EUR/USD Price Analysis: Struggles for clear directions around 1.0500

- EUR/USD bears take a breather after three-week downside, sidelined of late.

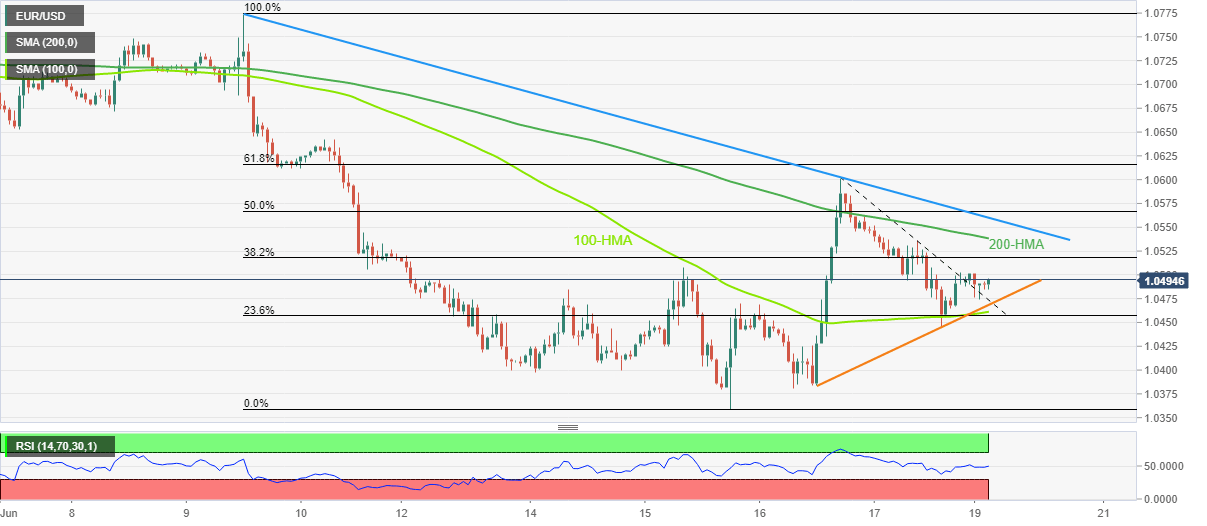

- Key HMAs restrict immediate moves below weekly resistance line.

- Firmer RSI hints at further recovery but bulls need validation from 1.0650 to retake control.

EUR/USD pares recent losses around 1.0500 during a quiet Asian session on Monday. In doing so, the major currency pair probe the three-week downtrend as traders struggle for clear directions.

That said, a two-day-old rising support line joins the 100-HMA to restrict short-term declines of the pair around 1.0460. Also keeping the bulls hopeful is the upward sloping RSI (14) line, not overbought.

However, the 200-HMA and one-week-long resistance, respectively around 1.0540 and 1.0560, could test the EUR/USD bulls afterward.

Even if the quote rises past 1.0560, the June 10 swing high around 1.0650 could act as the last defense of the EUR/USD bears.

Meanwhile, the aforementioned support confluence near 1.0460 holds the key to the EUR/USD pair’s slump towards the yearly low of 1.0360.

During the fall, the 1.0400 level may offer intermediate support ahead of the year 2017’s trough close to 1.0340.

Overall, EUR/USD stays on the way to refresh yearly low but bears have limited downside to cheer.

EUR/USD: Hourly chart

Trend: Limited recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.