- EUR/USD bulls need to commit at a key juncture on the lower time frame charts.

- Bears are focussed on a break of critical support.

EUR/USD is testing a key support area on the four-hour charts within what could be the makings of a fresh daily bullish impulse. The following analysis identifies the key market structures on a multi time frame basis.

EUR/USD prior analysis daily chart

It was stated that ''the price broke the horizontal resistance that is now responding as a support zone on the retest. The bulls have committed to the course and a run into prior support and resistance between 1.0761 and 1.0936 could be in order with the 1.08 figure a key target.''

EUR/USD, prior analysis H4 chart

The W-formation's neckline near 1.0705 was eyed as a potential base from which bulls could engage in order to target the 1.08 areas.

EUR/USD live charts

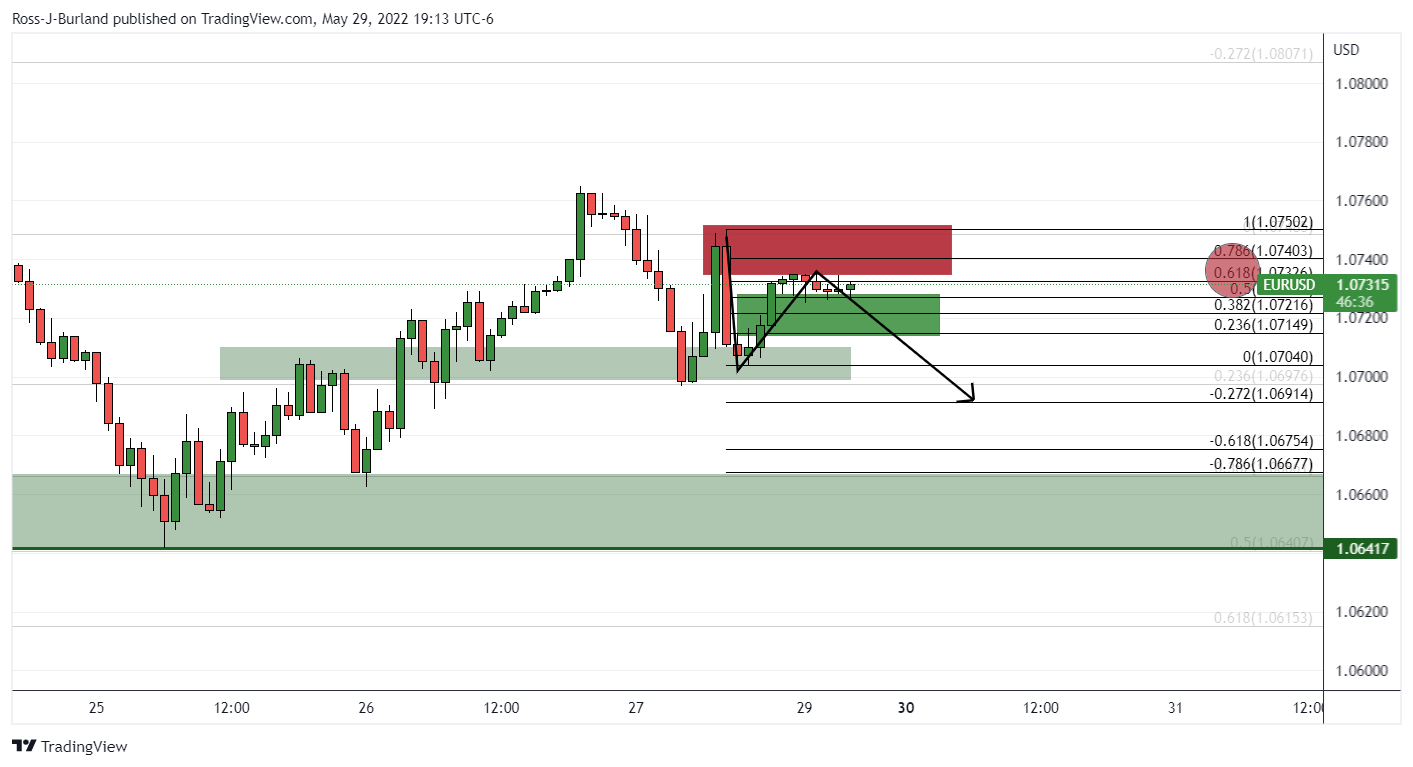

The price has moved in a W-formation and retested the pattern's neckline and has treated it as support. The bulls need to commit at this juncture if the daily extension is going to take place.

EUR/USD H1 charts

If the price is going to respect support and continue higher, the outcome could look something like the above on the hourly chart. However, there is the possibility that the bears will take control and send the price lower to restest 1.07 the figure as follows:

As illustrated, the price is being resisted at a 61.8% golden ratio and should the bears commit and break support, then a downside continuation will be on the cards. This will leave the pair in no man's land and trapped between longer-term support and resistance on the daily chart:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD on the defensive around 1.0400 after upbeat US data

EUR/USD is under mild selling pressure around the 1.0400 mark following the release of upbeat United States data. Q3 GDP was upwardly revised to 3.1% from 2.8% previously, while weekly unemployment claims improved to 220K in the week ending December 13.

GBP/USD accelerates south after BoE rate decision

GBP/USD retreated from its daily peak and extends its slide sub-1.2600 following the Bank of England monetary policy decision. The BoE kept the benchmark interest rate unchanged at 4.75% as expected, but the accompanying statement leaned to dovish. Three out of nine MPC members opted for a cut.

Gold price resumes slide, pierces the $2,600 level

Gold resumes its decline after the early advance and trades below $2,600 early in the American session. Stronger than anticipated US data and recent central banks' outcomes fuel demand for the US Dollar. XAU/USD nears its weekly low at $2,582.93.

Bitcoin slightly recovers after sharp sell-off following Fed rate cut decision

Bitcoin (BTC) recovers slightly, trading around $102,000 on Thursday after dropping 5.5% the previous day. Whales, corporations, and institutional investors saw an opportunity to take advantage of the recent dips and added more BTC to their holdings.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.