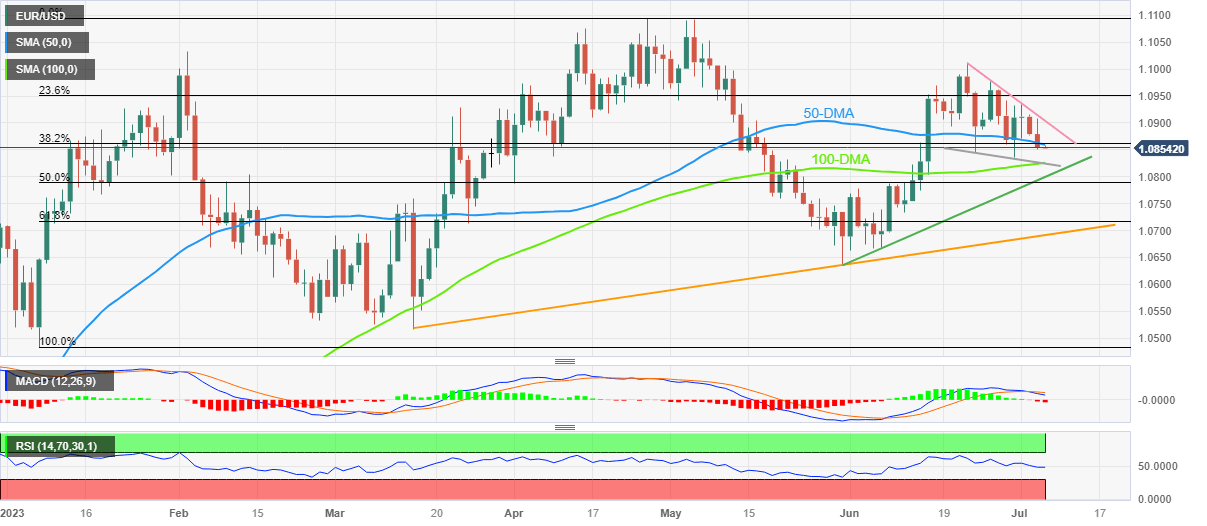

EUR/USD Price Analysis: Euro bears approach 1.0825 support confluence on 50-DMA break

- EUR/USD remains depressed at the lowest level in a week after breaking the key DMA support.

- Bearish MACD signals, steady RSI line add strength to downside bias.

- Convergence of 100-DMA, fortnight-old descending trend line appears short-term key support.

- Euro bulls should remain cautious below two-week-long resistance line.

EUR/USD holds lower grounds at the weekly bottom surrounding 1.0850 amid the early hours of Thursday in Asia. In doing so, the Euro pair justifies the previous day’s closing beneath the 50-DMA, the first clear break in three weeks, while also keeping the bears on the table after a three-day downtrend.

Not only the 50-DMA break but the bearish MACD signals and a near-50.0 RSI (14) line also suggests further downside of the EUR/USD pair.

However, a convergence of the 100-DMA and a fortnight-old descending trend line, around 1.0825 by the press time, becomes a tough nut to crack for the Euro bears.

Following that, an ascending support line from May 31, near 1.0800, becomes the last defense of the EUR/USD buyers before directing the quote toward the 50% and 61.8% Fibonacci retracements of January-April upside, respectively near 1.0790 and 1.0715.

Alternatively, the 50-DMA and 38.2% Fibonacci retracement together guard the EUR/USD recovery around 1.0865.

Even if the major currency pair crosses the 1.0865 hurdle, a downward-sloping resistance line from June 23, close to 1.0900 at the latest, will be in the spotlight.

Overall, EUR/USD remains on the back foot but the downside room appears limited.

EUR/USD: Daily chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.