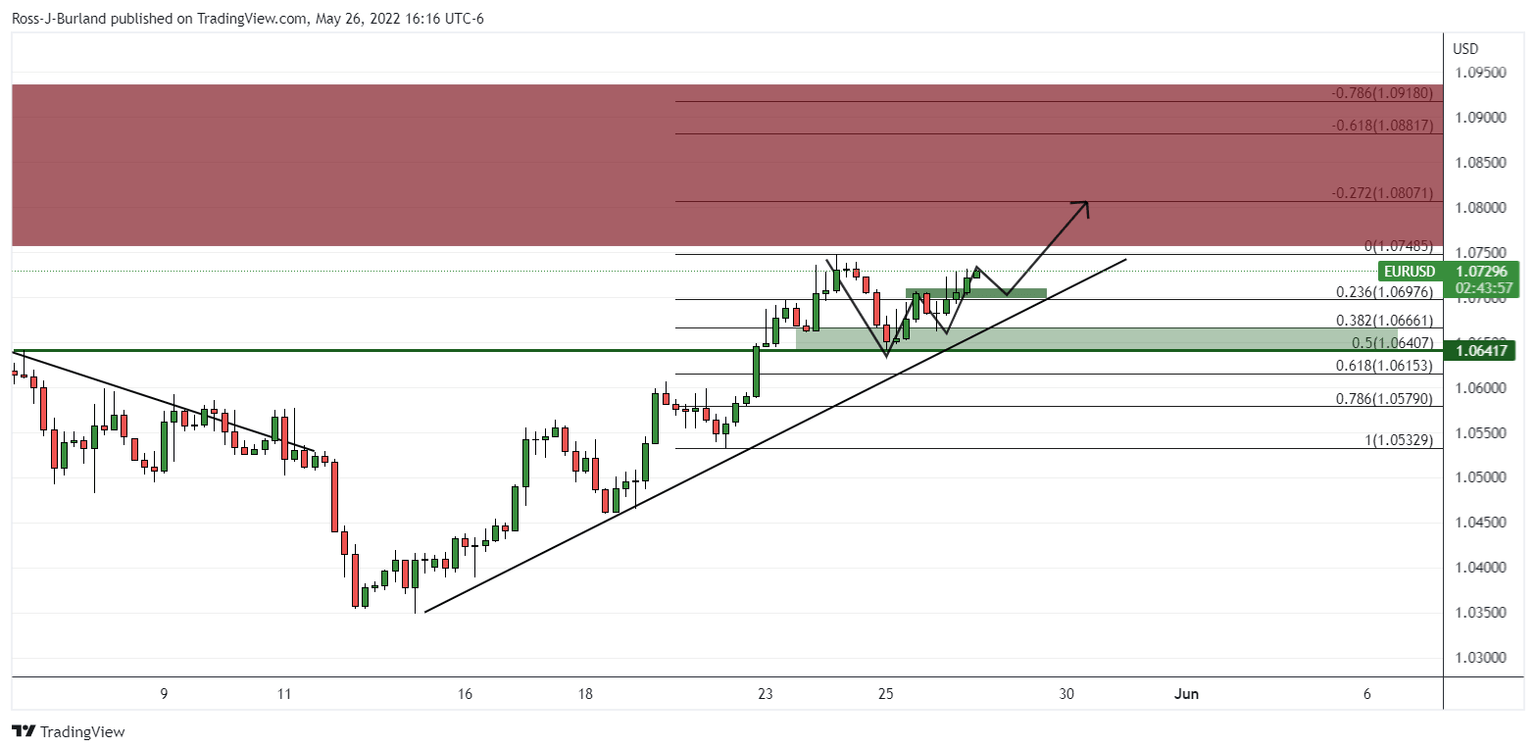

EUR/USD Price Analysis: Bulls are taking control and eye the 1.08 area

- EUR/USD's market structure is now bullishon the daily chart.

- EUR/USD's support near 1.0705 could offer a base from which bulls can engage in order to target the 1.08 areas.

