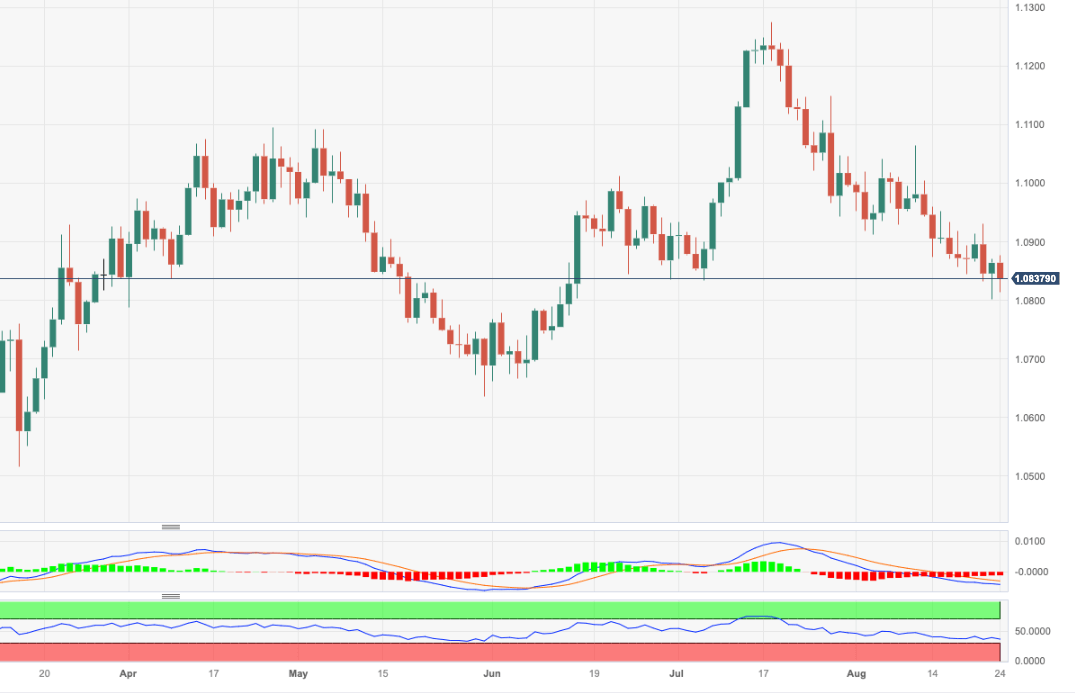

EUR/USD Price Analysis: The 200-day SMA holds the downside… for now

- EUR/USD resumes the downtrend and re-visits the 1.0810 area.

- Firm contention remains at the 200-day SMA at 1.0800.

EUR/USD quickly forgets Wednesday’s uptick and resumes the downtrend with the immediate target at recent lows near 1.0800 the figure.

This area of recent lows appears so far propped up by the critical 200-day SMA, while the loss of the latter could prompt a potential test of the May low of 1.0635 (May 31) to re-emerge on the horizon.

A drop below the 200-day SMA should keep extra losses in store for the time being.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.