EUR/USD Price Analysis: Grinds below 1.1030 upside hurdle with eyes on US NFP

- EUR/USD retreats from intraday high after snapping two-day uptrend.

- Multiple technical indicators challenge immediate moves amid pre-NFP anxiety.

- Looming bull cross on MACD, downbeat US data forecasts keep Euro buyers hopeful.

EUR/USD eases from the intraday high even as it pares the previous day’s losses near 1.1020 during the mid-Asian session on Friday. In doing so, the Euro pair portrays the typical pre-NFP anxiety as multiple technical indicators restrict immediate moves.

Also read: EUR/USD stays pressured around 1.1000 after Fed, ECB plays, US NFP eyed

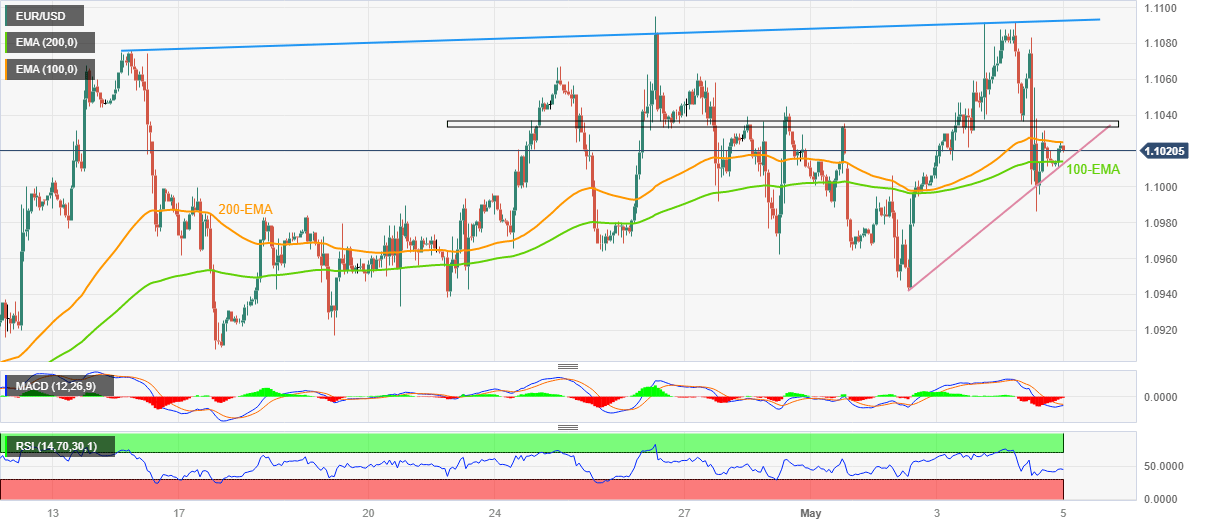

That said, a convergence of the ascending trend line from Tuesday and the 100-bar Exponential Moving Average (EMA), around 1.1010, restricts the immediate downside of the EUR/USD pair amid steady RSI and an impending bull cross on the MACD.

The likely rebound, however, needs to cross the 200-EMA hurdle of around 1.1025 to convince intraday buyers. Even so, a fortnight-old horizontal resistance area surrounding 1.1030-35 appears a tough nut to crack for the EUR/USD bulls.

It’s worth noting that an upward-sloping resistance line from mid-April, close to 1.1095, quickly followed by the 1.1100 round figure, could restrict short-term further upside of the Euro pair past 1.1035.

Meanwhile, pullback moves need not only conquer the 1.1010 support confluence but also the 1.1000 round figure to convince EUR/USD sellers.

Following that, multiple supports near 1.0980 and 1.0940 can challenge the Euro bears before directing them to the previous monthly low of around 1.0790.

EUR/USD: Hourly chart

Trend: Recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.