EUR/USD Price Analysis: On its way to 1.1090?

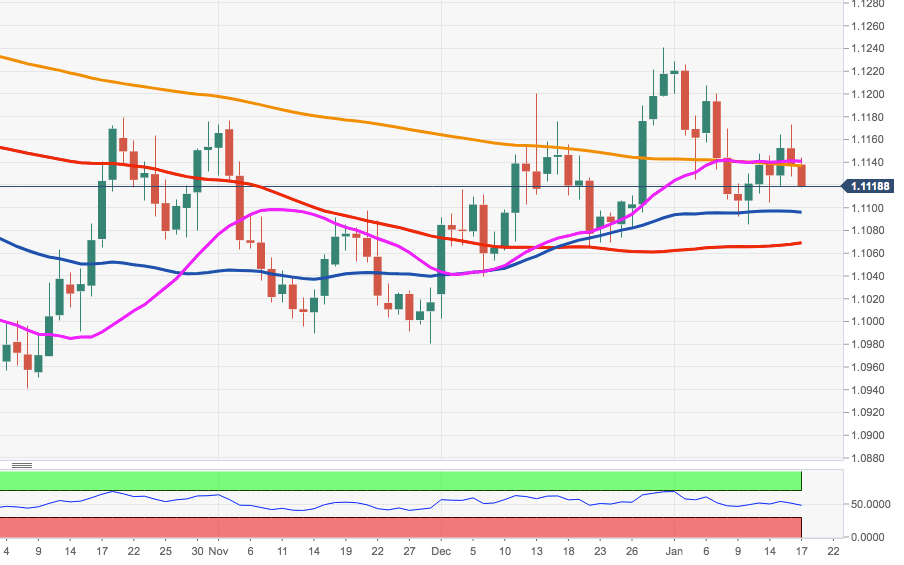

- EUR/USD continues to fade the recent move to the 1.1170 zone.

- The 55-day SMA in the 1.1090 area now emerges on the radar.

EUR/USD is facing extra selling pressure on Friday after hitting fresh weekly peaks in the 1.1170/75 band on Thursday.

If the selling pressure gathers impulse, then a potential move to the key 55-day SMA in the 1.1090 area should start gathering consensus.

The bullish view is seen unaltered as long as the 55-day SMA at 1.1094 underpins.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.