EUR/USD Price Analysis: Slight end-of-week rebound fails to break key resistance

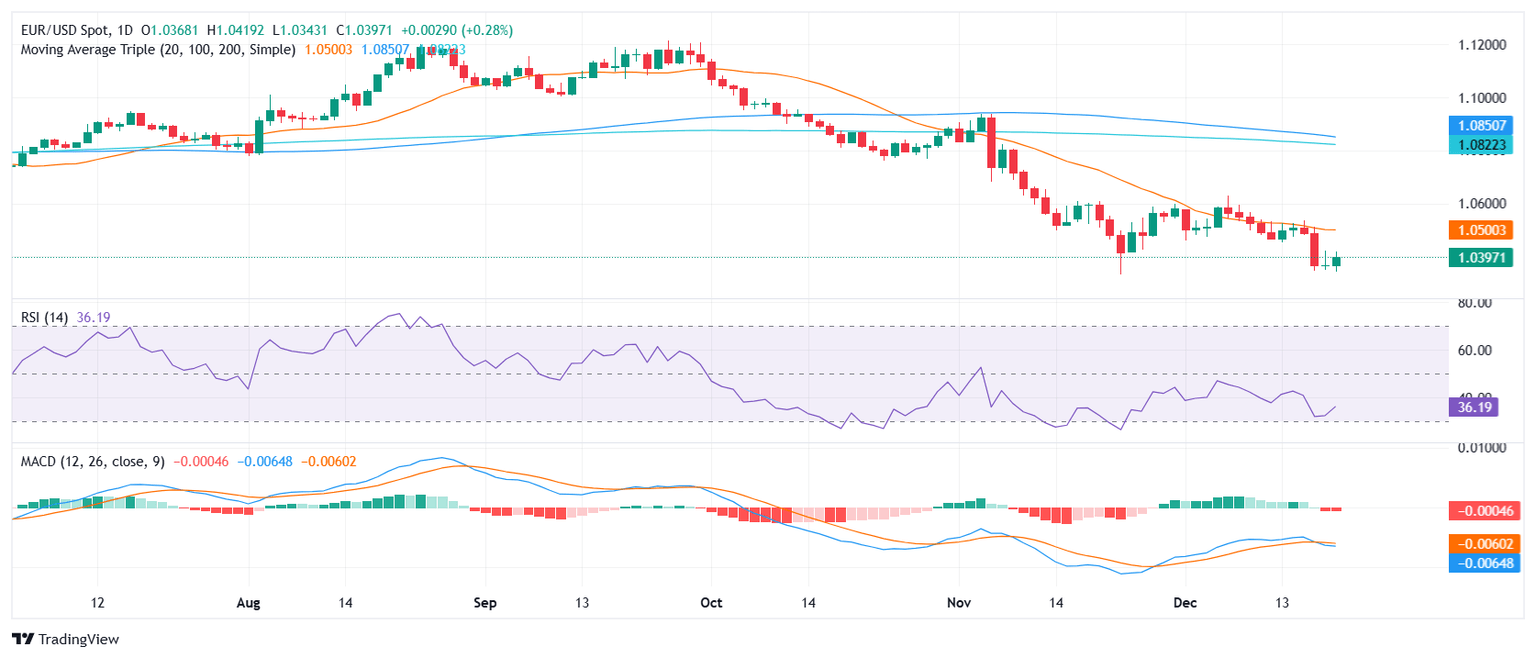

- EUR/USD gains on Friday, settling near 1.0395 after Wednesday’s steep decline.

- RSI rises sharply to 37, remaining in negative territory and reflecting hesitant recovery attempts.

- MACD histogram prints flat red bars, indicating persistent bearish pressure albeit with signs of stabilization.

After suffering a sharp drop of more than 1% on Wednesday, the EUR/USD managed a minor rebound by the end of the week, adding 0.28% to trade near 1.0395 on Friday. Despite this modest improvement, the pair remains below the 20-day Simple Moving Average (SMA), which continues to limit upside potential and maintain a cautious outlook.

Technical indicators suggest that while selling pressure may be easing, the overall bias remains tilted to the downside. The Relative Strength Index (RSI) has climbed to 37, still in negative territory but indicating a gradual reduction in bearish momentum. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram shows flat red bars, reflecting ongoing weakness with tentative signs of stabilization.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.