- EUR/USD attracts some buyers and moves away from a two-week low set on Tuesday.

- The technical setup warrants some caution for bullish trades ahead of the Fed decision.

- A sustained break below the 1.0835 confluence should pave the way for deeper losses.

The EUR/USD pair edges higher during the Asian session on Wednesday and for now, seems to have snapped a two-day losing streak to a nearly two-week low, around the 1.0835 region touched the previous day. Spot prices, however, lack follow-through buying as traders seem reluctant to place aggressive bets and prefer to wait on the sidelines ahead of the outcome of the highly anticipated two-day FOMC policy meeting later today.

The Federal Reserve (Fed) is widely expected to keep rates at their historic highs, though might lower its projection for rate cuts in 2024 to two from three previously in the wake of still-sticky inflation. Hence, the focus will remain glued to the so-called "dot plot", which, along with Fed Chair Jerome Powell's remarks, will be scrutinized for cues about the future rate-cut path. This, in turn, will play a key role in influencing the US Dollar (USD) price dynamics and provide a fresh directional impetus to the EUR/USD pair.

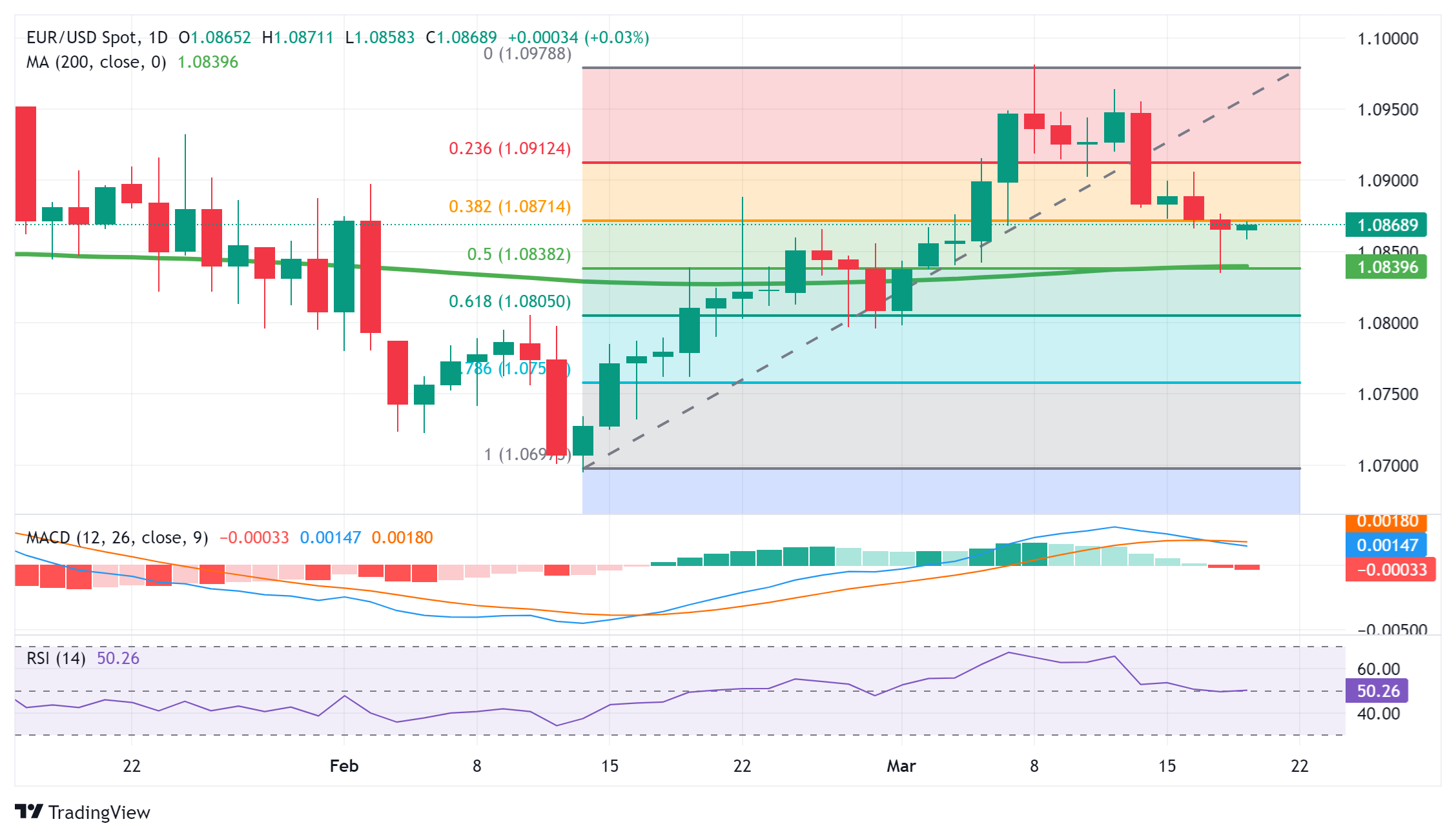

From a technical perspective, the recent pullback from the 1.0980 region, or the highest level since January 12 touched earlier this month, stalled near the 1.0835 confluence support. The said area comprises the very important 200-day Simple Moving Average (SMA) and the 50% Fibonacci retracement level of the February-March positive move, which might continue to protect the immediate downside and act as a key pivotal point. A convincing break below will be seen as a fresh trigger for bears and drag the EUR/USD pair lower.

Given that oscillators on the daily chart have just started gaining negative traction, spot prices might then accelerate the fall to the 1.0800 mark, or the 61.8% Fibo. level, en route to the 1.0760-1.0755 region. Some follow-through selling could make the EUR/USD pair vulnerable to retesting sub-1.0700 levels, or the YTD low touched on February 14.

On the flip side, any subsequent move up is likely to confront stiff resistance near the 1.0900 round-figure mark, nearing the 23.6% Fibo. support breakpoint. A sustained strength beyond will suggest that the corrective pullback has run its course and lift the EUR/USD pair back to the monthly peak, around the 1.0980 region. The momentum could get extended further beyond the 1.1000 psychological mark, towards the next relevant hurdle near the 1.1040 zone.

EUR/USD daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD holds lower ground below 1.0300 as traders await US NFP

EUR/USD holds lower ground below 1.0300 in European trading hours on Friday. Concerns over US President-elect Trump's policies and hawkish Fed expectations favor the US Dollar ahead of the critical US Nonfarm Payrolls data release.

GBP/USD falls back below 1.2300, US NFP eyed

GBP/USD is falling back below 1.2300 in the European morning on Friday, failing to sustain the rebound. The pair remains vulnerable amid persistent US Dollat strength and the UK bond market turmoil. The focus now shifts to the US labor market data for fresh trading directives.

Gold price sticks to intraday gains near multi-week top; US NFP in focus

Gold price attracts buyers for the fourth straight day on Friday amid some haven flows. The Fed’s hawkish stance, elevated US bond yields and a bullish USD should cap gains. Traders might also opt to wait for the release of the key US NFP report later this Friday.

Nonfarm Payrolls forecast: US December job gains set to decline sharply from November

US Nonfarm Payrolls are expected to rise by 160K in December after jumping by 227K in November. US jobs data is set to rock the US Dollar after hawkish Fed Minutes published on Wednesday.

How to trade NFP, one of the most volatile events Premium

NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world. The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.