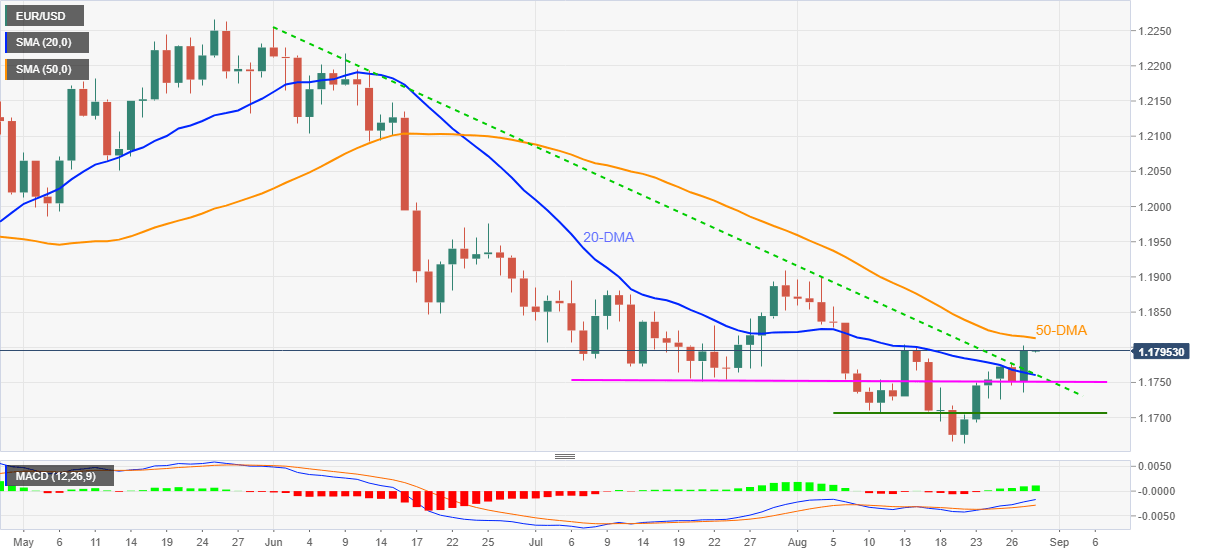

EUR/USD Price Analysis: 50-DMA guards immediate upside around 1.1800

- EUR/USD keeps break of three-month-old falling trend line, 20-DMA.

- Bullish MACD keeps buyers hopeful to aim for July’s top.

- Multiple hurdles above 1.1700 to challenge bear’s entry.

EUR/USD holds onto Friday’s key resistance breakout during early Monday morning in Asia.

The currency major pair crossed a confluence of 20-DMA and a descending trend line from early June the previous day to jump to the fortnight high. However, 50-DMA seems to challenge the upside momentum of late.

Even so, bullish MACD and a clear break of the 1.1760 resistance, now support, signals further upside of the EUR/USD buyers towards the previous month’s peak surrounding 1.1910.

During the rise, the 1.1830 and the monthly high near the 1.1900 round figure will join the immediate hurdle, namely the 50-DMA level around 1.1815.

Alternatively, a daily closing below 1.1760 won’t recall the EUR/USD bears as five-week-long horizontal support near 1.1750 adds to the downside filter.

On the same line, multiple levels marked since August 11 also challenge the pair sellers near 1.1710 ahead of directing them to the yearly low of 1.1664.

To sum up, EUR/USD remains bullish even as 50-DMA challenges short-term upside moves.

EUR/USD: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.