EUR/USD Price Analysis: Drops to near 1.0850, further support at nine-day EMA

- EUR/USD could retest the upper boundary aligned with the psychological level of 1.0900.

- The momentum indicator MACD suggests a bullish sentiment for the pair.

- The potential support appears at the nine-day EMA at 1.0818.

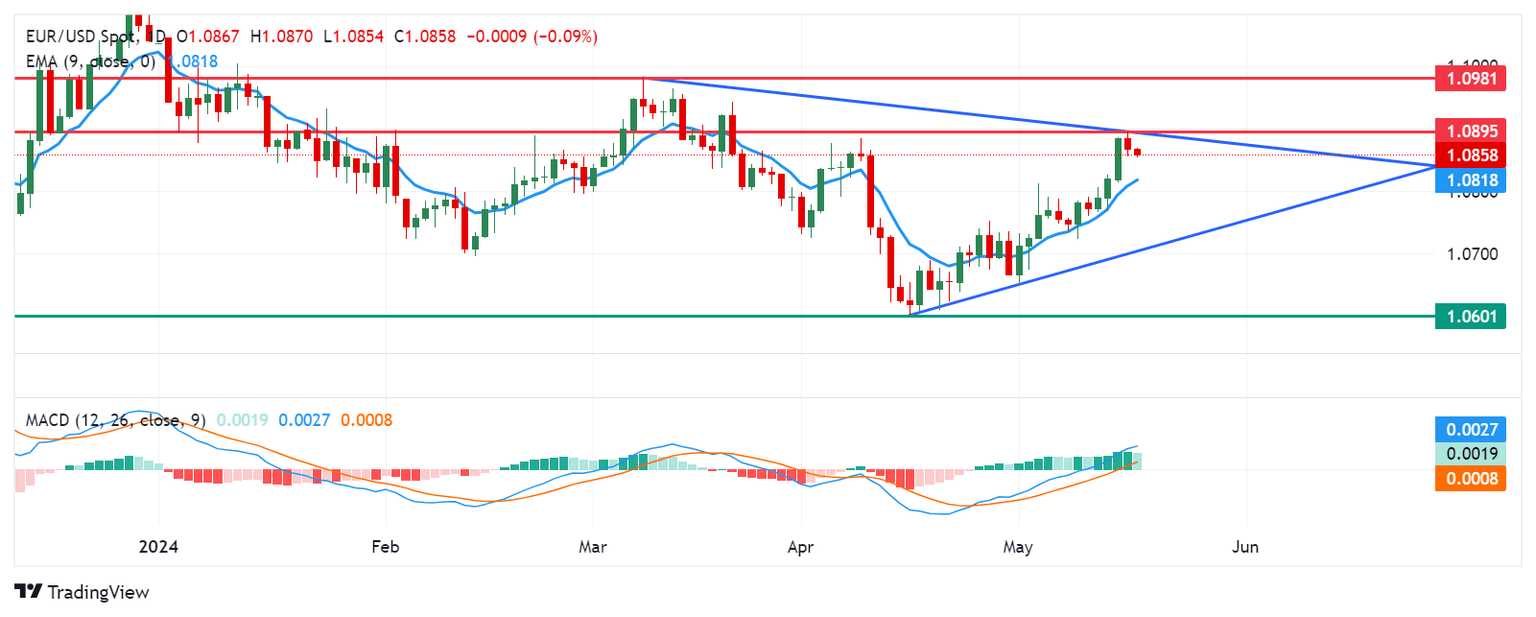

EUR/USD continues to lose ground, trading around 1.0860 during the Asian hours on Friday. From a technical perspective on a daily chart, analysis indicates a sideways trend for the pair as it continues to lie within the symmetrical triangle. A surpassing of the upper boundary could shift the momentum toward a bullish bias.

However, the momentum indicator Moving Average Convergence Divergence (MACD) suggests a bullish sentiment for the EUR/USD pair. Positioned above the centerline, there's a noted divergence above the signal line, indicating upward momentum.

The EUR/USD pair could challenge the key barrier at the upper boundary of the symmetrical triangle aligned with the psychological level of 1.0900. A break above this level could support the pair to test the pullback resistance at 1.0981.

Conversely, downside potential for the EUR/USD pair suggests initial support near the significant level of 1.0850, with further support expected around the nine-day Exponential Moving Average (EMA) at 1.0818. A breach below the latter could prompt movement toward the lower boundary of the symmetrical triangle, aligning with the psychological threshold of 1.0700. Additional support levels might come into play around April’s low at 1.0601.

EUR/USD: Daily Chart

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.