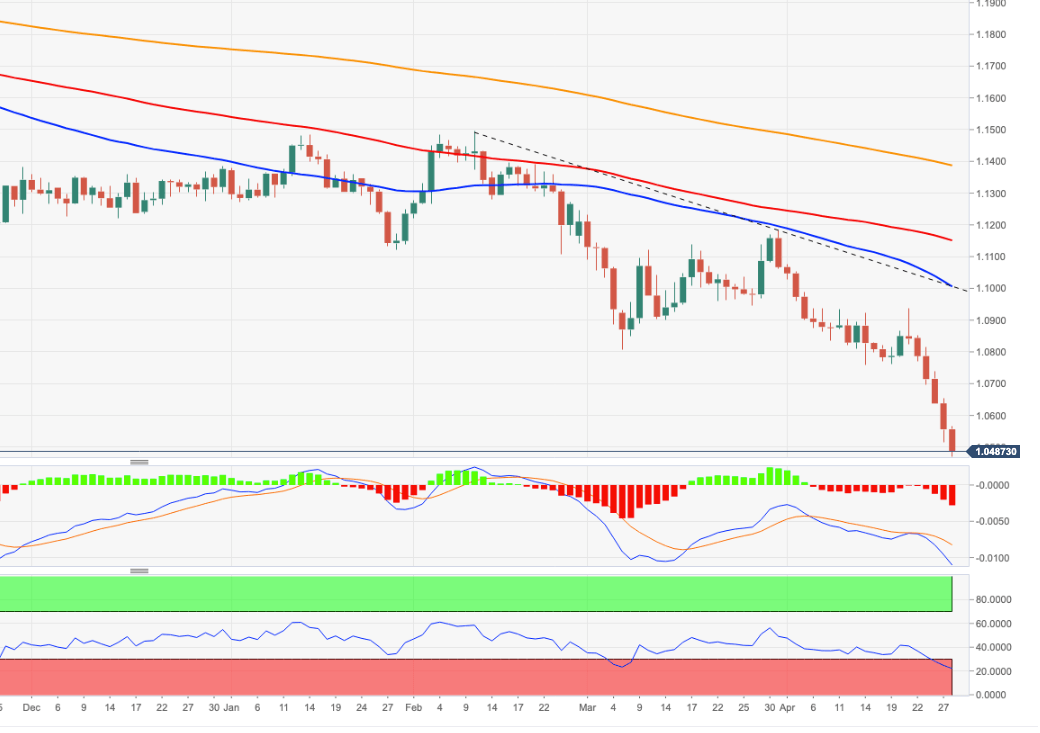

EUR/USD Price Analysis: A drop to the 2017 low near 1.0340 looks likely

- EUR/USD drops further and breaks below 1.0500.

- Extra losses could now extend to the 1.0340 area.

EUR/USD remains well into the negative territory and tests lows in the 1.0470 zone, an area last traded back in January 2017.

The downside momentum in the pair remains well and sound and now the door looks wide open to a potential visit to the 2017 low at 1.0340 (April 3) sooner rather than later.

While below the 2-month line around 1.1000, extra losses remain well on the cards for the pair.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.