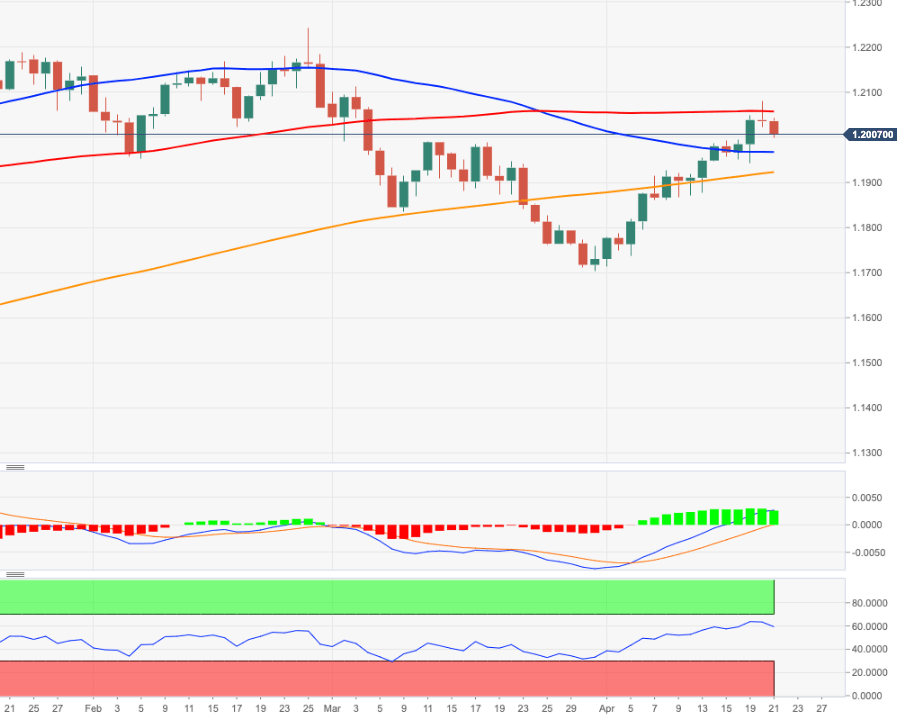

EUR/USD Price Analysis: A surpass of 1.2100 exposes extra gains

- EUR/USD’s corrective downside meets support around 1.2000.

- The resumption of the uptrend targets the 1.2100 level.

EUR/USD retreats further after climbing to as low as the 1.2080 region earlier in the week.

The current leg lower is deemed as temporary, with the resumption of the upside should target recent tops near 1.2080 ahead of the 1.2100 level.

A convincing break above the latter should expose the February highs around 1.2240 ahead of the 2021 peaks in the mid-1.2300s.

Above the 200-day SMA (1.1913) the stance for EUR/USD is predicted to remain positive.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.