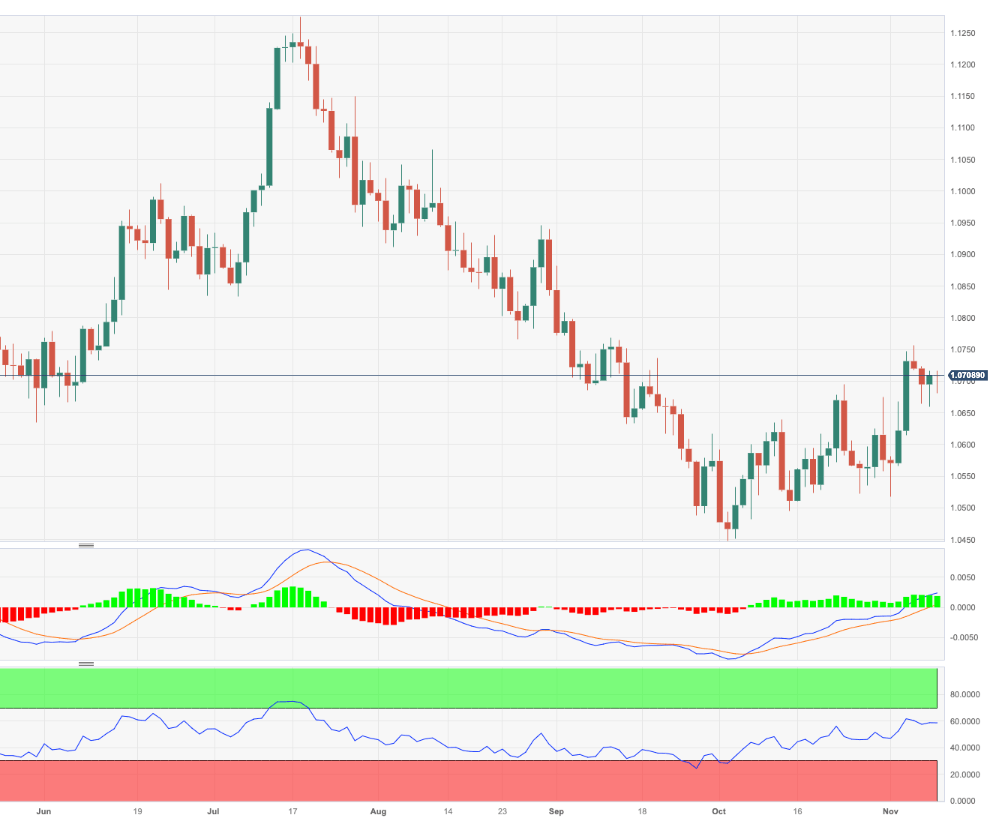

EUR/USD Price Analysis: Interim contention emerges around 1.0645

- EUR/USD struggles for direction around the 1.0700 neighbourhood.

- Bouts of weakness should meet initial support near 1.0650.

EUR/USD trades in an inconclusive fashion around the 1.0700 region on Thursday.

In case the downward bias picks up extra pace, the 55-day SMA at 1.0645 should offer temporary contention prior to the weekly low of 1.0495 (October 13).

In the meantime, while below the 200-day SMA at 1.0801, the pair’s outlook should remain negative.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.