EUR/USD Price Analysis: Bears eye 1.0960 as US Dollar cheers pre Fed, ECB anxiety

- EUR/USD takes offers to refresh intraday low, prints three-day losing streak.

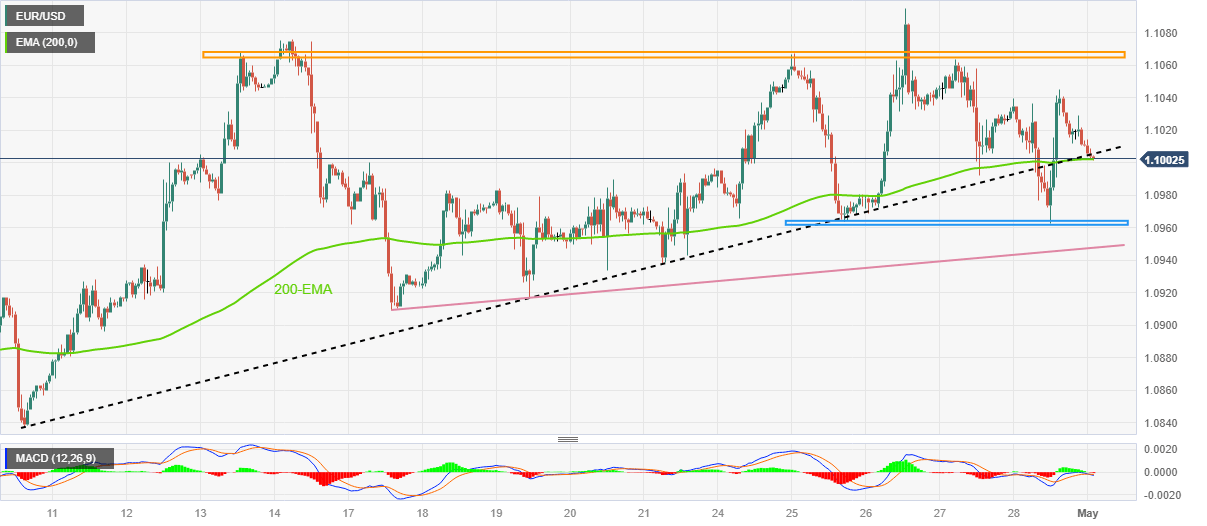

- Euro bears attack three-week-old ascending support line, 200-EMA.

- Impending bear cross on MACD, failure to keep bounce off one-week-old horizontal support favor sellers.

- Wait for First Republic bidding results to join hawkish Fed bets to weigh on EUR/USD ahead of key monetary policy meetings.

EUR/USD renews intraday low as bears attack the 1.1000 round figures early Monday amid broad US Dollar strength, as well as sluggish markets due to holidays at many bourses.

Also read: EUR/USD drops towards 1.1000 as ECB hawks retreat, First Bank roils the mood, US NFP, Fed eyed

In doing so, the Euro pair drops for the third consecutive day as it breaks the 200-bar Exponential Moving Average (EMA) and an ascending trend line from April 10.

Given the Euro pair’s failure to defend the previous week’s bounce off short-term horizontal support, coupled with the recently impending bearish signals from the MACD indicator, the EUR/USD sellers are likely to keep the reins.

That said, the major currency pair presently drops towards a horizontal support zone comprising multiple levels marked since April 25, near 1.0960.

However, a two-week-long ascending trend line near 1.0945 could challenge the EUR/USD bears afterward.

On the contrary, EUR/USD recovery may aim for the 1.1050 round figures before directing the pair buyers towards a 12-day-long horizontal resistance area surrounding 1.1065-70.

Following that, the recently marked multi-month high of 1.1095 can prod the Euro pair buyers before directing them to the March 2022 peak close to 1.1185.

EUR/USD: Hourly chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.