EUR/USD Price Analysis: Bulls struggle as key resistance holds firm

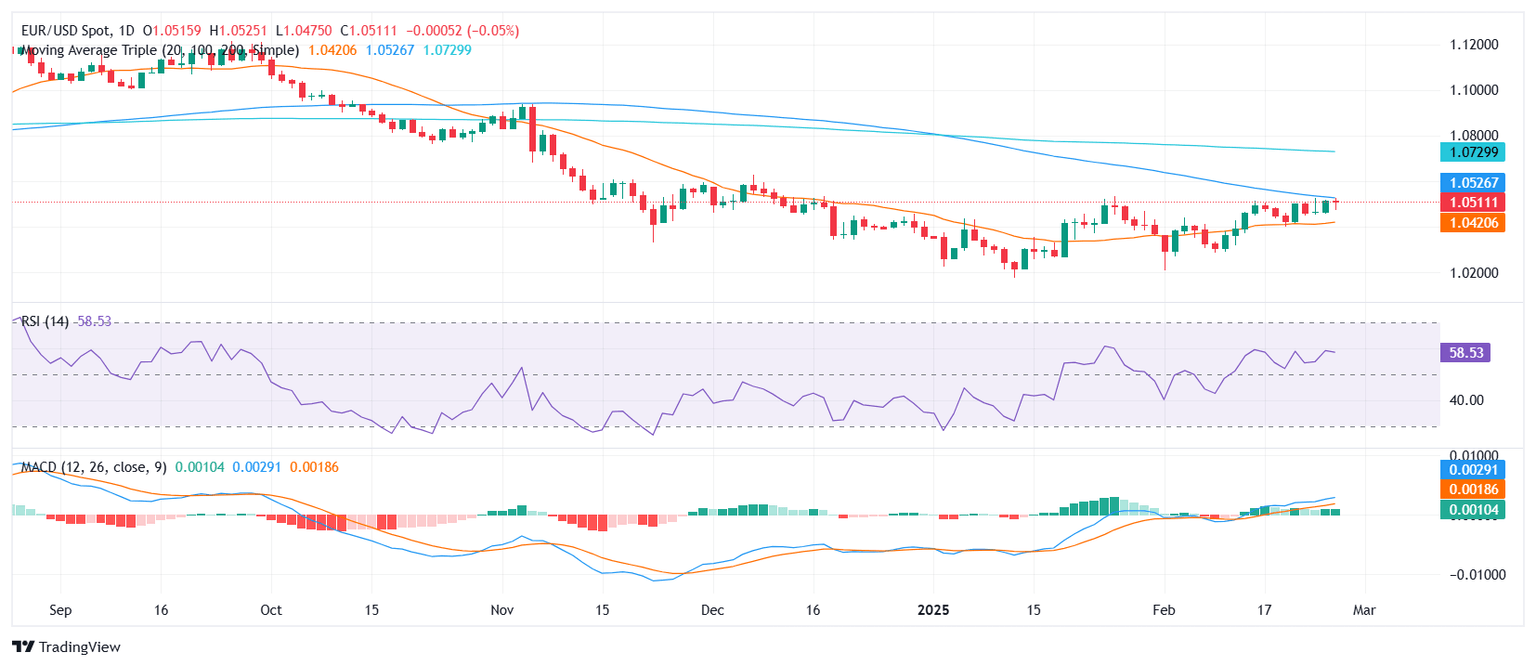

- EUR/USD registers another decline after facing its third rejection at the 100-day SMA.

- RSI remains in positive territory but declines sharply, signaling fading bullish momentum.

- The 100-day and 20-day SMAs are converging, hinting at a possible bearish crossover.

EUR/USD continued to struggle on Wednesday, retreating after failing to break above the 100-day Simple Moving Average (SMA) for a third time. This repeated rejection suggests that bullish attempts are losing traction, while sellers are gradually regaining control. The confluence of technical indicators now hints at a potential shift in the broader outlook.

Technical readings point to weakening momentum. The Relative Strength Index (RSI) remains in positive territory but has turned lower, indicating that buyers are losing confidence. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram prints flat green bars, reflecting a lack of strong directional conviction.

A key development to watch is the approaching convergence of the 100-day and 20-day SMAs, which could form a bearish crossover if the trend persists. A successful break below the 20-day SMA near the 1.0450 zone could reinforce downside risks, while any renewed attempt to breach the 100-day SMA would be critical for bullish continuation.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.