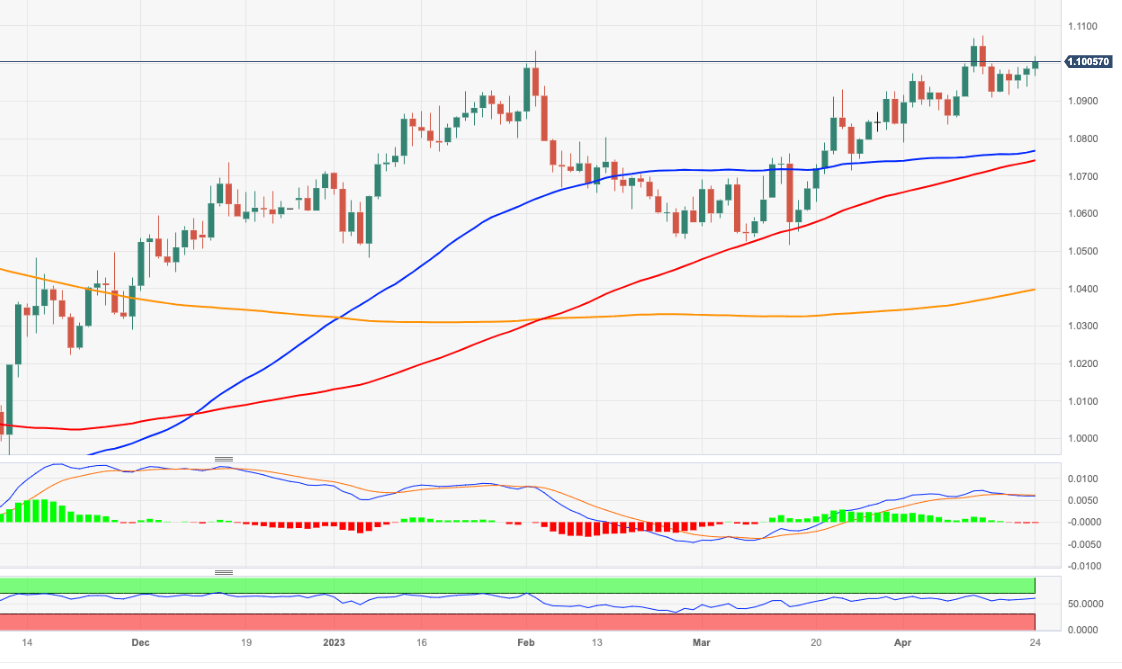

EUR/USD Price Analysis: Extra gains target the 1.1080 region

- EUR/USD reclaims the area beyond the 1.1000 yardstick on Monday.

- Extra upside appears on the cards with the target at the YTD top.

EUR/USD extends the bullish mood north of the key 1.1000 barrier at the beginning of the week.

The pair looks poised to extend the recovery further in the near term at least. That said, the immediate hurdle is expected at the 2023 high at 1.1075 (April 14) seconded by the round level at 1.1100.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0395.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.