EUR/USD Price analysis: Bulls move and seek a test of key H4 resistance structure

- EUR/USD remains on the front side of the bullish cycle's trendline.

- The 4-hour M-formation neckline resistance is key as bulls move in.

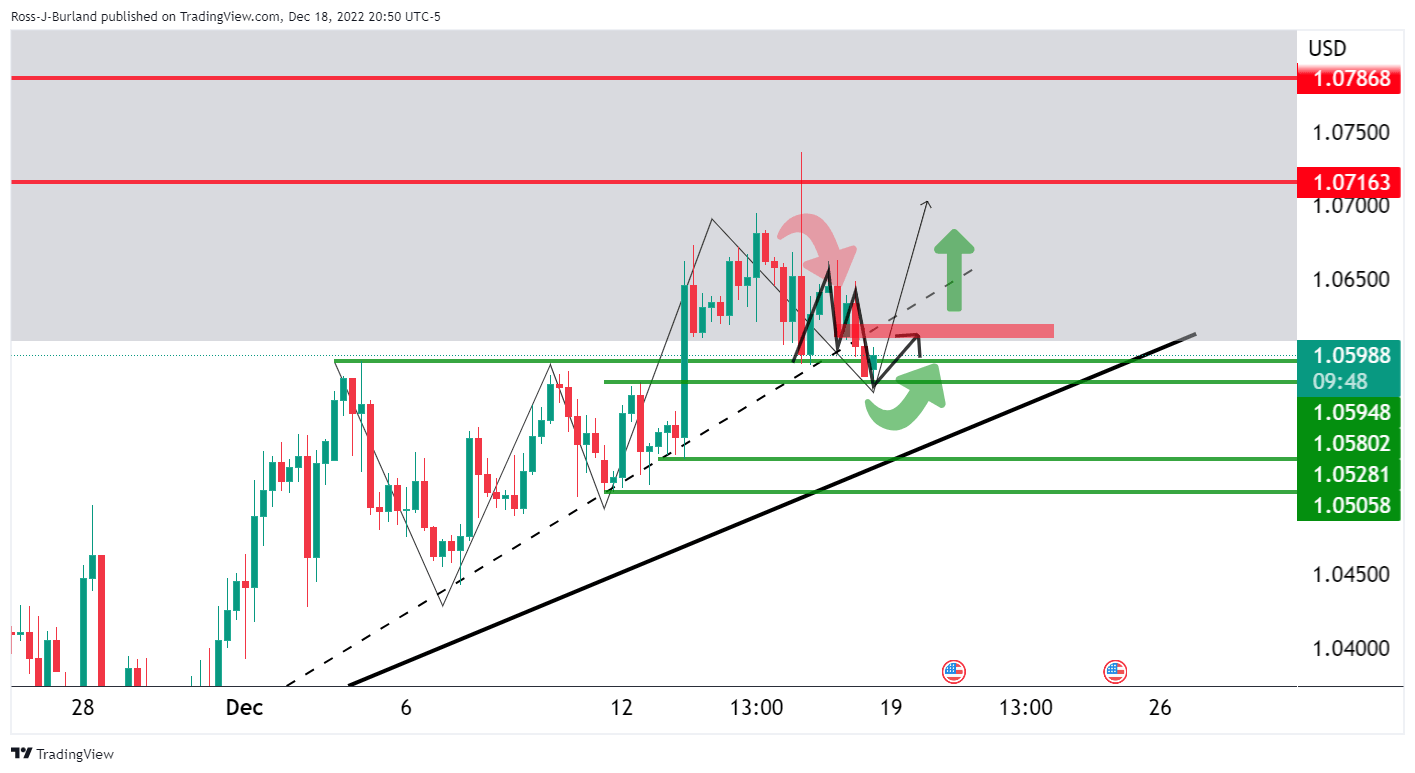

As per the pre-open analysis, EUR/USD Price Analysis: Bulls under pressure as bears test commitments at 1.0600, there are prospects of an upside correction. Should the bulls commit beyond 1.0650, the 1.07s will be in focus. The following illustrates the bias as per the lower time frames.

