EUR/USD Price Analysis: Breakout traders triggered long, bears looking to pounce

- EUR/USD bearish W-formation is in focus.

- Bulls could find themselves trapped in trying to break out through recent highs.

- US CPI red news event could be the catalyst for a sizeable downside move.

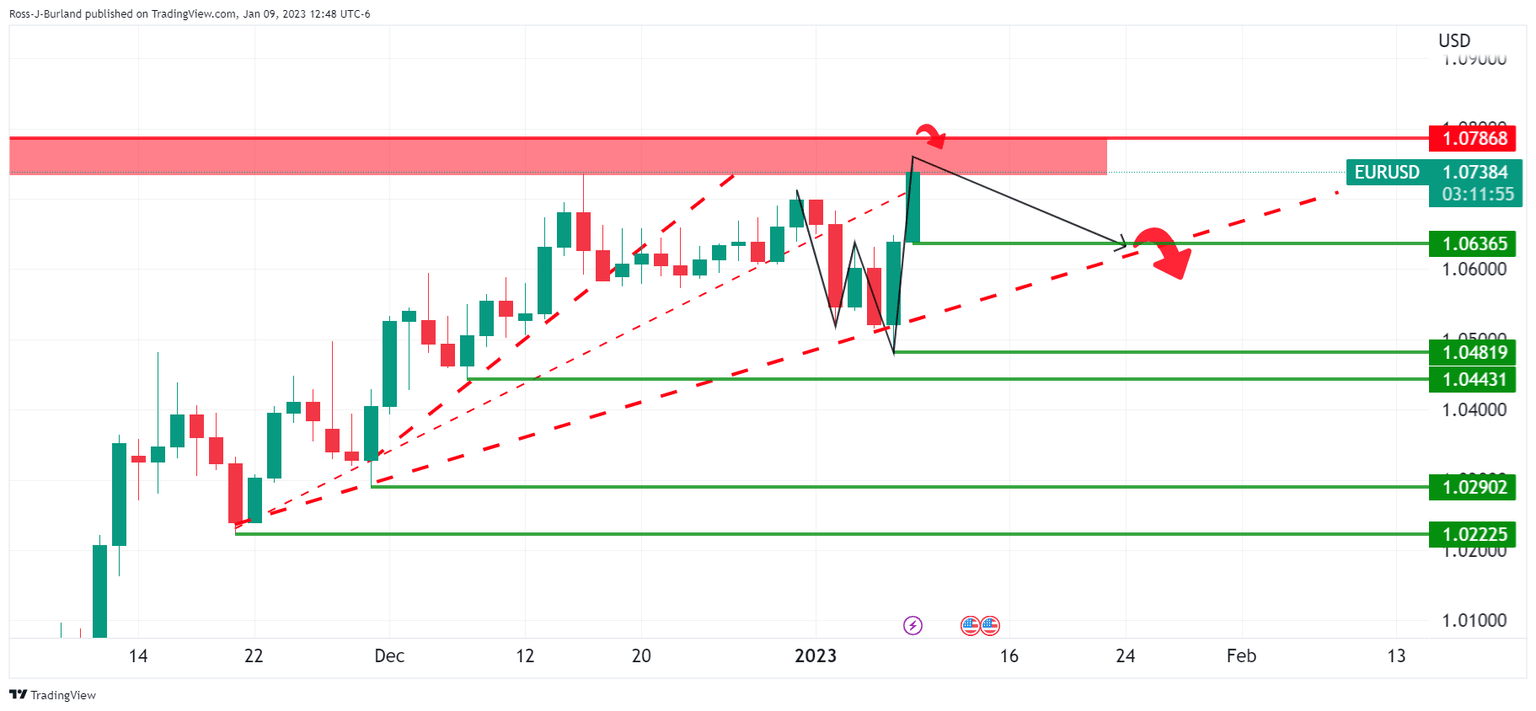

EUR/USD broke to the backside of the bearish trend at the end of last year. It has since rallied towards a key resistance area but has started to slow in its ascent which leaves the focus on signs of distribution for the days ahead. The following illustrates this on a daily chart and highlights a key reversion pattern that has emerged at the start of the year:

EUR/USD daily chart

EUR/USD has reached up to test prior highs of 1.0736 and has moved into a critical resistance area as a potential last stop before the bears move back in.

