EUR/USD Price Analysis: Bulls push higher but overbought signals hint at correction

- EUR/USD holds gains after the European session, trading near the 1.0870 area and marking fresh highs since November 2024.

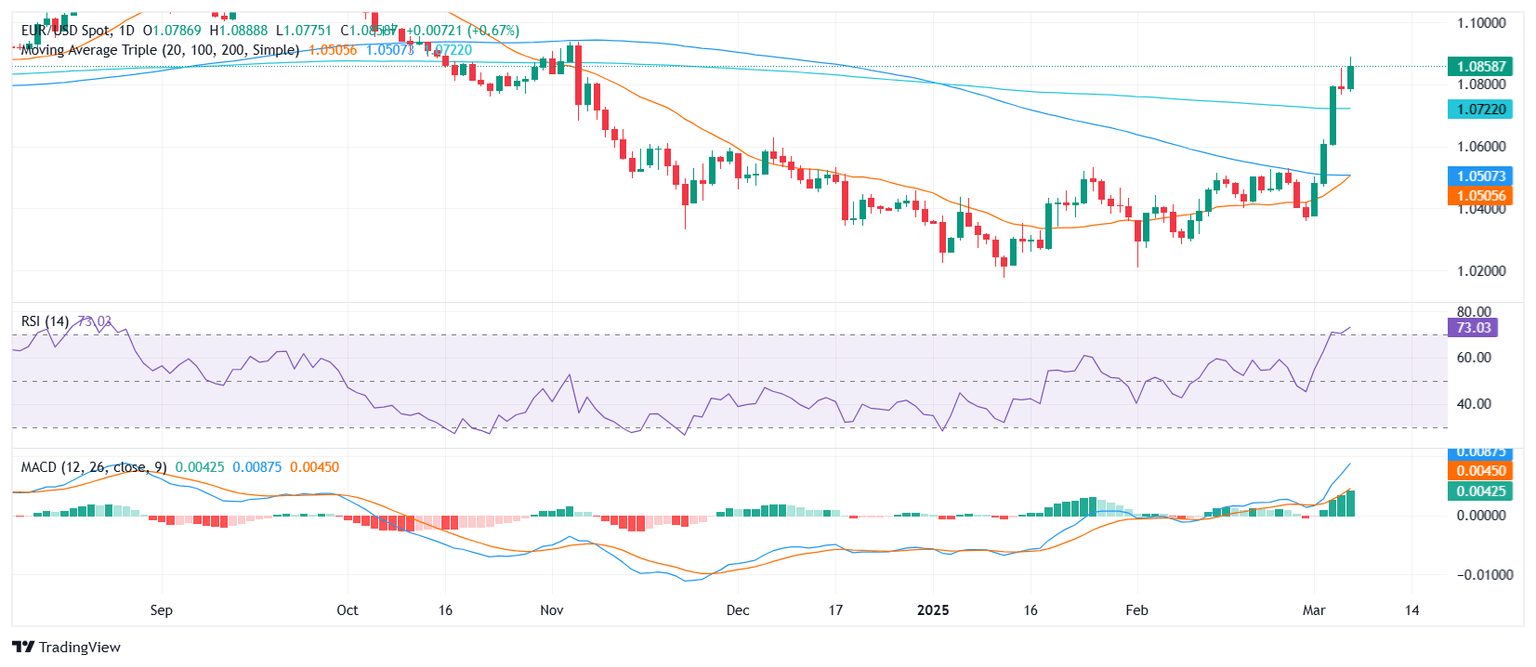

- The 20 and 100-day moving averages are nearing a bullish crossover, while overbought RSI suggests a possible correction.

- Immediate resistance is seen near 1.0900 while key support lies at 1.0800.

The EUR/USD pair stands higher on Friday after the European session, reaching its strongest level since November 2024 above 1.0800 as bullish momentum continued to build. Buyers remain firmly in control, driving the pair into fresh territory, with price action now reflecting strong upward momentum.

The Relative Strength Index (RSI) is positioned in overbought territory and rising sharply, indicating strong buying pressure but also signaling that the rally could face exhaustion soon. Meanwhile, the Moving Average Convergence Divergence (MACD) is printing rising green bars, reinforcing the current bullish outlook. A notable development is the approaching bullish crossover between the 20-day and 100-day Simple Moving Averages (SMAs), which could further support buyers if confirmed.

On the technical front, resistance is now seen near the 1.0900 zone, with a break above potentially opening the door for further gains toward 1.0950. On the downside, immediate support stands around 1.0800, followed by 1.0700 and well below the 20 and 100-day SMA convergence near 1.0500. If selling pressure emerges, a pullback toward these levels could signal a technical correction before another bullish attempt.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.