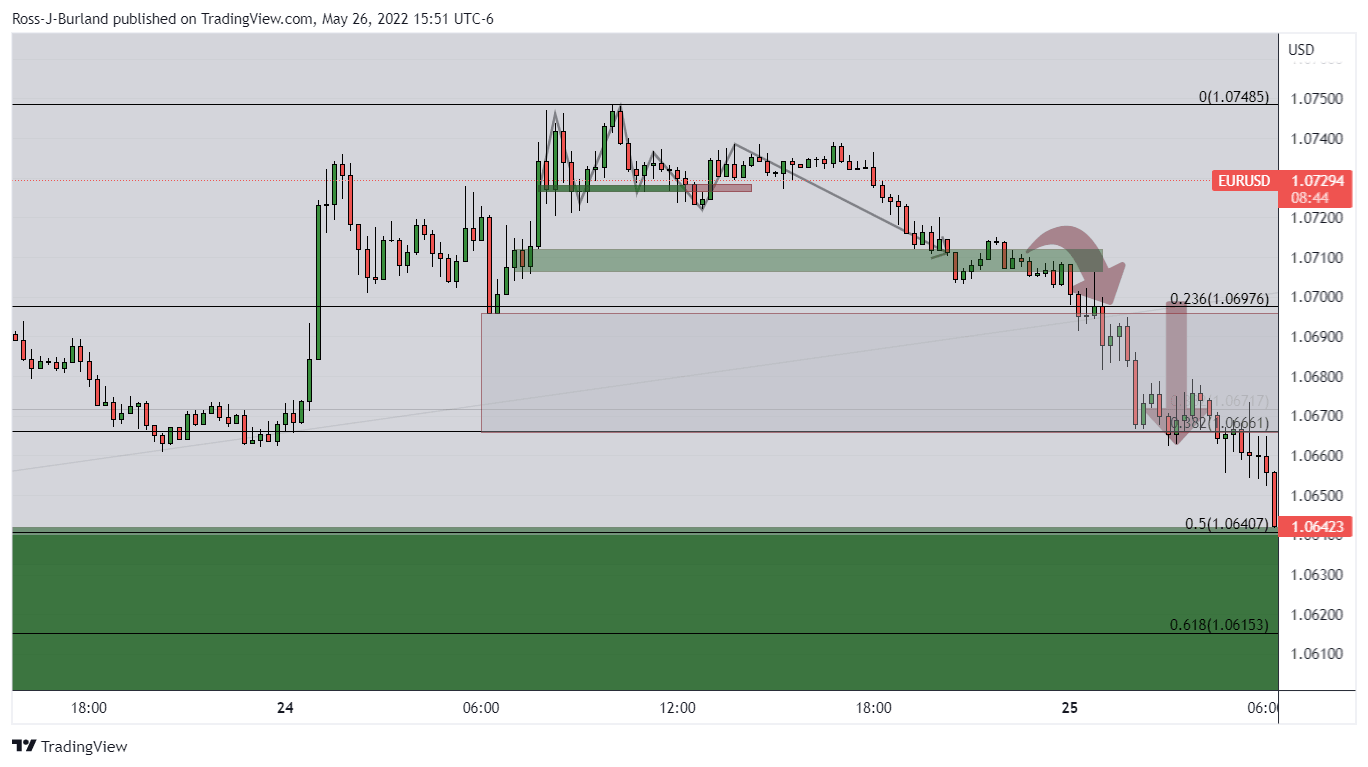

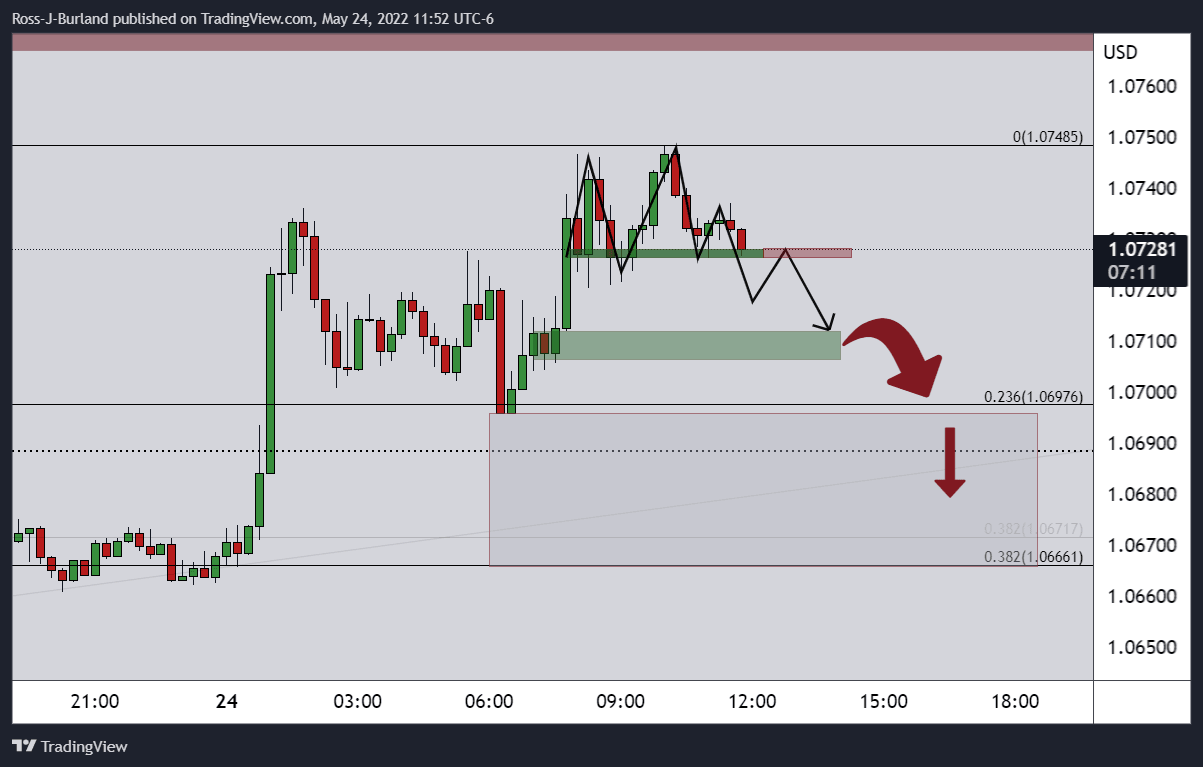

As per the prior analysis, EUR/USD Price Analysis: Traders looking for a catalyst from the Fed, bulls on a knife's edge, the euro, following initial mitigation of some upside eventually melted to the downside into the targetted area of 1.0640.

EUR/USD prior analysis

''The bearish head and shoulders are a topping pattern that currently features in the 15-min time frame. A break of the neckline near 1.0725 could spell trouble for the committed bulls. A break of 1.0705 will likely open the way for further supply to mitigate the price imbalance towards a 38.2% Fibonacci retracement of the daily bullish breakout impulse near 1.0665 that guards a 50% mean reversion to 1.0640.''

Subsequent price action:

