EUR/USD Price Analysis: Bears eye a break of key dynamic support, 1.0850 eyed

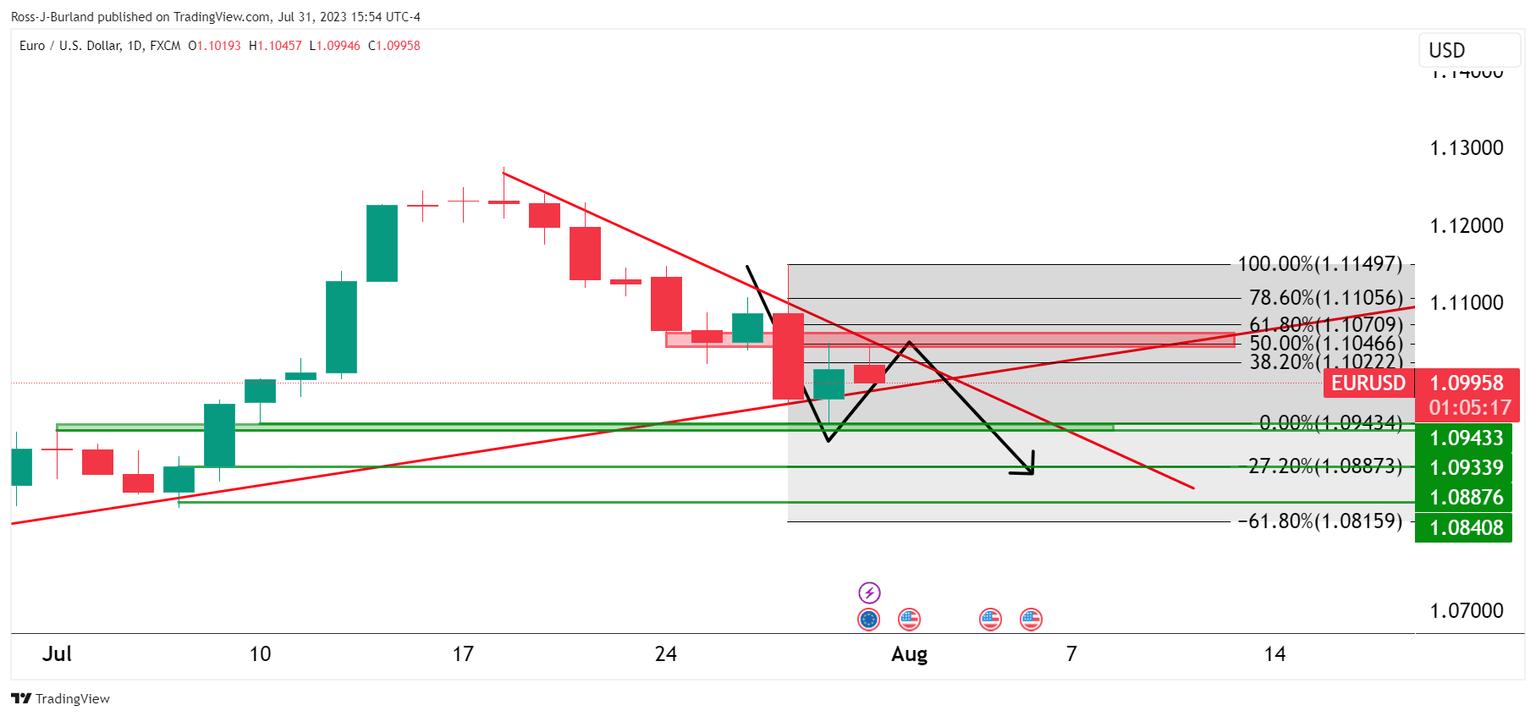

- The Euro is facing resistance in a 50% mean reversion area on the daily charts.

- Bears eye a break of dynamic support to open risk to towards 1.0850 next support.

EUR/USD was offered on Monday and was bleeding heavily later in the US session, dropping to a fresh low of 1.0992 after the 1.10 figure finally gave way that was otherwise propped up for the best part of the day with option expiries.

At the start of the day, data showed economic growth in Europe nudged higher and inflation ticked lower, but that was not enough to keep the bears at bay given a survey from the Federal Reserve that showed US banks reported tighter credit standards and weaker loan demand during the second quarter.

The Fed's quarterly Senior Loan Officer Opinion Survey, or SLOOS, which is directed both at businesses and consumers, also showed that banks expect to further tighten standards over the rest of 2023, Reuters reported. this is a sign rising interest rates are having an impact on the economy and the US Dollar has risen, driving the Euro towards trendline support again:

EUR/USD technical analysis

The daily charts above show the Euro is facing resistance in a 50% mean reversion area on the daily charts and a break of support opens risk to towards 1.0850 next support.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.