EUR/USD pivots into a loss-making week after US NFP bolsters Greenback

- EUR/USD tumbled into 1.0800 once again, trimming the week’s earlier gains.

- US NFP figures came in much higher than expected.

- ECB rate cut unlikely to be chased by a follow-up rate trim.

EUR/USD tumbled sharply on Friday, receding after US Nonfarm Payrolls climbed well above forecasts and European Central Bank (ECB) President Lagarde warned that a follow-up rate cut to June’s quarter-point rate trim may not be on the cards as many investors hope.

US Nonfarm Payrolls added 272K net new jobs in May, well above the 185K forecast while th previous month saw only a slight downside revision to 165K from the initial print of 175K. US Average Hourly Earnings also outpaced expectations as wages grew at a firmer pace than investors had anticipated, growing at a MoM rate of 0.4% versus the forecast uptick to 0.3% from 0.2%.

The US Unemployment Rate ticked higher to 4.0%, but a still-tight US labor market and rising wages threw a large wrench into broad-market rate cut hopes to wrap up the trading week. According to the CME’s FedWatch Tool, rate traders are pricing in 51% odds of no rate cut at all in September, down steeply from 70% odds of at least a quarter-point trim on September 8 that was priced in prior to Friday’s NFP print.

ECB's Lagarde: Still a long way to go on defeating inflation

Despite the ECB delivering a much-sought after rate cut this week, ECB President Christine Lagarde tamped down expectations for a follow-up rate cut in July, noting that progress on inflation has been a choppy affair, and the ECB will need to see firmer progress on disinflation before committing to further rate cuts. A hawkish, or rather, not-dovish showing from the head of the ECB hobbled Euro bulls hoping for a late-session rebound to wrap up the trading week.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Last release: Fri Jun 07, 2024 12:30

