EUR/USD Price Analysis: Bears move in and eye a break of 1.0600

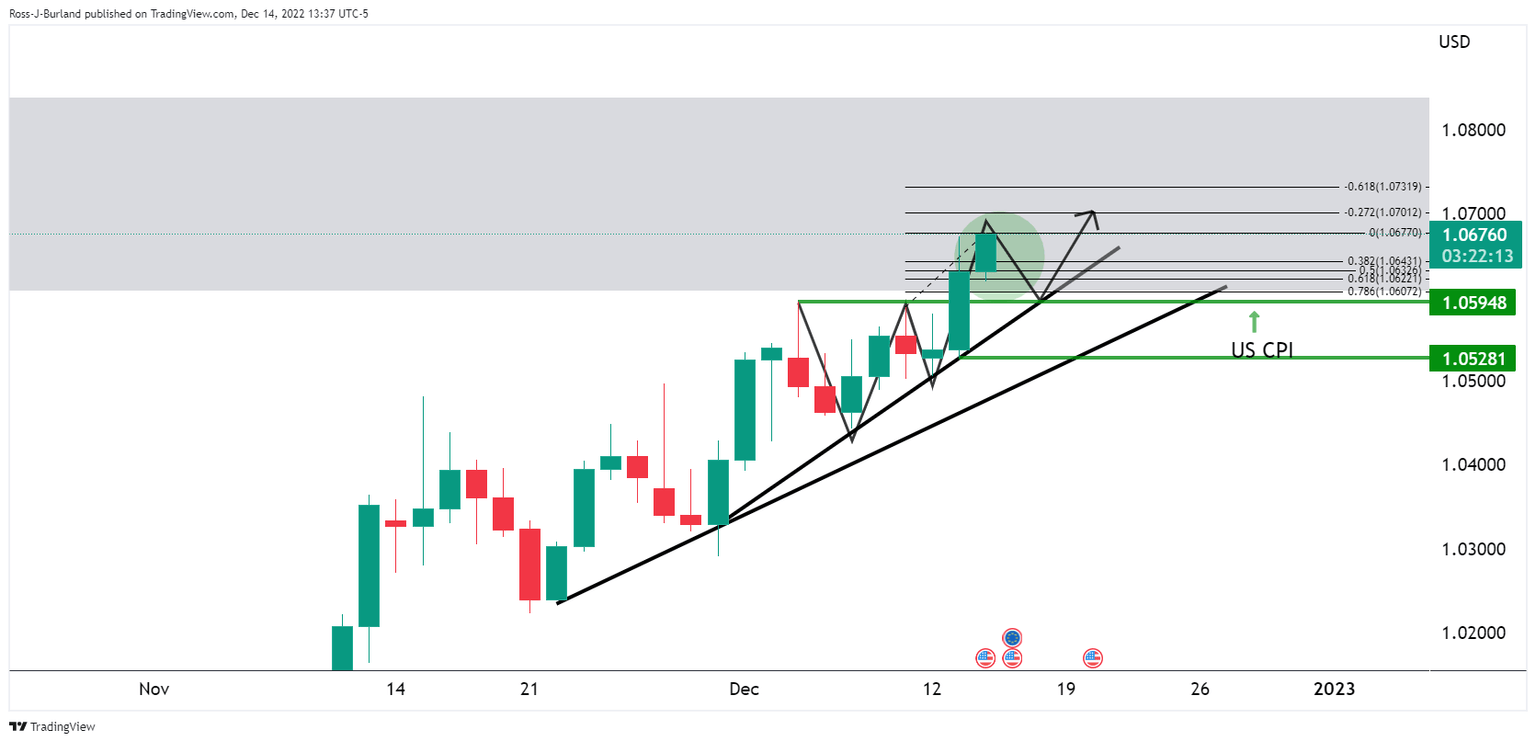

- EUR/USD is stalling on the bid and the W-formation could play out for a move into the 1.0620s.

- On the upside, we have 1.0700 as a key level where a measured move of -0.272% of the potential correction's range.

As illustrated in the prior analysis, the price has moved into the target area, leaving a W-formation in its tracks. This is a reversion pattern whereby bulls would still be expected to move in at a discount from the neckline should there be a test of 1.0600 or there abouts.

