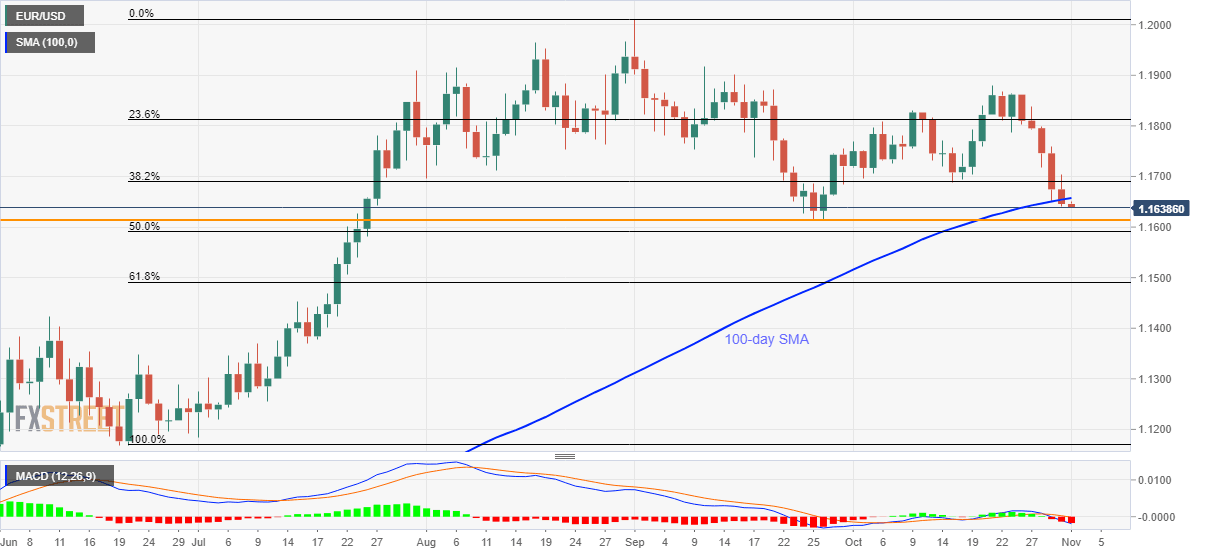

EUR/USD Price Analysis: Inches closer to September low above 1.1600

- EUR/USD refreshes five-week low after breaking 100-day SMA.

- Bearish MACD favor sellers, mid-October low offers additional immediate resistance.

- Key Fibonacci retracement levels can lure bears below September bottom.

EUR/USD drops to 1.1638, the fresh low since September 28, during the early Monday. In doing so, the major currency pair respects Friday’s closing below 100-day SMA amid bearish MACD.

As a result, sellers are currently targeting the September month’s trough surrounding 1.1615/10 as immediate support ahead of looking at the 50% Fibonacci retracement of the pair’s late-June to September 01 upside, at 1.1590.

Although EUR/USD bears are likely to catch a breather around 1.1590, failure to do so might not refrain from attacking 61.8% of Fibonacci retracement near 1.1490.

Alternatively, a daily closing beyond the 1.1660 level comprising 100-day SMA will have to cross the October 15 low of 1.1688 before targeting the 1.1700 threshold and the 1.1785/90 resistance.

In a case where the EUR/USD bulls dominate past-1.1790, the October month’s high of 1.1880 could become their favorite.

EUR/USD daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.