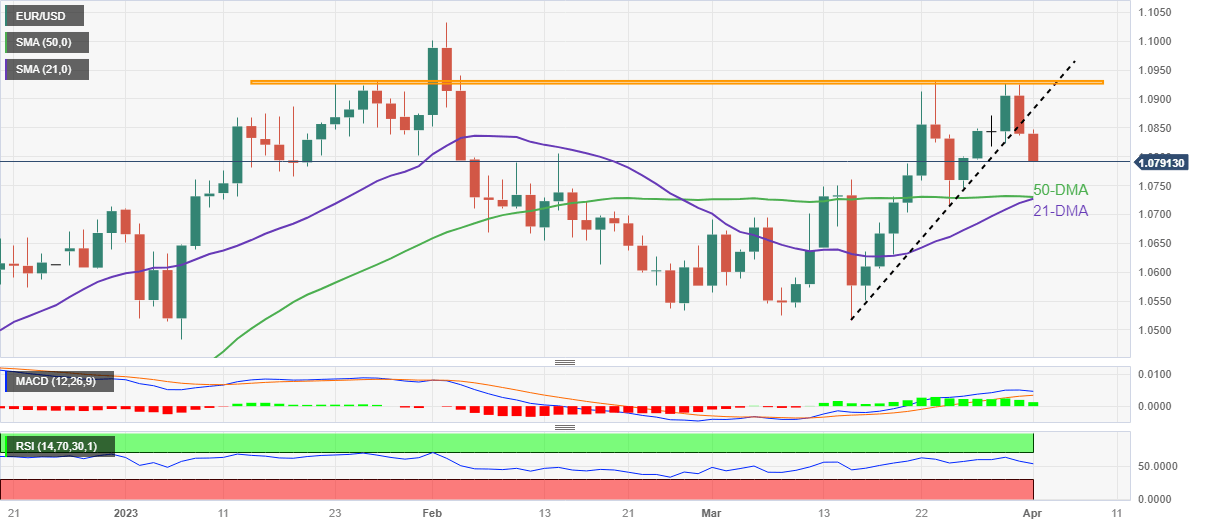

EUR/USD Price Analysis: Bears appear well-set to prod 1.0730 support as NFP week begins

- EUR/USD extends pullback from 10-week-old horizontal resistance, renews intraday low of late.

- Downside break of 13-day-old support line, easing bullish bias of MACD signals add strength to bearish view.

- Convergence of 50-DMA, 21-DMA joins RSI (14) retreat to challenge EUR/USD bears.

- Receding hawkish hopes from Fed, recently mixed US data prod Euro pair sellers.

EUR/USD takes offers to renew intraday low around 1.0790 as it extends the previous U-turn from a short-term key hurdle during early Monday. Adding strength to the downside bias is the clear break of a two-week-old support line, now resistance, as well as the receding bullish bias of the MACD. It should be observed that the RSI (14) line retreats towards the 50 level, which in turn suggests further grinding towards the south.

Hence, the EUR/USD price is well-set to test the 1.0730 support confluence including the 50-DMA and 21-DMA as traders begin the key week.

Also read: EUR/USD sellers attack 1.0800 as risk aversion joins consolidation ahead of US PMI, NFP

In a case where the Euro pair remains weaker past 1.0730, the 1.0700 threshold may act as an intermediate halt before directing the major currency pair towards the previous monthly low surrounding 1.0520-15.

On the flip side, the support-turned-resistance line and the aforementioned horizontal resistance area, respectively near 1.0880 and 1.0930, challenge the EUR/USD pair buyers.

Following that, the 1.1000 psychological magnet may act as an intermediate halt before directing the Euro bulls towards the February 2023 high of around 1.1035.

Overall, EUR/USD is likely to decline further but the downside room below 1.0730 appears limited.

EUR/USD: Daily chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.