EUR/USD Price Analysis: Bulls regain control, breaking key resistance levels

- EUR/USD surged at the start of the week, posting strong gains and reclaiming higher ground.

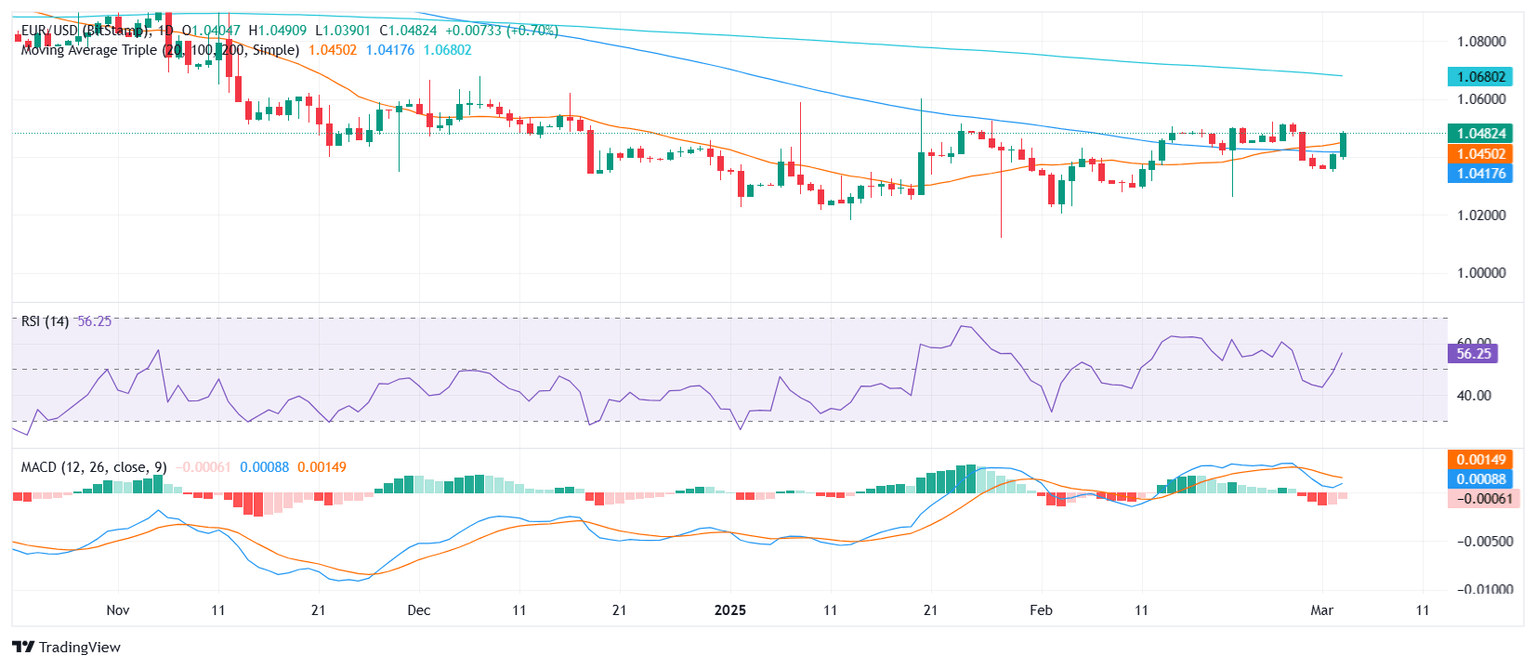

- The pair soared past the convergence of the 20-day and 100-day SMA, signaling renewed bullish momentum.

- Resistance is now seen at 1.0520, while support lies at 1.0450, with indicators suggesting further upside potential.

EUR/USD kicked off the week with a solid rally rising past 1.0450, climbing above key technical levels and suggesting that buyers are regaining momentum. The pair decisively broke through the confluence of the 20-day and 100-day Simple Moving Averages (SMA), reinforcing a shift in sentiment. This move comes after last week's struggle around these levels, where sellers had temporarily kept the pair in check.

Technical indicators reflect this resurgence. The Relative Strength Index (RSI) is rising sharply in positive territory, confirming an increase in buying pressure. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram shows decreasing red bars, hinting that while bullish momentum is strengthening, some consolidation could still take place before another push higher.

Looking ahead, immediate resistance is now located at 1.0520, a level that, if breached, could accelerate gains toward 1.0560. On the downside, support is found at 1.0450, which coincides with the recently broken moving averages. A drop below this level would weaken the bullish outlook and bring 1.0400 into focus.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.