EUR/USD Price Analysis: Bearish impulsive eyes 1.0530, German inflation and Fed’s Beige Book

- EUR/USD fades previous rebound from the lowest levels in two months.

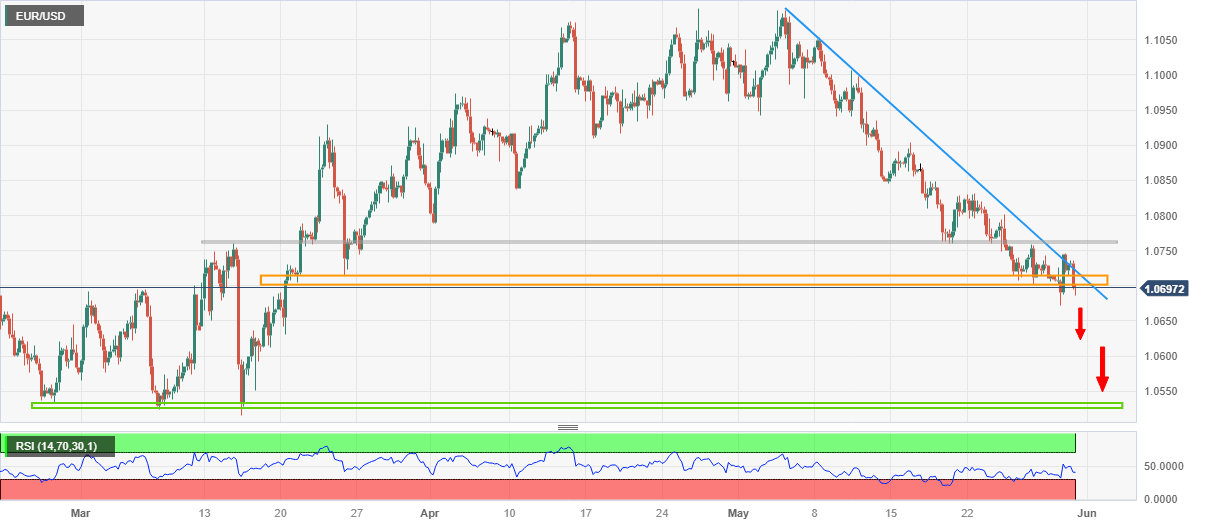

- Failure to stay beyond short-term key horizontal area, three-week-old falling trend line favors Euro sellers.

- RSI conditions may offer intermediate halt during the anticipated fall towards three-month-old “triple bottom” formation.

EUR/USD remains on the back foot around an intraday low of 1.0685 as it reverses the previous day’s corrective bounce heading into Wednesday’s European session.

In doing so, the Euro pair registers the buyer’s inability to keep the reins past the two-month-old horizontal resistance area, as well as a downward-sloping trend line from May 04.

Additionally favoring the EUR/USD seller is the RSI (14) line which still has some room before hitting the oversold territory, suggesting a gradual south-run of the major currency pair.

As a result, the quote is well-set for a slow grind toward the 1.0600 round figure. However, the triple bottoms near the 1.0530 support zone comprising multiple levels marked since late February appears a tough nut to crack for the EUR/USD bears afterward, especially amid a likely oversold RSI line at that level.

Meanwhile, the aforementioned horizontal region surrounding 1.0700-15 precedes the descending resistance line, close to 1.0725 at the latest, to restrict short-term EUR/USD recovery.

Following that, a 10-week-old horizontal hurdle around 1.0760-65 may act as the last defense of the Euro pair bears before giving control to the buyers.

EUR/USD: Four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.