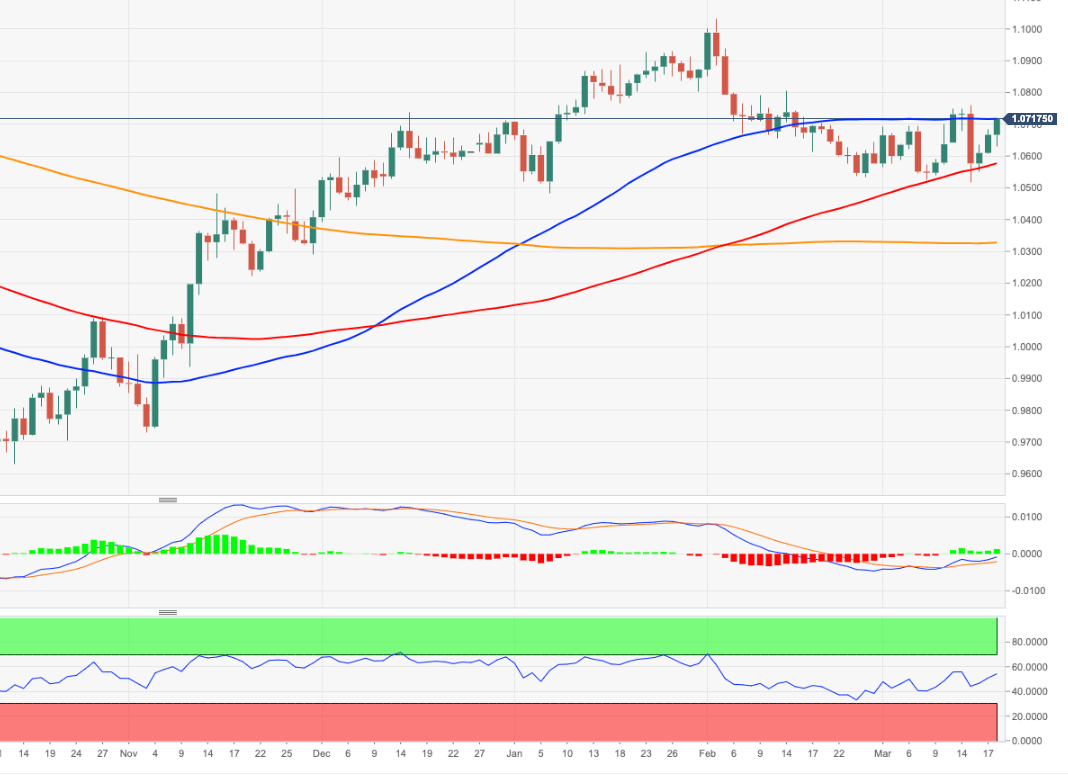

EUR/USD Price Analysis: Extra gains could see 1.0760 retested

- EUR/USD picks up extra impulse and surpasses 1.0700.

- Further north emerges the monthly high near 1.0760.

EUR/USD climbs to 3-day highs past 1.0700 the figure and extends the rebound for the third consecutive session on Monday.

If the recovery gathers impulse, then the pair could confront the March high at 1.0759 (March 15) ahead of the weekly peak at 1.0804 (February 14).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0325.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.