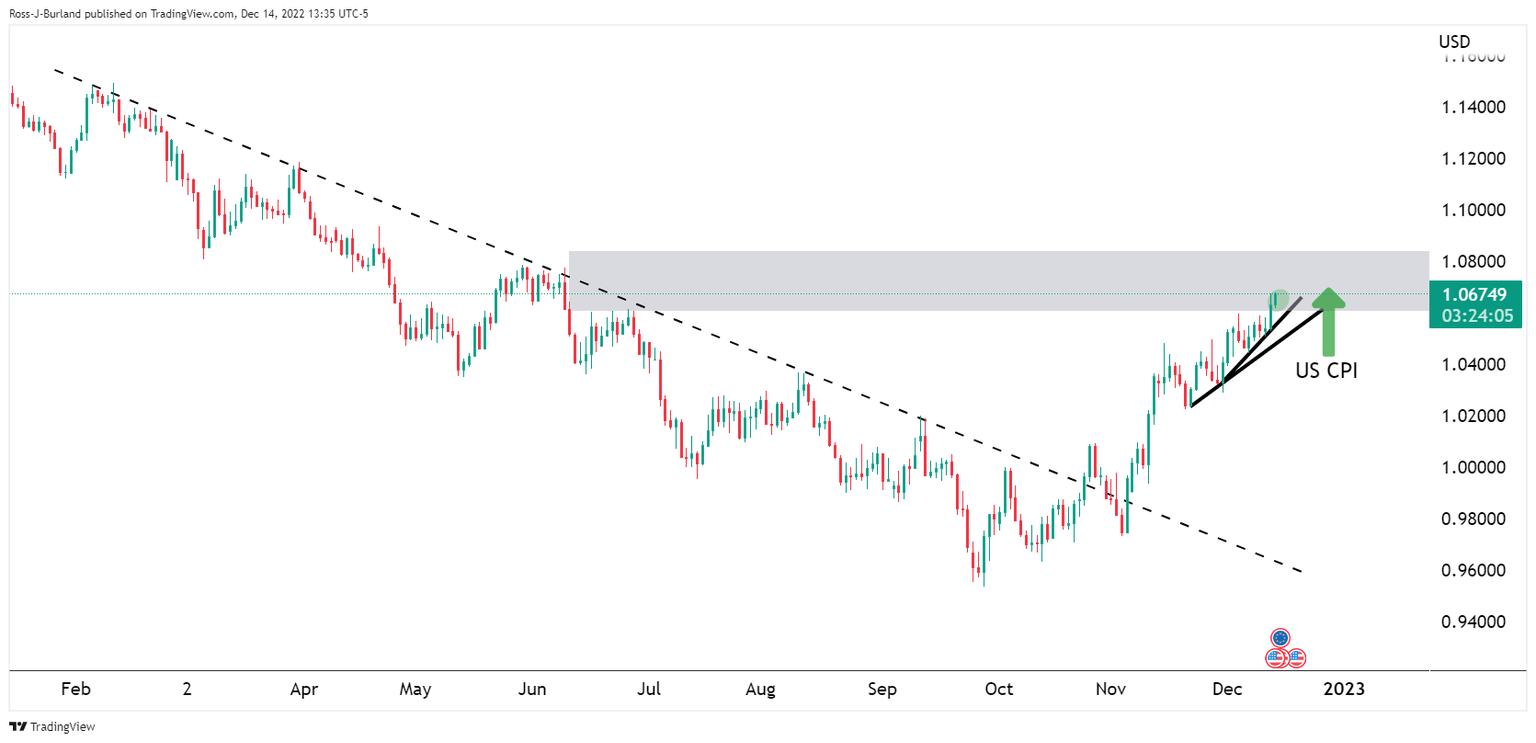

EUR/USD prior analysis

This still marks 1.0600 as a key support area and 1.0520s below it as being the CPI take-off point.

EUR/USD update

The price is stalling on the bid and the W-formation could play out for a move into the 1.0620s as a first objective and then to test 1.0600 thereafter. 1.0580 and 1.0520/05 could be the last defence for a significant bearish correction for the weeks ahead and New Year.

On the upside, however, we have 1.0700 as a key level where a measured move of -0.272% of the potential correction's range to support meets the prior mid-summer resistance looking left. We have 1.0790 thereafter as the next level.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.