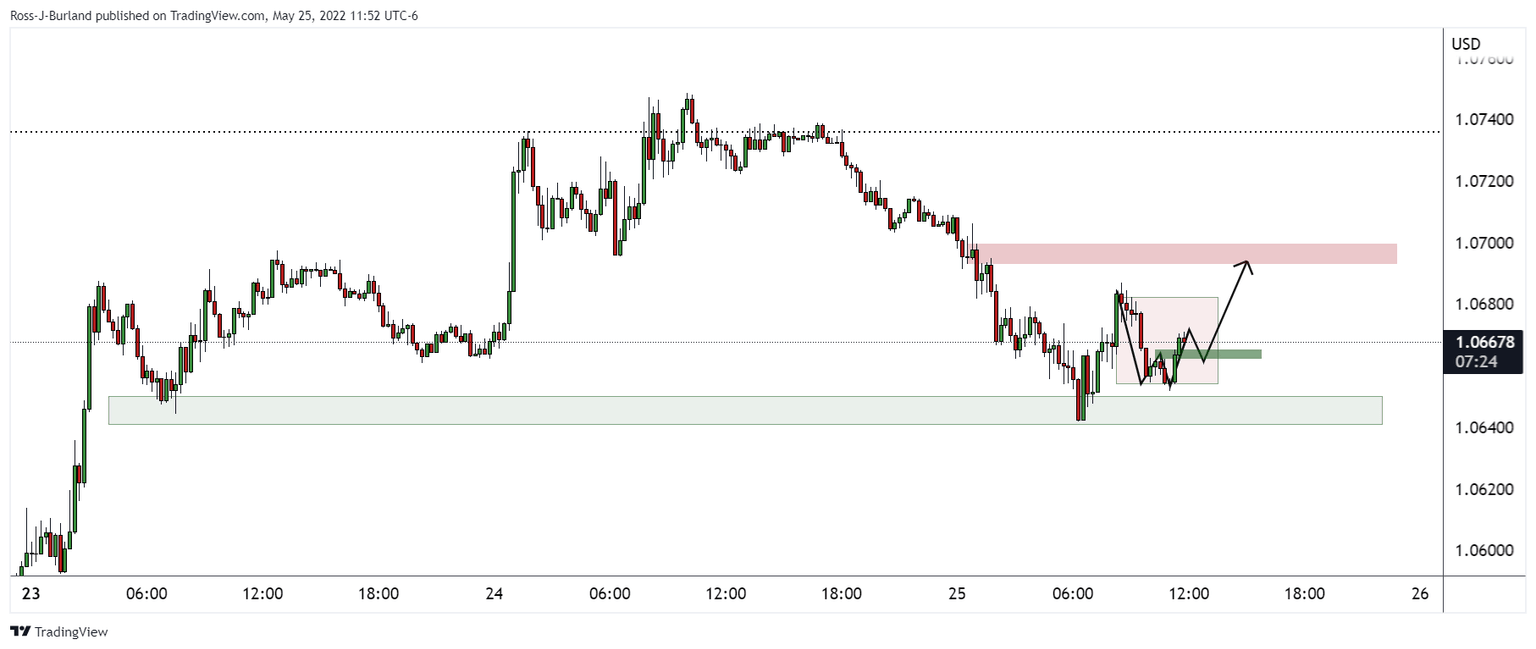

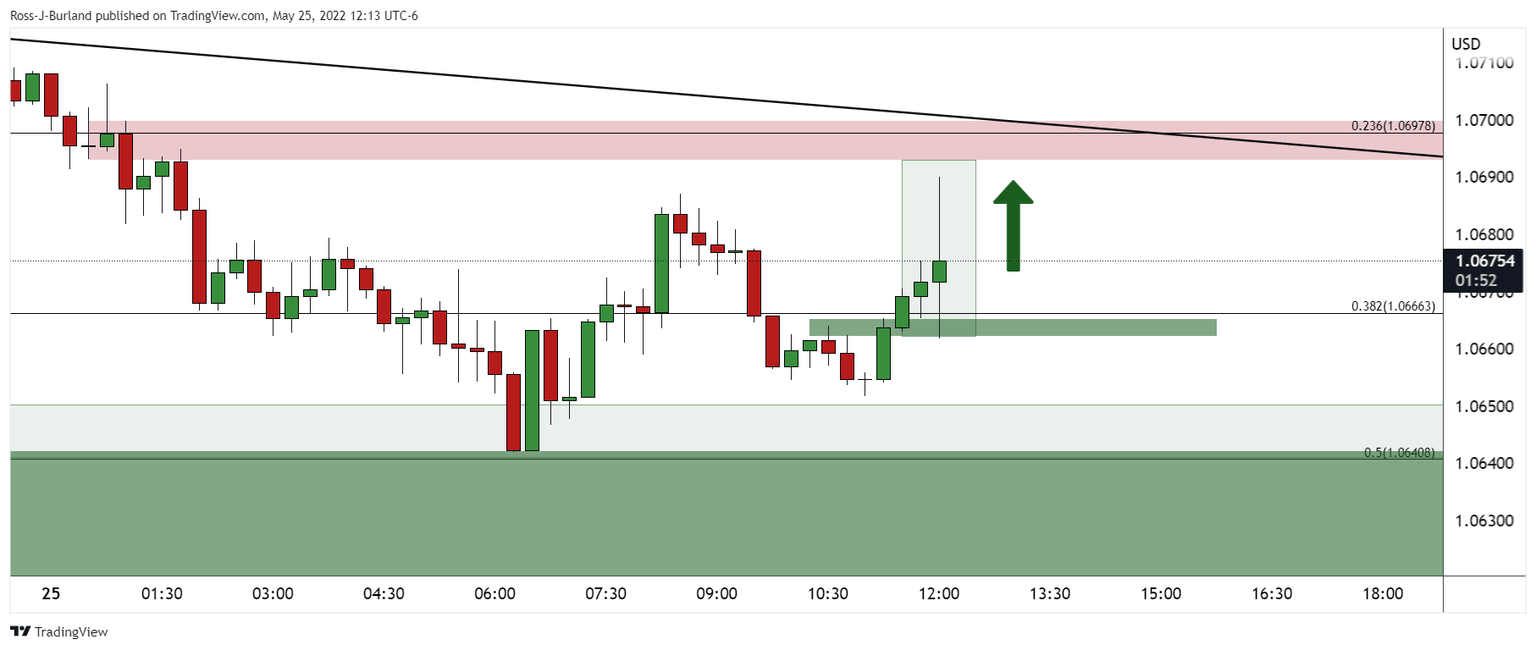

For the FOMC minutes, the pair was based at the targetted support area and there