Frequency: Monthly

Actual: 272K

Consensus: 185K

Previous: 175K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

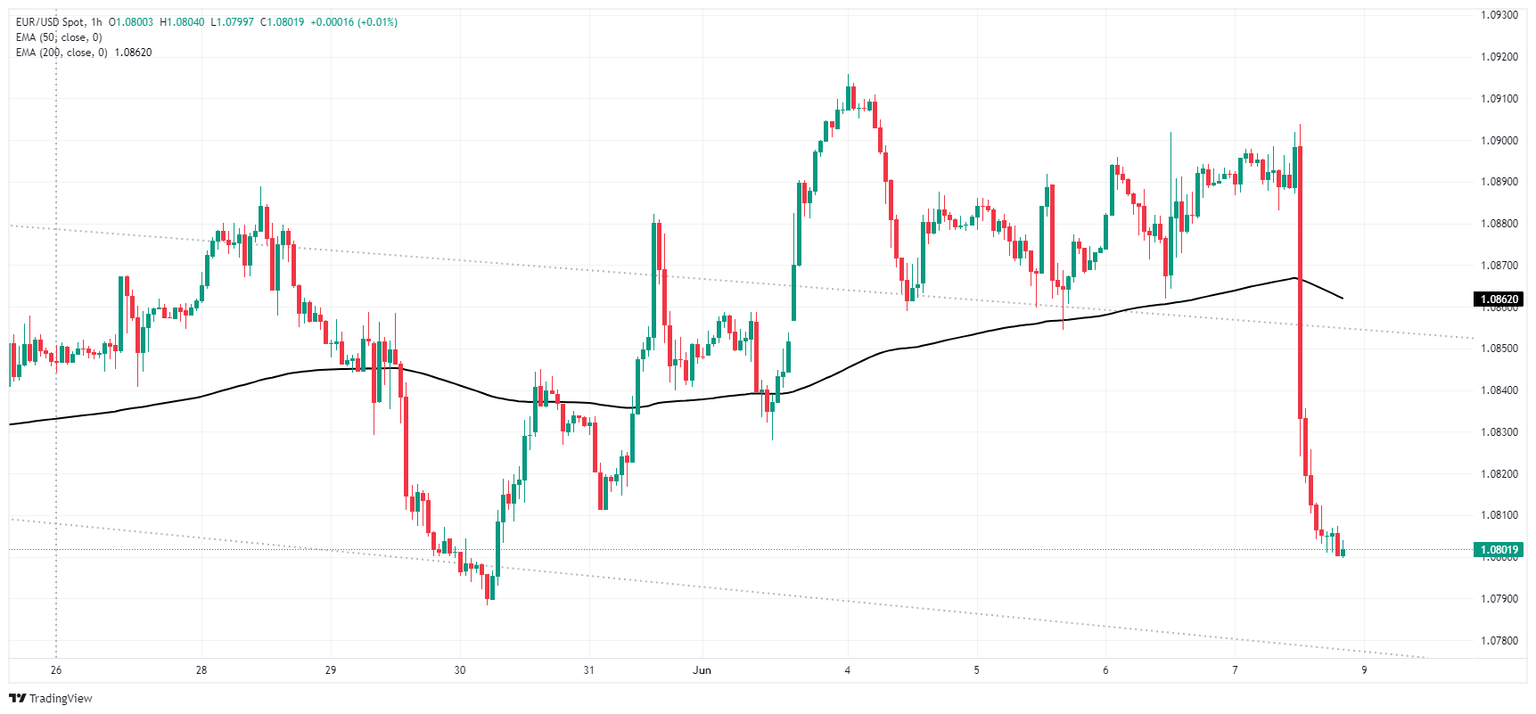

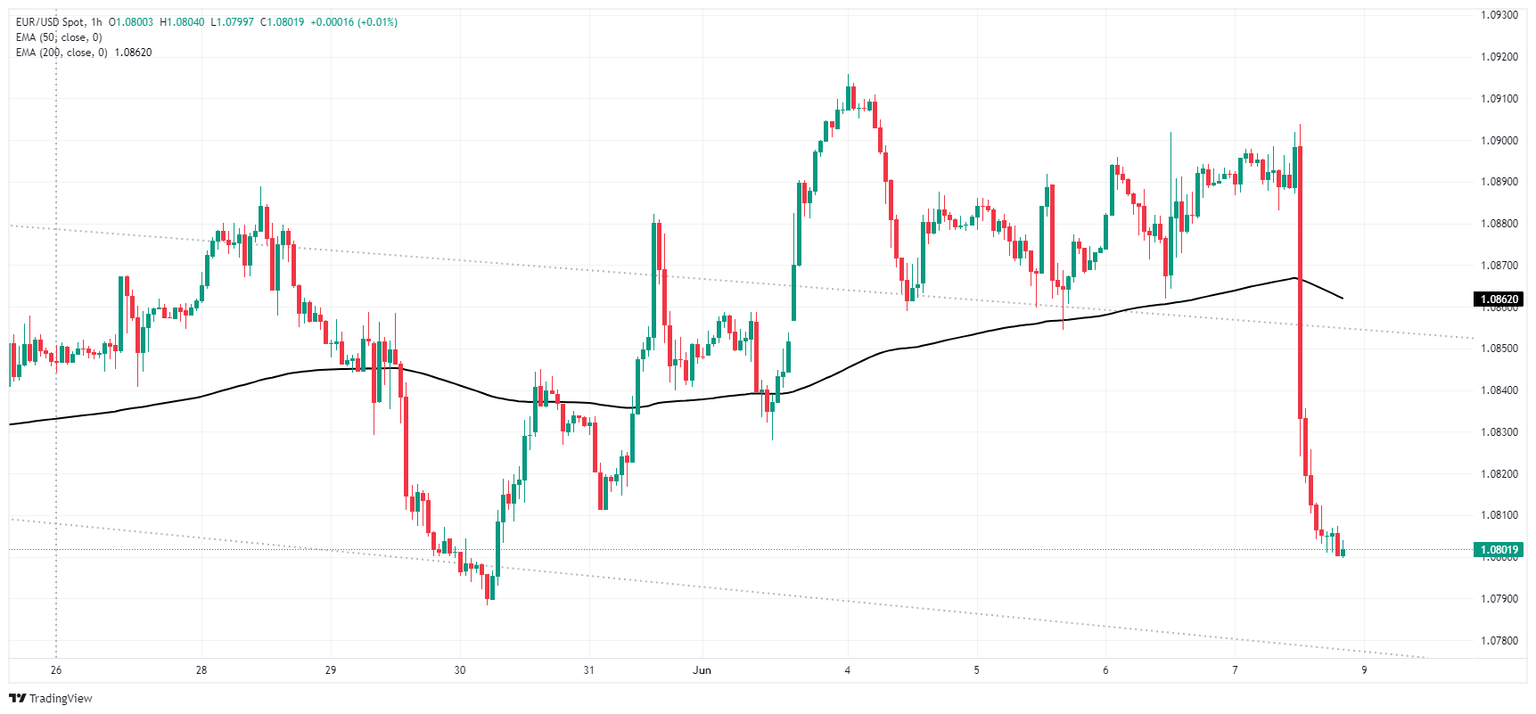

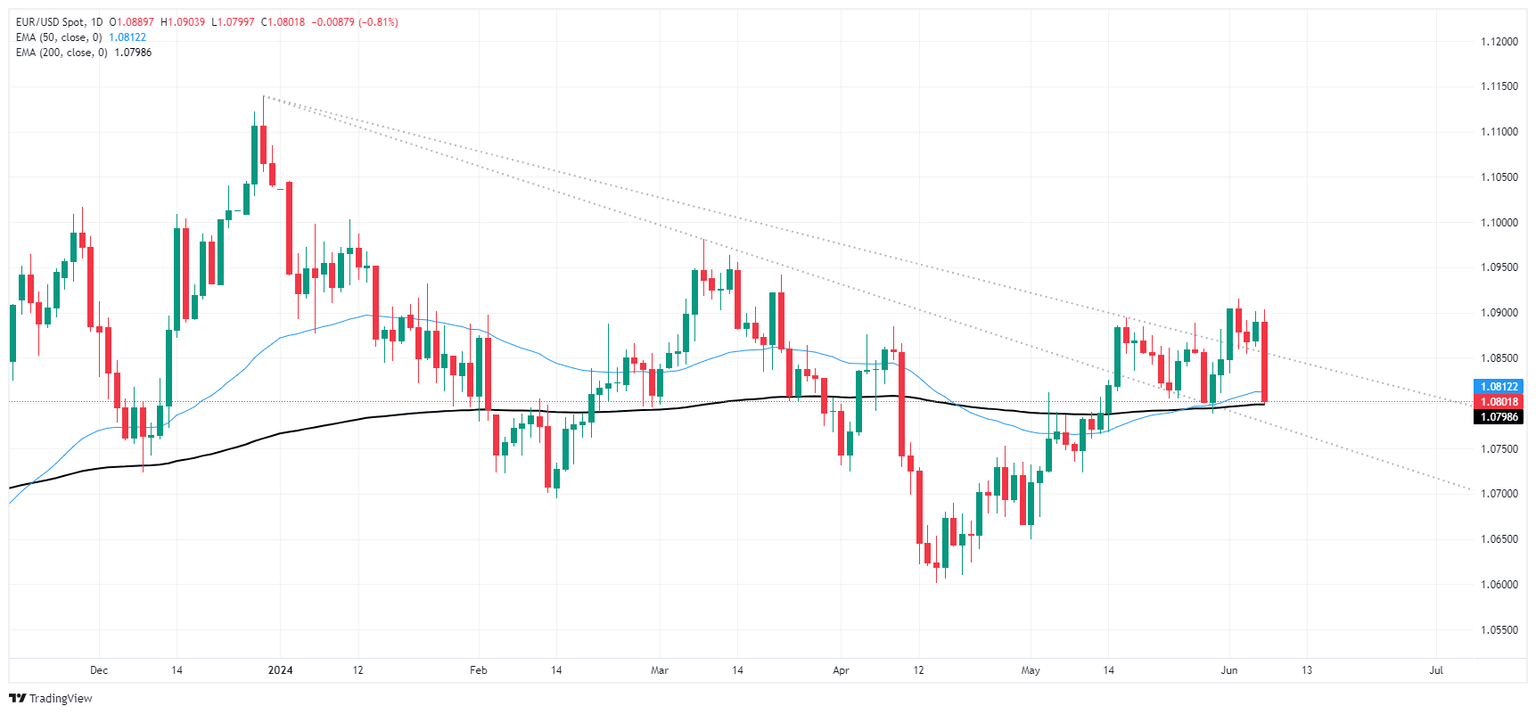

