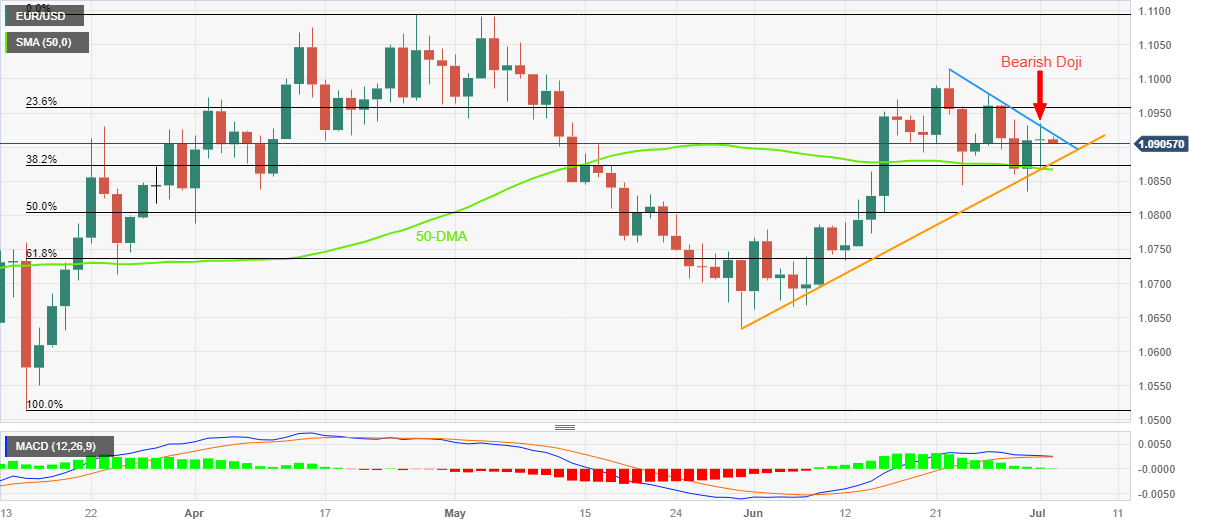

EUR/USD Price Analysis: Euro slips to 1.0900 on Monday’s Doji, downbeat MACD signals

- EUR/USD renews intraday low after an unimpressive week-start, lures bears amid sluggish session.

- Monday’s Doji candlestick, looming bear cross on MACD direct Euro sellers towards five-week-old rising support line.

- Seven-day-long falling trend line guards immediate recovery; 50-DMA acts as additional downside filters.

EUR/USD takes offers to refresh the intraday low near 1.0905 as it justifies the previous day’s bearish candlestick formation, as well as downbeat MACD signals, during a sluggish Tuesday morning due to the US Independence Day holiday.

Also read: EUR/USD floats above 1.0870-65 support confluence as softer US data prods hawkish Fed bias

That said, the Euro pair portrayed an indecisive closing the previous day while reversing from 1.0934, after an upbeat start of the week, which in turn marked a bearish Doji candlestick on the daily chart, suggesting a reversal of Friday’s recovery.

Additionally favoring the EUR/USD bears is the quote’s sustained trading below a downward-sloping resistance line from June 22, close to 1.0920 at the latest.

It’s worth noting that the impending bear cross on the MACD indicator adds strength to the downside bias surrounding the Euro pair.

With this, the EUR/USD price appears well-set to prod a five-week-old rising support line, near 1.0870. However, the 50-DMA acts as an extra filter toward the south and challenges the EUR/USD bears near 1.0865.

In a case where the EUR/USD remains bearish past 1.0865, Friday’s bottom of 1.0835 can act as the final defense of the Euro bulls.

On the flip side, a daily closing beyond the 1.0920 resistance can trigger a run-up toward the 1.1000 psychological magnet before directing the bulls toward the previous monthly high of around 1.1015.

It should be noted that the EUR/USD pair’s rise past 1.1015 enables it to challenge the yearly peak of 1.1095.

EUR/USD: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.