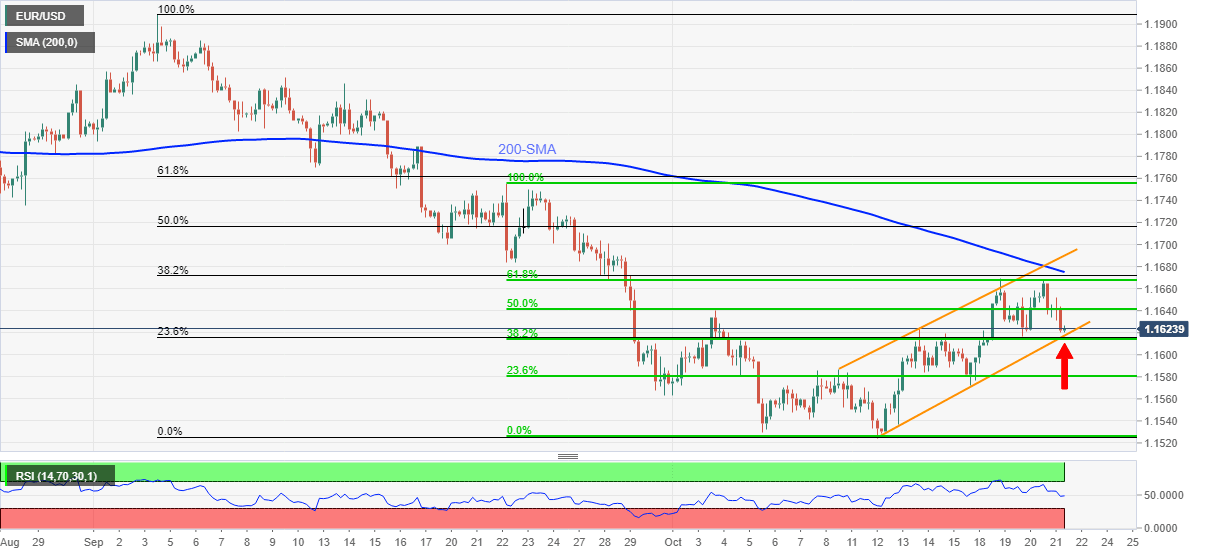

EUR/USD Price Analysis: Sellers attack 1.1620-15 key support

- EUR/USD holds lower grounds inside fortnight-old rising channel formation.

- Convergence of Fibonacci retracements, channel’s support restricts immediate downside.

- Descending RSI joins double tops around 1.1665-70 to keep bears hopeful.

EUR/USD fades bounce off 1.1620 amid a quiet start to Friday’s Asian session. In doing so, the major currency pair remains near crucial support confluence following its rejection from an important short-term Fibonacci retracement (Fibo.) level, namely 61.8% Fibo. of September 22 to October 12 downturn.

Given the descending RSI conditions and a double top around 1.1665-70, not to forget sustained trading below 200-SMA, EUR/USD prices are likely to remain weak.

However, the support line of a two-week-old ascending trend channel joins 38.2% Fibonacci retracement of the stated short-term moves, also 23.6% Fibo. level of a decline from early September, restrict the quote’s immediate downside around 1.1620-15.

Hence, a clear break of the stated support level becomes necessary for the EUR/USD bears to aim for the yearly low surrounding 1.1525. Though, the 1.1570 level may act as a buffer during the fall.

Meanwhile, recovery moves remain less important until crossing the 1.1665-70 level. Also challenging the EUR/USD bulls are the 200-SMA level of 1.1675 and the stated channel’s resistance line close to 1.1690.

Should the EUR/USD buyers manage to cross the 1.1690 hurdle, the late September highs near 1.1755 will be in focus.

EUR/USD: Four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.