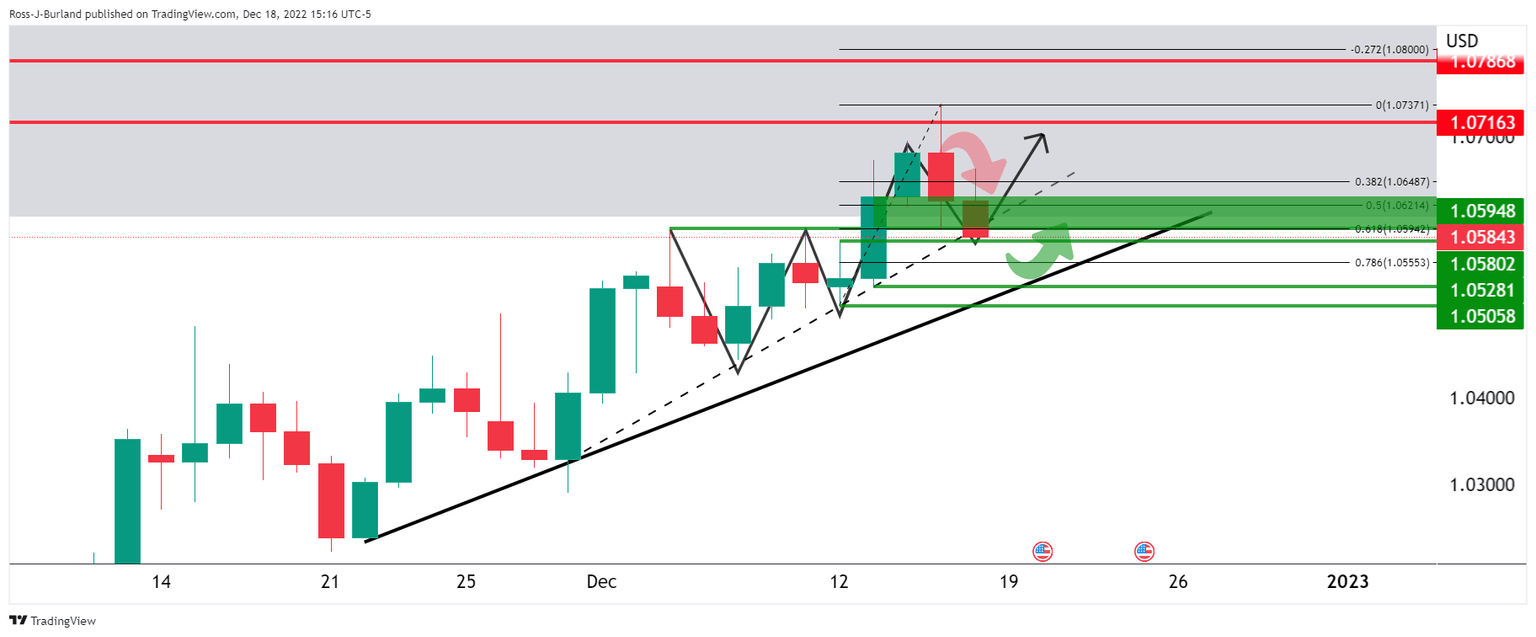

EUR/USD daily chart, prior analysis

It was stated that the bulls will need to show up on the front side of the more dominant trendline support or face a downside continuation as explained above.

However, on the upside, we have 1.0700 as a key level. We have 1.0790 thereafter as the next level.

EUR/USD H4 chart

The 4-hour M-formation is a reversion pattern and while the price remains in a bullish trend on the front side of the bullish trendline, should the neckline resistance give, then there will be prospects of a fresh cycle high for the week ahead.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.