EUR/USD Price Analysis: Euro struggles within 1.0940-65 key resistance zone, mid-tier EU/US data eyed

- EUR/USD bulls run out of steam inside seven-week-old horizontal resistance region.

- Overbought RSI, market’s consolidation after ECB, Fed moves challenge Euro pair’s further upside.

- 78.6% Fibonacci retracement acts as additional challenge for buyers; Euro bears remain off the table beyond 1.0820 support confluence.

- Final prints of Eurozone inflation, US Michigan Consumer Sentiment Index awaited for clear directions.

EUR/USD treads water around mid-1.0900s during a sluggish early Friday morning in Europe. In doing so, the Euro pair struggles to extend the previous day’s run-up, the biggest since early February, while making rounds to a five-week high.

That said, the pair rallied the previous day as the European Central Bank (ECB) marked a hawkish play to beat Wednesday’s Federal Reserve (Fed) announcements. The latest inaction, however, appears to lack clear catalysts amid a light calendar and cautious mood ahead of the final readings of Eurozone inflation data for May, as per the Harmonized Index of Consumer Prices (HICP) details. Additionally important will be the preliminary readings of the Michigan Consumer Sentiment Index (CSI) for June and five-year inflation expectations.

Also read: EUR/USD grinds at five-week top around 1.0950 as Euro bulls seek more clues of ECB vs. Fed play

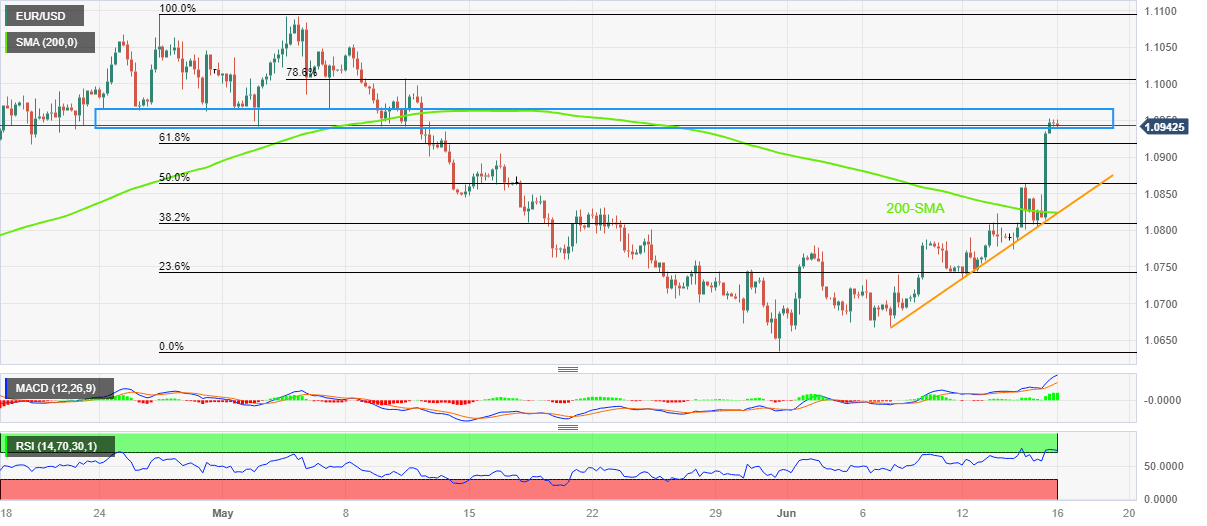

Technically, a horizontal resistance zone comprising multiple levels marked since April 24, between 1.0965 and 1.0940, restricts immediate EUR/USD moves amid the overbought RSI.

Even if the quote manages to cross the 1.0965 hurdle, the 78.6% Fibonacci retracement level of its previous monthly fall, around the 1.1000 psychological magnet, can challenge the EUR/USD bulls ahead of directing them to the yearly high of near 1.1100 marked in April.

On the contrary, a downside break of the 1.0940 immediate support can drag the EUR/USD price to the 61.8% Fibonacci retracement surrounding the 1.0920 level. Following that, the 50% Fibonacci retracement level near 1.0865 may lure the Euro bears.

It should be noted, however, that the EUR/USD buyers should remain hopeful unless witnessing a clear downside break of the 1.0825-20 support confluence including the 200-SMA and an ascending trend line from June 07.

EUR/USD: Four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.