EUR/USD Price Analysis: Off yearly low inside nearby bearish channel, eyes to reclaim 1.1100

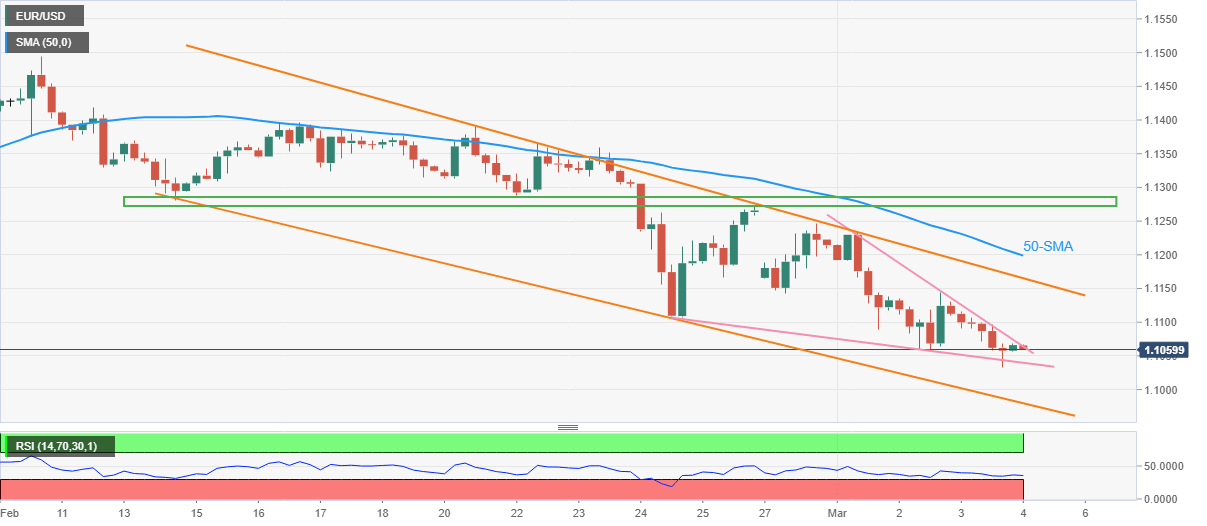

- EUR/USD battles three-day-old resistance line inside short-term descending trend channel.

- Nearly oversold RSI, a corrective pullback from weekly support line favor further recovery.

- Bearish chart pattern, 50-SMA will challenge the bulls.

EUR/USD licks its wounds around the yearly bottom, bouncing off adjacent support to 1.1065 during Friday’s Asian session.

In doing so, the major currency pair pokes a nearby resistance line while staying inside a three-week-long falling channel.

Given the quote’s U-turn from a three-day-long support line amid almost oversold RSI, the EUR/USD prices may regain the 1.1100 mark on breaking the immediate hurdle surrounding 1.1070.

However, the stated channel’s upper line and the 50-SMA, respectively around 1.1165 and 1.1200, will challenge the quote’s further upside.

Even if the pair rises past 1.1200, a horizontal area from February 14, around 1.1270-85, will be crucial to watch for the bulls.

Alternatively, pullback moves may initially aim for the aforementioned nearby support line of 1.1040 ahead of the 1.1000 threshold.

The channel’s lower, though, will become a tough nut to crack for the pair sellers around 1.0980 afterward.

EUR/USD: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.