EUR/USD Price Analysis: Looks south towards 1.1250 amid a potential bear flag

- EUR/USD resumes declines towards 16-month lows of 1.1264.

- Bear flag spotted on the 4H chart, awaits confirmation for further downside.

- RSI has recovered from the oversold region, backs the negative bias.

EUR/USD is testing daily lows above 1.1300, having faltered its recovery from 16-month lows of 1.1264, as the recovery in the Treasury yields is lifting the demand for the greenback across the board.

The tepid market mood, in the face of persisting inflation concerns and global economic prospects, dent the sentiment around the euro while lending some support to the safe-haven US dollar.

Meanwhile, the dovish comments from the European Central Bank (ECB) policymakers continue to remain a weight on the euro, as it brings the monetary policy divergence between the Fed and the ECB back to the fore.

Attention now turns towards the ECB-speak and the US weekly Jobless Claims data for fresh trading impetus on the major.

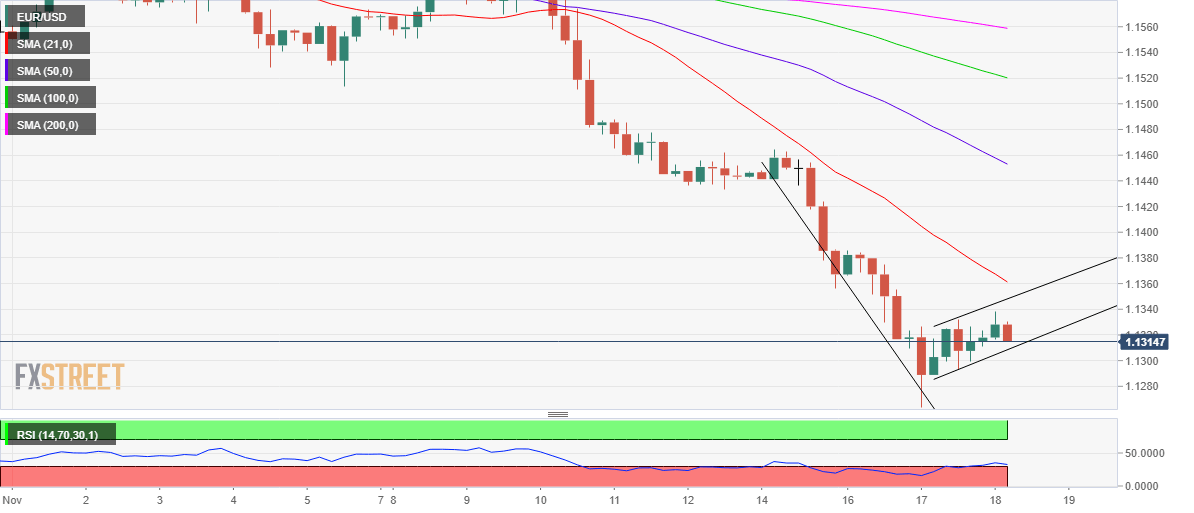

From a short-term technical perspective, the recent sell-off that followed a brief recovery stint carved out a bear flag formation on the four-hour chart.

A four-hourly candlestick closing below the rising trendline support at 1.1308 will confirm the bearish continuation pattern, opening floors for a retest of the yearly lows.

A breach of the latter will accelerate the downside towards 1.1200.

The Relative Strength Index (RSI) has recovered from the oversold territory but remains well below the midline, suggesting that there is room for another leg lower.

EUR/USD: Four-hour chart

On the flip side, the recovery will gain momentum only on a firm break above the rising trendline resistance at 1.1348.

The next critical upside barrier is seen at the bearish 21-Simple Moving Average (SMA) at 1.1361.

Recapturing 21-SMA is critical to negate the bearish bias in the near term.

EUR/USD: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.