EUR/USD Price Analysis: Bulls reclaim momentum as pair nears November highs

- EUR/USD was seen trading around the 1.0900 area after the European session, extending its recent rally.

- Following a brief pause on Monday, the pair surged by more than 0.70%, approaching its highest levels since November 2024.

- Technical indicators remain in overbought territory, signaling potential exhaustion, while key resistance levels lie ahead.

The EUR/USD pair regained bullish traction on Tuesday after the European session, advancing past the 1.0900 zone and continuing its strong upward trend. After stalling briefly on Monday, buyers re-entered the market, fueling a more than 0.70% rally. The pair now hovers near its highest levels since November 2024, with market momentum firmly favoring the bulls.

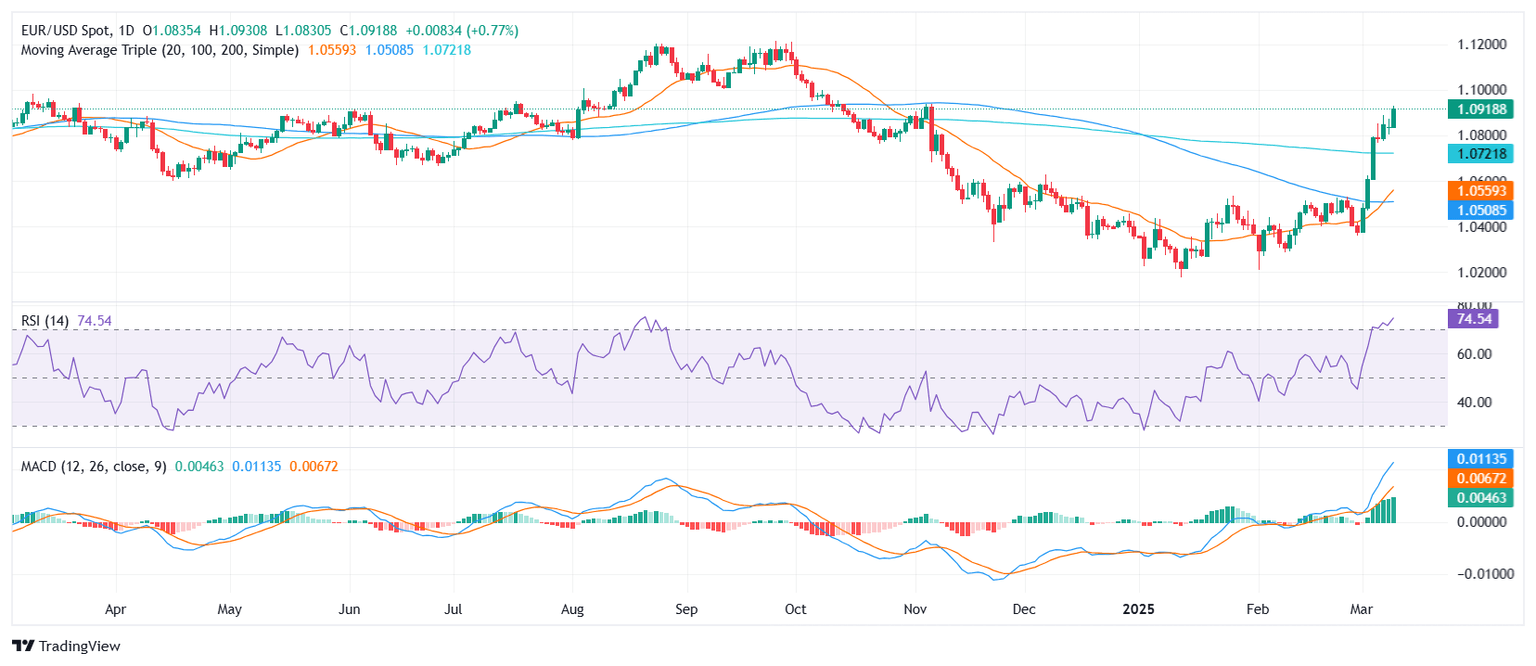

From a technical perspective, the Relative Strength Index (RSI) has climbed further into overbought territory, rising sharply to indicate strong buying pressure. Meanwhile, the Moving Average Convergence Divergence (MACD) continues to print rising green bars, reflecting sustained bullish momentum. However, these overbought conditions suggest a possible correction could be on the horizon if buyers start to take profits.

Looking at key levels, immediate resistance is now seen near the 1.0930 zone, a break of which could open the door toward the 1.0970-1.1000 range. On the downside, support is aligned near the 1.0850 region, followed by the 1.0800 psychological level, where the 200-day Simple Moving Average (SMA) is positioned.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.