EUR/USD Price Analysis: Bulls eye 1.0615 on triangle breakout

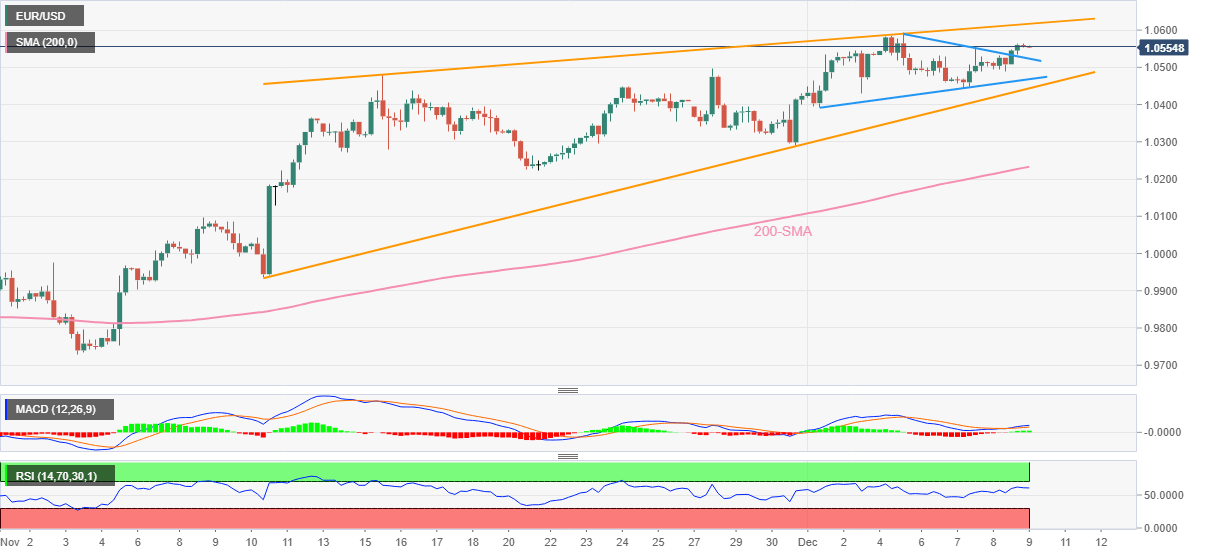

- EUR/USD grinds higher inside monthly rising wedge following a two-day winning streak.

- Triangle breakout, firmer oscillators favor bulls, 1.0440 holds the key to rising wedge confirmation.

- 200-SMA acts as the last defense of EUR/USD bulls, May’s high will be in focus past 1.0615.

EUR/USD struggles to justify the bullish triangle breakout near 1.0550-55 during early Friday. In doing so, the major currency pair probes the two-day uptrend while staying inside a one-month-old rising wedge bearish chart formation.

Not only the upside break of the weekly triangle’s resistance line but bullish MACD signals and firmer RSI (14) also favor the EUR/USD bulls.

However, the upper line of the stated wedge formation, near 1.0615 by the press time, could challenge the pair’s further upside.

In a case where the EUR/USD crosses the 1.0615 hurdle, highs marked in June and May, around 1.0775 and 1.0785 respectively, could lure the buyers.

On the contrary, the resistance-turned-support line of the immediate triangle, near 1.0525, holds the key for EUR/USD seller’s entry.

Following that, the stated triangle’s bottom and the rising wedge’s lower line, close to 1.0470 and 1.0440 in that order, will be crucial for the pair traders to watch.

Should the EUR/USD price successfully break the 1.0440 support, the 200-SMA level surrounding 1.0230 acts as the last defense of the bulls.

EUR/USD: Four-hour chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.