EUR/USD Price Analysis: Grinds higher within falling wedge, 1.0940 is the key hurdle

- EUR/USD stays defensive after bouncing off five-week low.

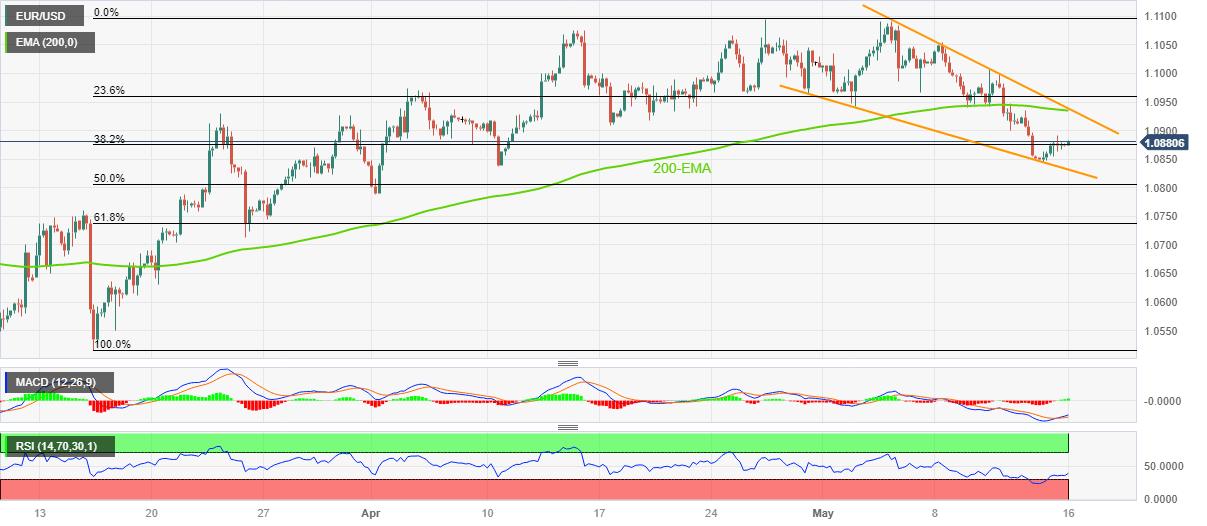

- Bullish chart formation, upbeat oscillators favor Euro buyers to confirm falling wedge and aim for March 2022 peak.

- Nearly oversold RSI, multiple filters to the south prod EUR/USD bears as the key data/events loom.

EUR/USD picks up bids to print mild gains around 1.0880 during early Tuesday as it defends the previous day’s rebound from a multi-day low ahead of the key European and the US catalysts. In doing so, the Euro pair remains firmer inside a two-week-old falling wedge bullish chart formation, bouncing off the stated pattern’s lower line of late.

That said, the major currency pair recovered from the lowest level in five weeks the previous day as it printed the first daily gain in four. With this, the EUR/USD portrayed a two-week-long falling wedge bullish pattern as the oversold RSI (14) favored the buyers. Adding strength to the recovery moves are the bullish MACD signals.

Hence, the EUR/USD buyers are likely to keep the reins, at least technically, as they approach the key 1.0940 resistance confluence comprising the top line of the stated falling wedge and the 200-bar Exponential Moving Average (EMA).

It’s worth noting that the 1.0900 round figure may act as an immediate resistance for the Euro buyers to watch.

In a case where the EUR/USD remains firmer past 1.0940, the theory suggests a run-up towards a March 2022 high of near 1.1185. It should be observed that the 1.1000 round figure and the yearly high of around 1.1090 may act as buffers during the pair’s run-up towards 1.1185.

Alternatively, the aforementioned wedge’s lower line, close to 1.0830, may join the nearly oversold RSI (14) line to restrict the short-term EUR/USD downside.

Following that, the mid-March swing high of 1.0760 will be in the spotlight as a break of which could give control to the EUR/USD bears.

EUR/USD: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.