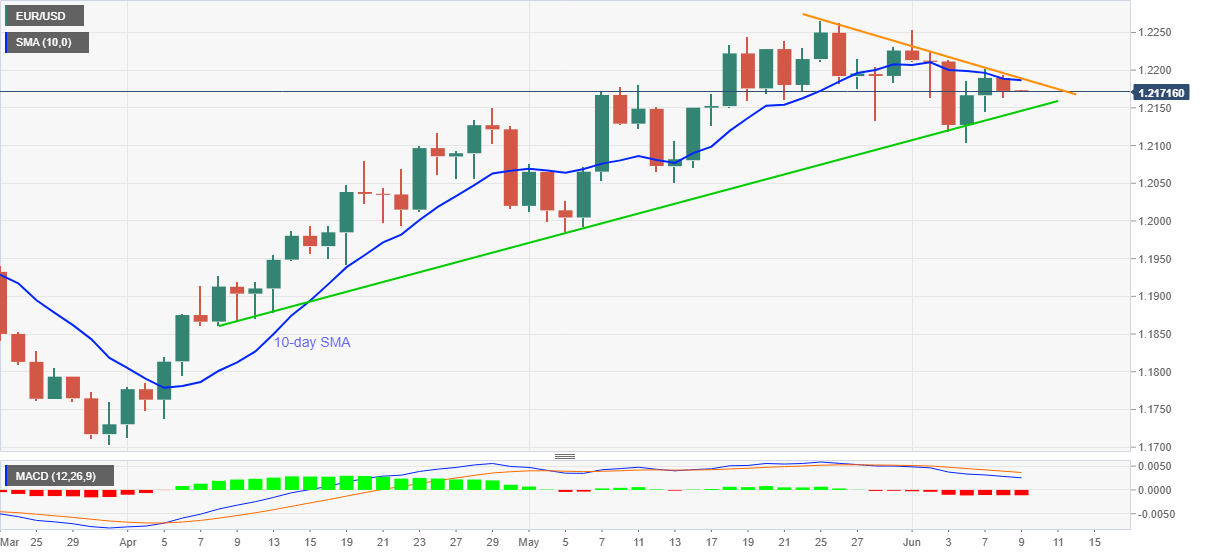

EUR/USD Price Analysis: Bears tighten grips below 1.2185-90 key hurdle

- EUR/USD holds lower ground below 10-day SMA, two-week-old resistance line.

- Further weakness envisioned amid stronger bearish bias of MACD.

- Bears aim for ascending trend line from April, bulls have a bumpy road.

EUR/USD stays pressured around 1.2170 during early Wednesday morning in Asia. The currency major pair snapped a two-day uptrend the previous day while extending pullback from 10-day SMA. The following moves gain downside momentum amid the strongest bearish MACD signals since late March.

However, sellers will have a tough time breaking an ascending support line from April 08, near 1.2145, which holds the gate for the EUR/USD slump towards the monthly low of 1.2104.

During the quote’s further weakness past 1.2100, levels marked during May around 1.2050 and 1.1985, coupled with the 1.2000 threshold could entertain the bears.

Alternatively, a confluence of 10-day SMA and a downward sloping trend line from April 25, around 1.2185-90, becomes crucial nearby resistance.

Though, a clearance of 1.2190 isn’t a free pass for the EUR/USD buyers as multiple hurdles close to 1.2240 and the latest high near 1.2265 could probe the pair’s further upside.

Overall, EUR/USD signals additional south-run but the losses are limited.

EUR/USD daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.