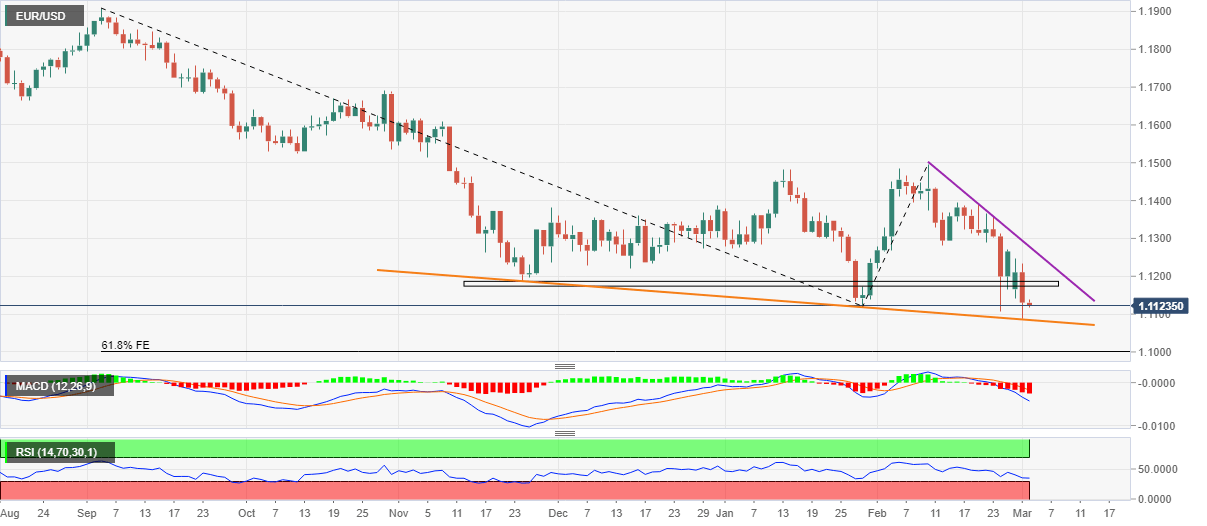

EUR/USD Price Analysis: 14-week-old support tests bears eyeing 1.1000

- EUR/USD bears take a breather after declining to May 2020 lows.

- Nearly oversold RSI, descending trend line from late November will challenge bears on the way to 61.8% FE.

- Multi-day-old horizontal area, short-term resistance line could test the recovery moves.

EUR/USD keeps the bounce off short-term support while taking rounds to 1.1125-20 during Wednesday’s Asian session.

The major currency pair dropped to the lowest levels since 21 months the previous day but couldn’t provide a daily closing below a downward sloping trend line from November 2021, around 1.1080 by the press time.

Also challenging the pair’s further downside is the nearly oversold RSI conditions.

It should be noted, however, that the EUR/USD weakness past 1.1080 won’t hesitate to meet the 61.8% Fibonacci Expansion (FE) of the pair’s moves between September 2021 and February 2022, near the 1.1000 threshold.

Alternatively, a horizontal area established since November 24 around 1.1175-85 guards the EUR/USD pair’s immediate rebound.

Following that, a three-week-old descending resistance line near 1.1280 will be the last line of defense for the pair sellers.

EUR/USD: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.