EUR/USD Price Analysis: Retreats towards 1.0620 support confluence

- EUR/USD remains pressured around short-term key support, snaps two-day uptrend.

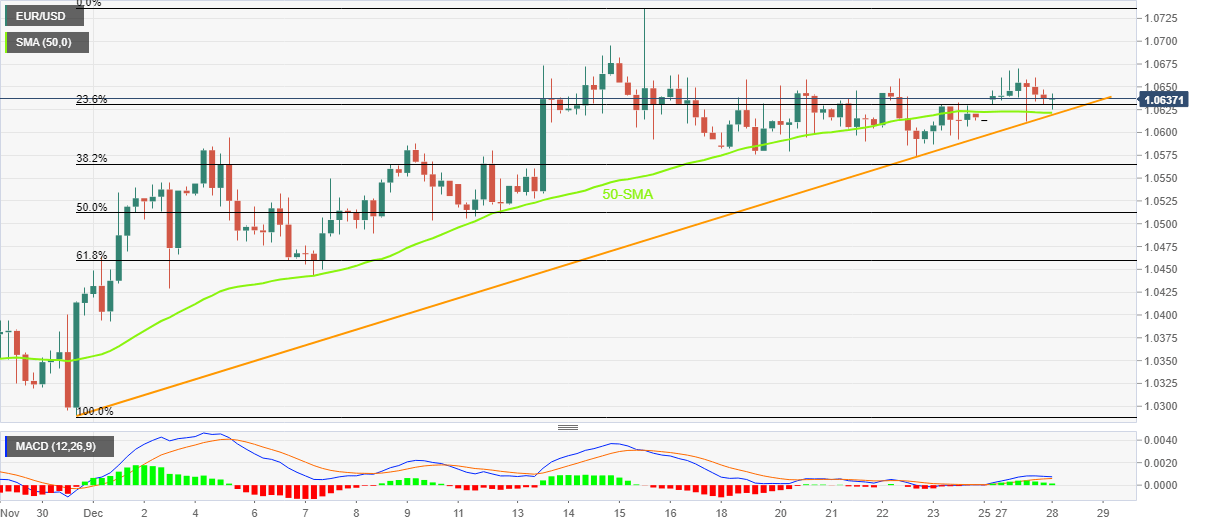

- Convergence of 50-SMA, one-month-old ascending trend line puts a floor under the prices.

- Impending bear cross on MACD also keeps sellers hopeful.

EUR/USD prints mild losses around 1.0635 despite recently bouncing off the intraday low. The reason could be linked to the previous day’s U-turn from the 1.0669 level, which in turn allows the major currency pair to snap a two-day winning streak by the press time.

In addition to the quote’s retreat from 1.0669, the looming bear cross on the MACD also teases the EUR/USD sellers of late.

However, a clear downside break of the 1.0620 support confluence comprising the 50-SMA and an upward-sloping trend line from late November becomes necessary for the EUR/USD sellers to retake control.

Following that, the previous weekly low near 1.0590 could lure intraday bears ahead of the 50% Fibonacci retracement level of the pair’s November 30 to December 15 upside, close to 1.0510.

In a case where the EUR/USD prices remain weak past 1.0510, the 61.8% Fibonacci retracement, also known as the golden ratio, near 1.0460 could act as the last defense of the pair buyers.

On the contrary, recovery moves need to stay beyond the latest swing high surrounding 1.0670 to direct the EUR/USD pair buyers toward the monthly high of 1.0736.

Also acting as an upside filter is May’s peak of around 1.0790 and the 1.0800 round figure.

Overall, EUR/USD is likely to return to the bear’s radar but a clear break of 1.0620 is necessary.

EUR/USD: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.