EUR/USD Price Analysis: Downside bias remains intact, 1.1250 likely at risk

- EUR/USD looks south, with 1.1250 at risks amid firmer USD, yields.

- Bearish RSI supports the potential move lower towards 1.1200.

- 1.1300 is the level to beat for the EUR bulls for any meaningful recovery.

EUR/USD is seeing some fresh selling pressure, as we progress towards the European opening bell this Monday.

The US dollar remains firmer on the session, tracking the rebound in the Treasury yields across the curve.

From a broader perspective, the euro remains undermined against the greenback, courtesy of the divergence in the monetary policy outlooks between the Fed and the ECB.

The Fed is set to hike the interest rates around mid-2022 while the ECB policymakers have repeatedly denied talks of a rate increase any time next year.

Attention, therefore, now remains on this week’s FOMC minutes for clarity on the Fed’s rate hike timings and the central bank’s tapering pace.

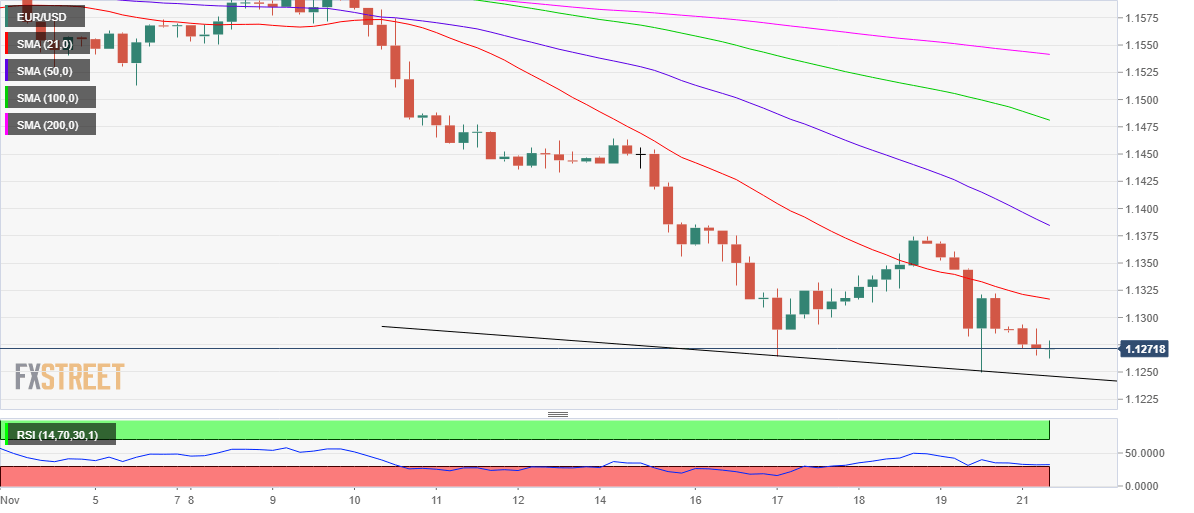

Meanwhile, looking at the currency pair on the four-hour chart, the 1.1250 target has been achieved last Friday, with the downside risks still intact.

At the time of writing, the spot is trading at 1.1268, down 0.16% on the day. If the strong support around 1.1250, the confluence of Friday’s low and the falling trendline, gets breached, then a test of the 1.1200 psychological level will be inevitable.

The Relative Strength Index (RSI) is holding the lower ground just above the oversold territory, suggesting that there is more room to the downside.

EUR/USD: Four-hour chart

On the flip side, any meaningful recovery will gain traction on recapturing the 1.1300 level.

The next critical upside barrier is seen at the bearish 21-Simple Moving Average (SMA) at 1.1317.

Further up, the 1.1350 psychological barrier will come into play.

EUR/USD: Additional levels to consider

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.