EUR/USD Price Analysis: Challenges bearish commitments at 100DMA ahead of ECB

- EUR/USD is breathing a sigh of relief on the ECB Thursday.

- ECB is set to hike rates by 75 bps, Lagarde’s presser holds the key.

- Euro bulls run into the bearish 100DMA at 1.0090, where next?

EUR/USD is trading almost unchanged on the day at around 1.0075 ahead of the European open. Investors take a pause and refrain from placing any directional bets on the pair, awaiting the critical ECB rate hike decision and the US advance Q3 GDP release.

Expectations of a super-sized rate hike from the ECB have underpinned the recent EUR/USD upsurge while the US dollar index was sold off into talks of a potential Fed pivot towards a dovish stance, in the face of weak economic data from the world’s largest economy.

Looking ahead, “the focus will be on the accompanying monetary policy statement and the post-meeting press conference amid worries about economic headwinds stemming from the protracted Russia-Ukraine war. Earlier this month, ECB President Christine Lagarde referred to rate increases as the best tool to fight runaway inflation,” FXStreet’s Editor, Haresh Menghani, explains.

The US growth numbers will be also watched for fresh hints on the Fed tightening outlook.

EUR/USD: Technical outlook

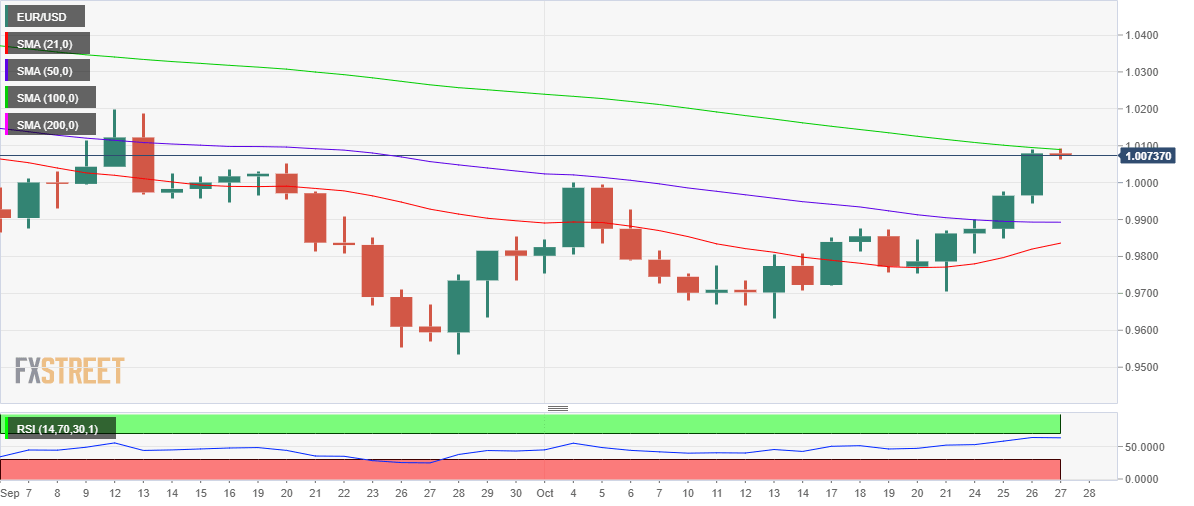

The bearish 100-Daily Moving Average (DMA) at 1.0090 is the critical daily resistance heading into the ECB verdict.

A hawkish rate hike by the ECB could enable bulls to yield a firm break above the latter, triggering a fresh uptrend towards 1.0200.

The 14-day Relative Strength Index (RSI) has turned lower but remains well above the 50.00 level, keeping bulls hopeful.

EUR/USD: Daily chart

If ECB surprises negatively, it could initiate a fresh retreat in the pair, with bears guarding the 100DMA.

Wednesday’s low at 0.9943 could limit the decline towards the 0.9900 barrier.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.