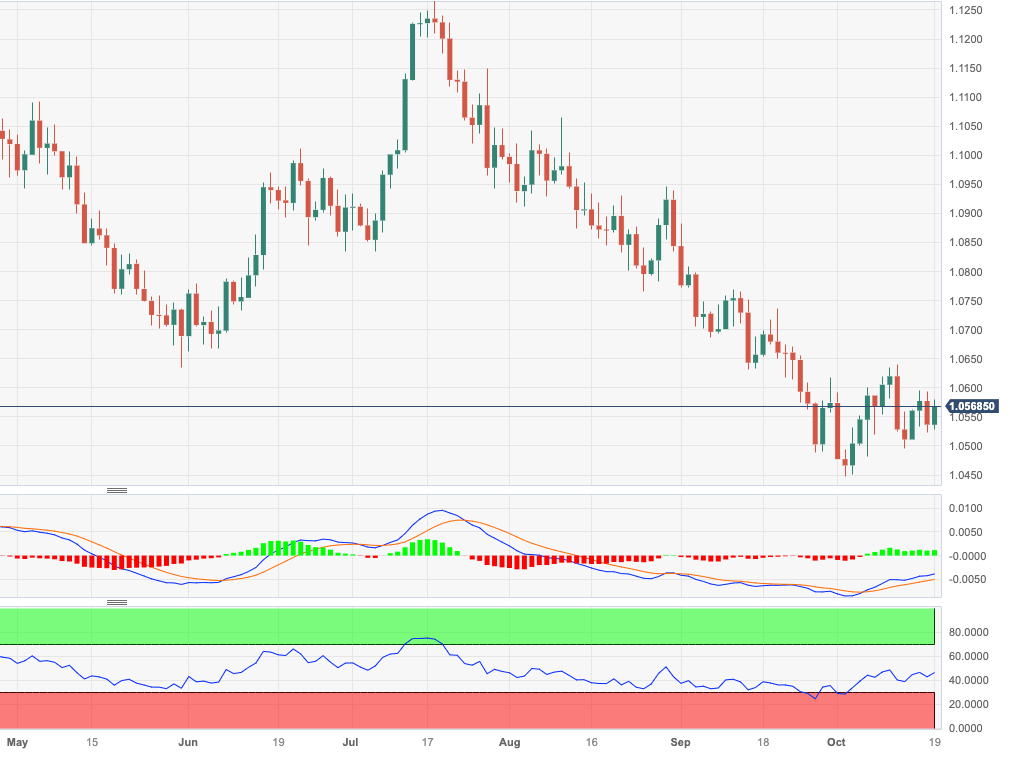

EUR/USD Price Analysis: There is an initial hurdle around 1.0640

- EUR/USD regains the smile and reverses Wednesday’s decline.

- Extra recovery could see the monthly high around 1.0640 revisited.

EUR/USD keeps the weekly choppiness well in place and now regains the 1.0570 region following Wednesday’s daily decline.

In case the recovery gathers a more serious pace, then the pair is expected to challenge the October high at 1.0639 (October 12) prior to a probable move to the transitory 55-day SMA at 1.0721.

Meanwhile, further losses remain on the table as long as the pair navigates the area below the key 200-day SMA at 1.0819.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.