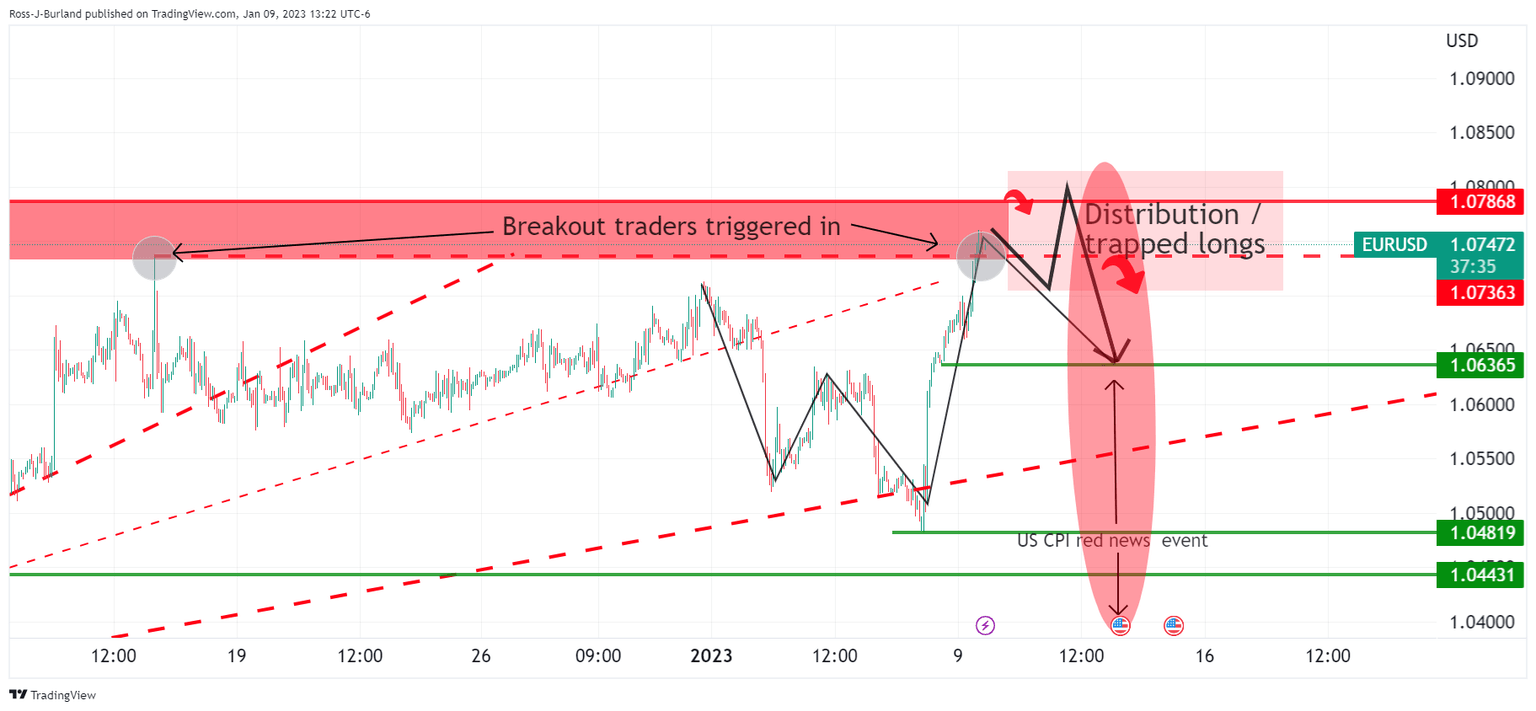

Zoomed in...

Should the bears emerge below 1.0790, then the focus will be on signs of distribution again that will ultimately trap the breakout long positions.

The W-formation is supportive of such a thesis given that it is a reversion pattern. EUR/USD would be expected to revert towards the neckline and day's lows of near 1.0637. This could put the trendline support back under pressure and open the risk of a move below 1.0500 and on to test 1.0480, 0.0440 and then 1.0300 that guards 1.0290 and 1.0225 lower down.

EUR/USD H1 chart

In the meantime, the lower time frames can be monitored for signs of buying exhaustion love the coming sessions:

A long squeeze below 1.0750/36 could be in order for the sessions and days ahead with US Consumer Price Index eyed as a potential catalyst on Thursday for a three-day set-up and bearish opportunity.

With that being said, a test of 1.0800 is on the table beforehand:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.