were prospects of a higher correction from support:

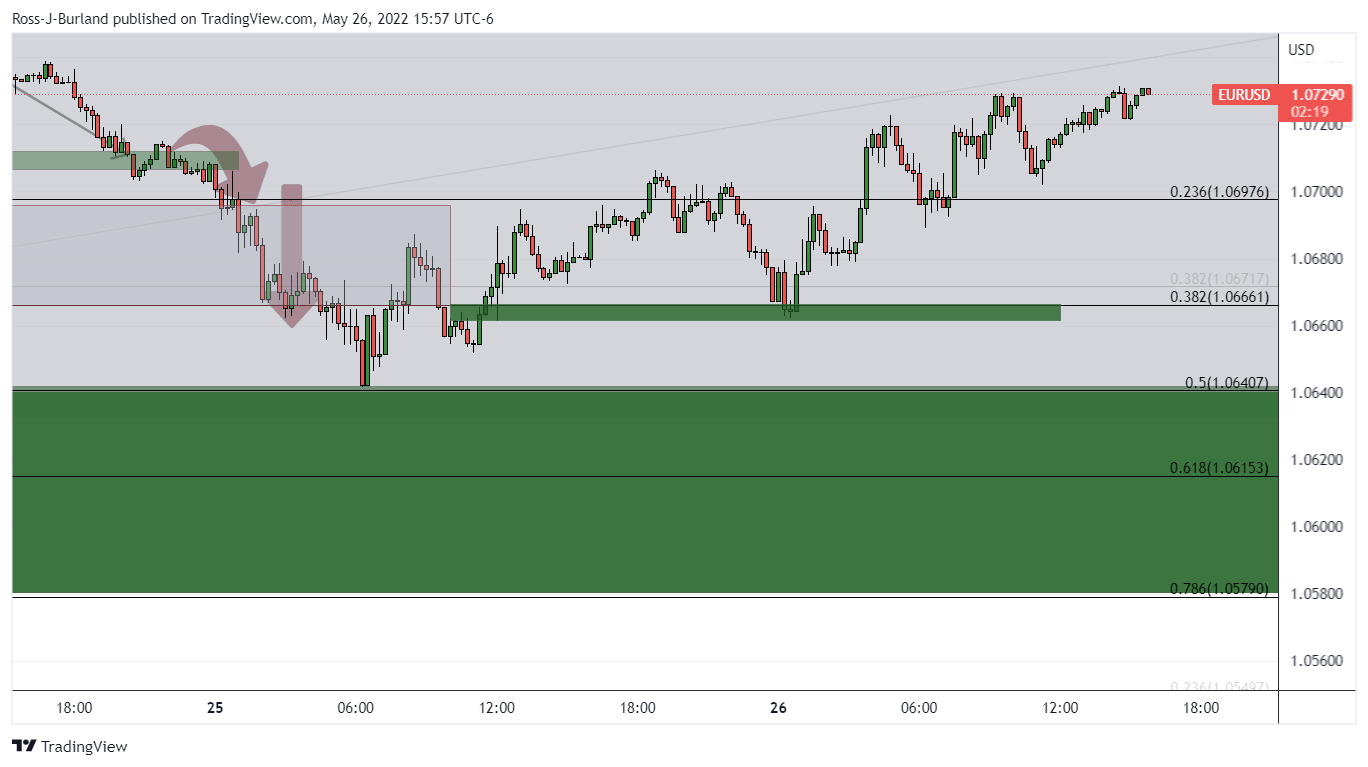

Immediately following the minutes the price indeed resumed the upside:

