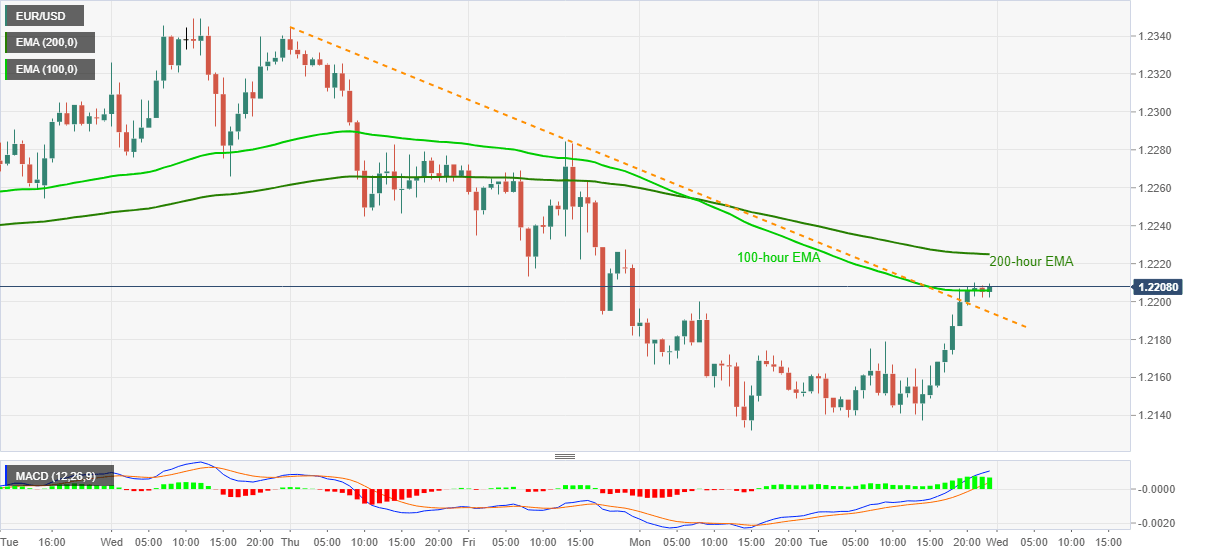

EUR/USD Price Analysis: Clings to 100-hour EMA amid bullish MACD

- EUR/USD battles the upper end of recent trading range.

- Bulls cheer upside break of one-week-old falling trend line amid upbeat MACD.

- 200-hour EMA guards immediate upside, sellers may look for entries below previous resistance line.

EUR/USD picks up bids near 1.2208 during Wednesday’s Asian session. In doing so, the quote keeps the recent choppy trading between the 1.2200 and 1.2210 levels after crossing a downward sloping trend line from last Thursday.

Although 100-hour EMA clutches the EUR/USD buyers, a sustained break of short-term resistance line, now support, joins bullish MACD signals to attack 200-hour EMA level of 1.2225.

If at all the bulls cross the key EMA, last Friday’s top surrounding 1.2285 and the 1.2300 threshold should gain the market’s attention.

Alternatively, a downside break of the previous resistance line, at 1.2194 now, will direct the EUR/USD sellers toward the monthly low near 1.2130.

However, any further weakness past-1.2130 will not hesitate to challenge the December 09 low of 1.2058 that holds the key to the pair’s extra downside eyeing September’s top close to 1.2010.

Overall, the EUR/USD bulls are catching a breather and are less likely to be considered fail unless the quote drops below the September top.

EUR/USD hourly chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.