EUR/USD Price Analysis: Pair extends gains above 20-day SMA, sustaining bullish momentum

- EUR/USD climbs to 1.0420 on Wednesday, extending its upward trend.

- The pair surges past the 20-day SMA, reinforcing a stronger short-term outlook.

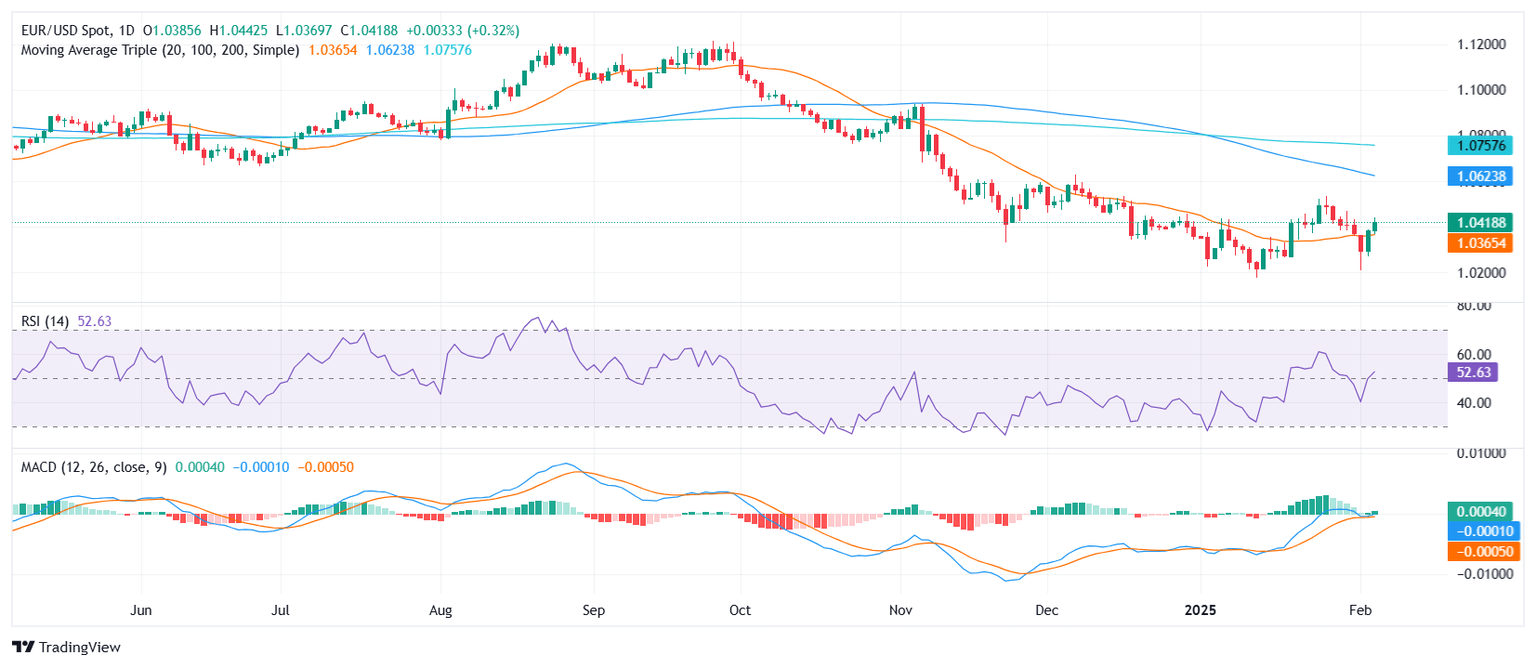

The EUR/USD pair continued its bullish advance on Wednesday, rising by 0.39% to 1.0420 as buyers maintained control. With the latest price action, the pair has decisively climbed above the 20-day Simple Moving Average (SMA), a key resistance level that had previously limited upside attempts. This breakout signals a potential shift in sentiment, favoring further gains in the short term.

Momentum indicators align with the pair’s continued strength. The Relative Strength Index (RSI) has risen sharply to 53, signaling increased buying interest and a stronger bullish bias. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram prints rising green bars, reflecting a sustained increase in momentum.

For EUR/USD to build on its recent gains, the next resistance levels to watch stand at 1.0450 and 1.0485. A break above these levels could open the door for a move toward 1.0520. On the downside, the 20-day SMA, now acting as support, is positioned near 1.0365, followed by a stronger support zone around 1.0350. Holding above the 20-day SMA will be key for the pair to sustain its positive trajectory.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.