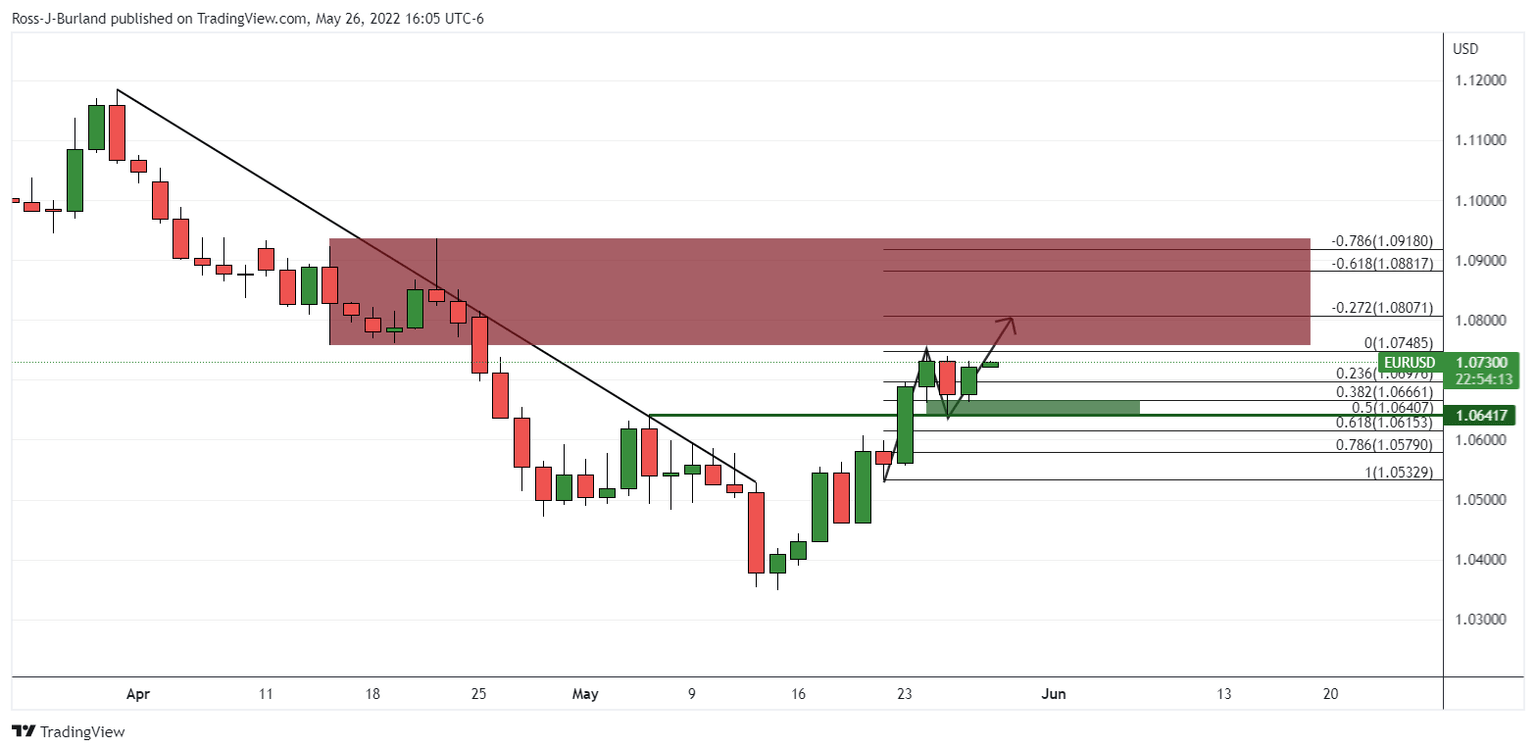

This now invalidates the immediate bearish outlook and leaves a bullish daily continuation on the map:

EUR/USD daily chart

The price broke the horizontal resistance that is now responding as a support zone on the retest. The bulls have committed to the course and a run into prior support and resistance between 1.0761 and 1.0936 could be in order with the 1.08 figure a key target.

EUR/USD H4 chart

The W-formation's neckline near 1.0705 could offer a base from which bulls can engage in order to target the 1.08 areas.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.