that as well as an insight into subsequent meetings.

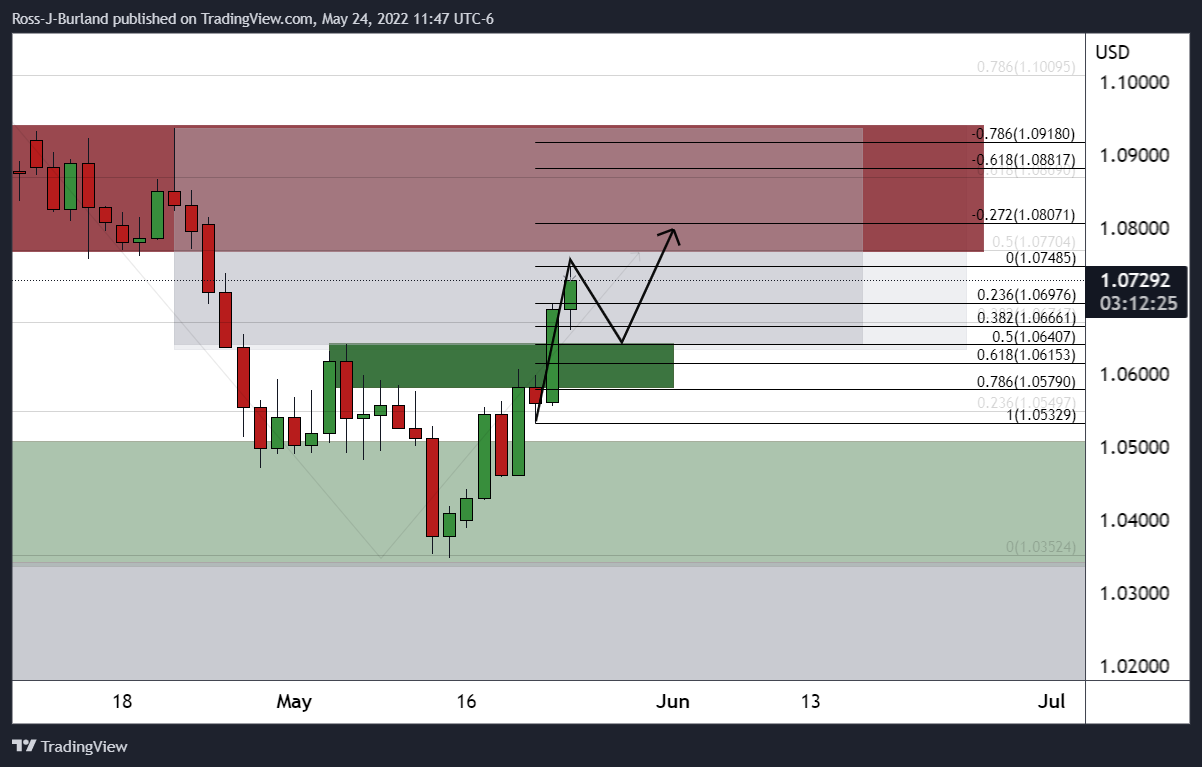

Nevertheless, the dovishness from some officials, coupled with European Central Bank President Christine Lagarde suggesting in a blog that the first ECB rate hike could occur in July, has pulled the rug from under the US dollar bulls and enabled the euro to correct in a significant manner toward a key zone on the weekly chart as per the prior analysis, EUR/USD Price Analysis: Bulls charge towards a critical weekly 50% mean reversion mile-stone, and as follows:

EUR/USD weekly chart

EUR/USD H4 chart

The 4-hour time frame confirms the prior analysis on the daily chart as follows where the W-formation on the weekly chart was noted as a potential meanwhile bearish factor:

However, at this juncture, the weekly W-formation should be noted:

''This is a reversion pattern and the price would be expected to revisit the neckline in due course. In the meantime, the daily impulse could be due for a meanwhile correction also:

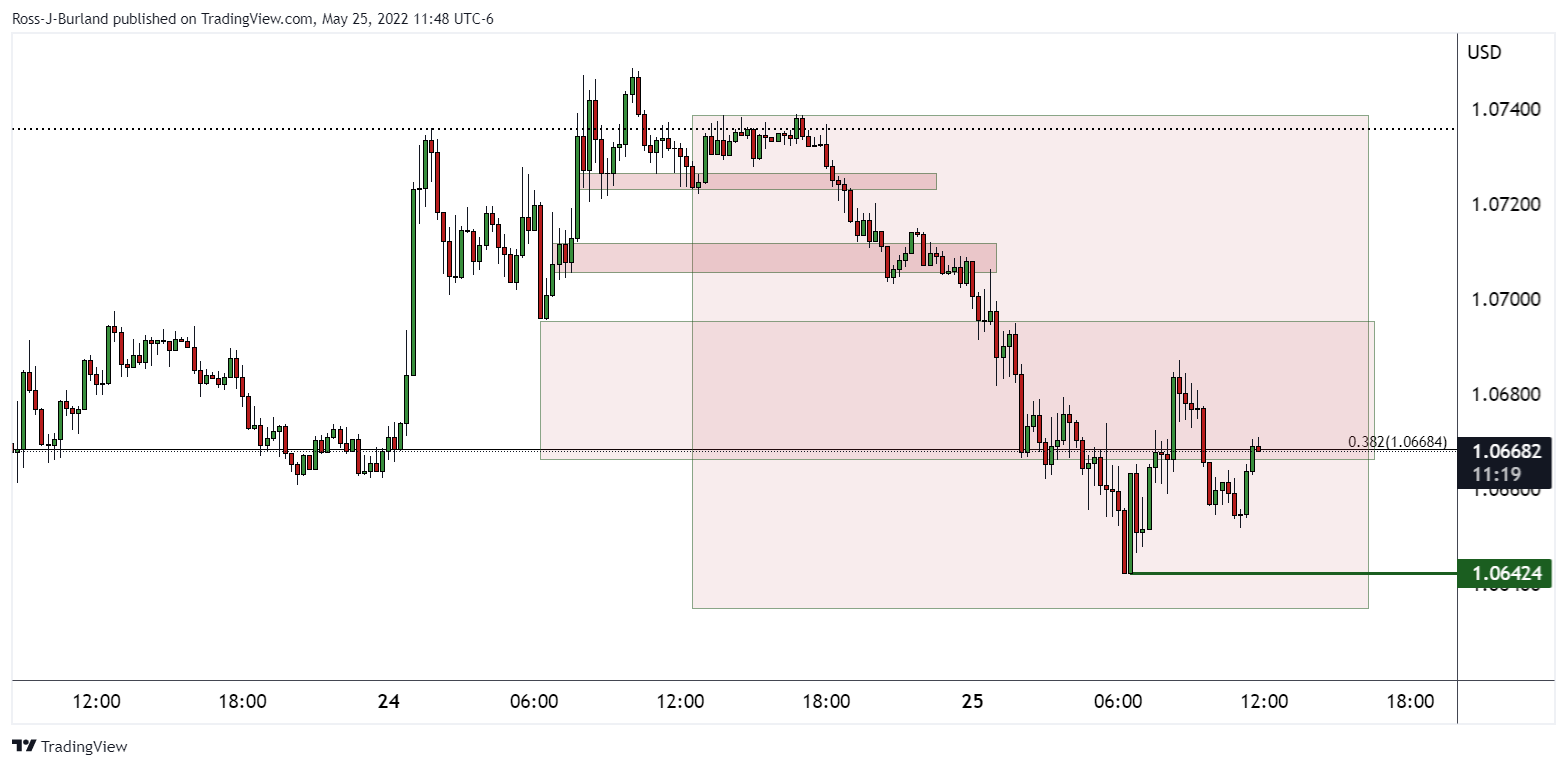

The move to the downside was projected from a 15-min time frame perspective as follows:

EUR/USD M15 chart, prior analysis

''The bearish head and shoulders are a topping pattern that currently features in the 15-min time frame. A break of the neckline near 1.0725 could spell trouble for the committed bulls. A break of 1.0705 will likely open the way for further supply to mitigate the price imbalance towards a 38.2% Fibonacci retracement of the daily bullish breakout impulse near 1.0665 that guards a 50% mean reversion to 1.0640.''

Live update:

For the minutes and sessions ahead, the pair could be based here and result in a higher correction from support:

However, anything uber hawkish is likely to support the greenback and potentially send the euro below 1.0640 towards a daily 61.8% ratio down at 1.0615 or deeper into the support area and nearer to a 78.6% ratio near 1.0580 in due course:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD remains vulnerable near 26-month low amid bullish USD

AUD/USD holds steady above the 0.6200 mark on Friday, though it remains close to its lowest level since October 2022 touched the previous day. The USD hovers near a two-year top on the back of the Fed's hawkish signal and a weaker risk tone. Furthermore, the RBA's dovish shift, concerns about China's economic recovery and trade war fears undermine the Aussie.

USD/JPY advances to a five-week high, around 158.00 neighborhood

USD/JPY hit a five-month top on Friday in the wake of the Fed's hawkish outlook and the BoJ's decision to keep interest rates steady. Bulls largely shrugged off data showing that Japan's National CPI rose in November, which bodes well for an additional interest rate hike by the BoJ.

Gold price oscillates in a range below $2,600 amid mixed cues

Gold price consolidates below the $2,600 mark following the previous day's good two-way price move and remains close to over a one-month low. The Fed signaled a cautious path of policy easing next year, which remains supportive of elevated US bond yields and assists the USD in standing firm near a two-year high.

Bitcoin's trajectory shows similarities with previous cycles as long-term holders book profits of $2.1 billion

Glassnode's Week on Chain report revealed the similarities between the current Bitcoin uptrend and previous cycles amid changing market conditions. Meanwhile, long-term investors began distributing their tokens at the $100K level, culminating in a new all-time high of $2.1 billion in realized profits.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.