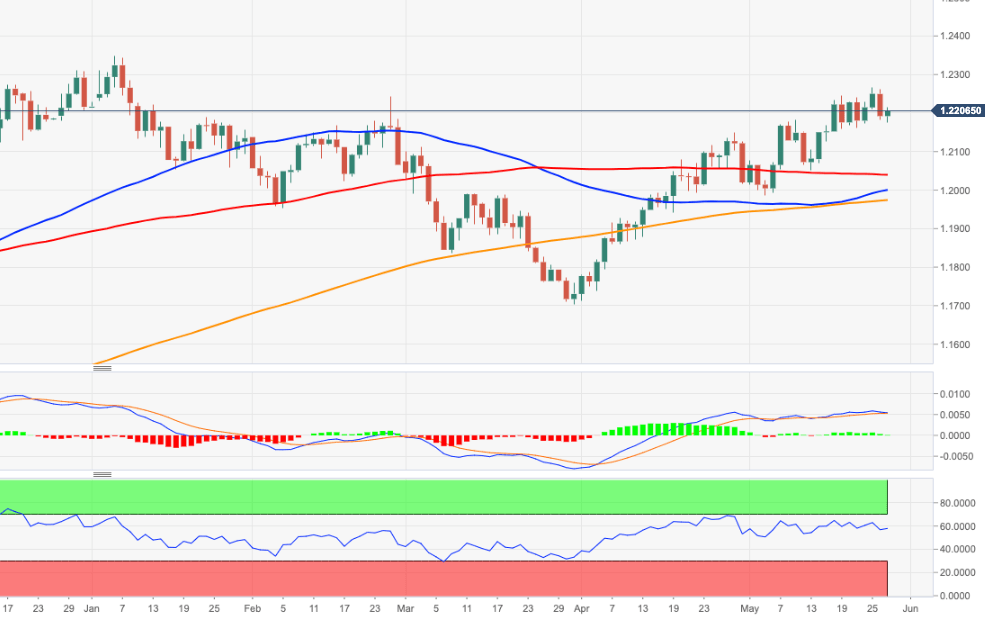

EUR/USD Price Analysis: The 1.2170 area holds the downside… for now

- EUR/USD meets support in the 1.2175/70 band.

- The upside is now limited by the 1.2270 region.

The downside pressure in EUR/USD looks well contained in the vicinity of 1.2170 for the time being. This area of contention is reinforced by a Fibo level (of the November-January rally and the short-term support line (off March lows).

If bulls regain the upper hand and manage to clear recent tops around 1.2270, there is the rising chance of an assault to the 1.2300 hurdle in the short-term horizon. Further north, another visit to the YTD peaks in the 1.2350 area (January 6) should not be ruled out.

On the broader view, the constructive stance on EUR/USD is forecast to remain intact as long as it trades above the 200-day SMA, today at 1.1969.

Of note, however, is that the daily RSI did not confirm the recent peak, which could be indicative that a deeper pullback could be shaping up.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.