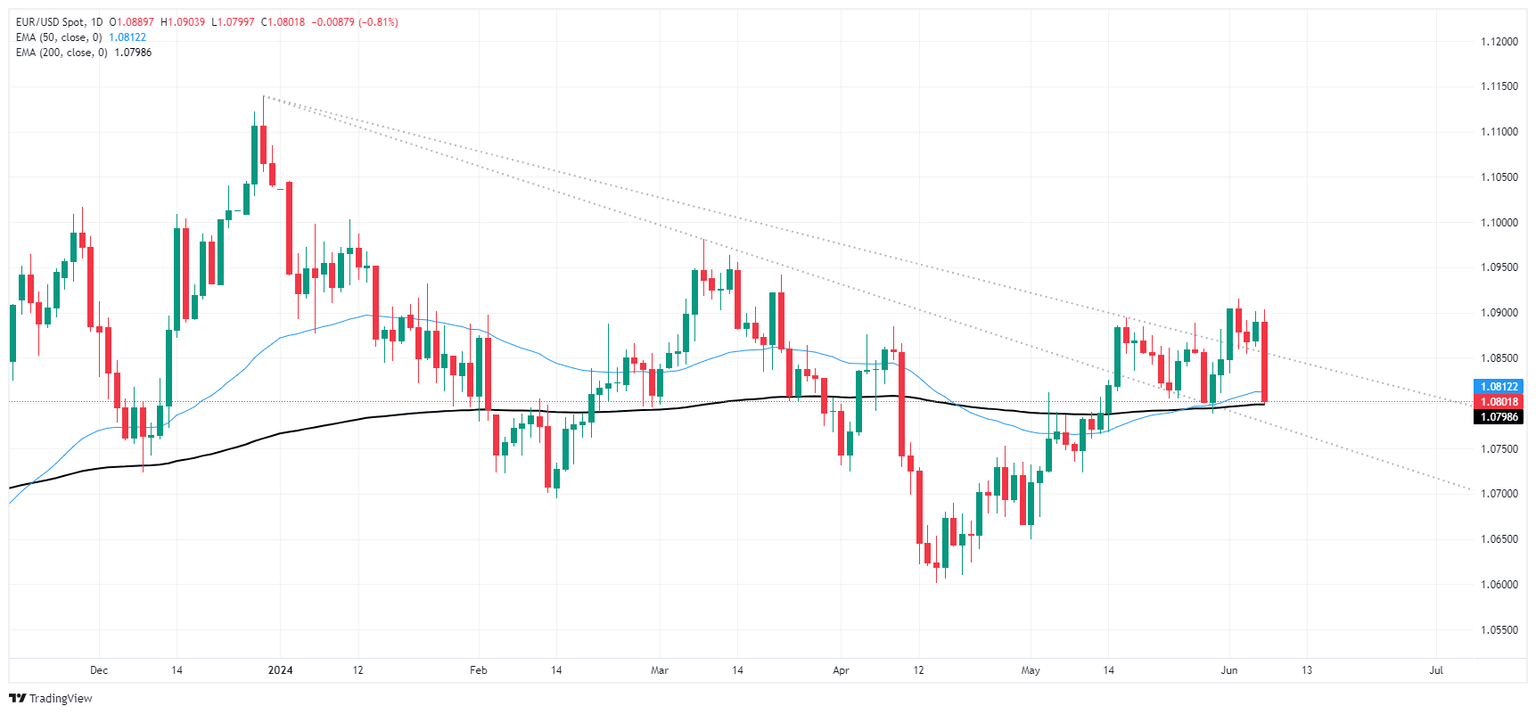

EUR/USD technical outlook

Friday’s steep tumble has forced the Fiber back into familiar technical congestion, knocking the pair down nearly a full percent peak-to-trough on the day. The pair has fallen from 1.0900 to the 1.0800 handle, with the pair backsliding into the 200-day Exponential Moving Average (EMA).

Bidders will be looking for a technical rebound off of key technical levels next week, but a near-term collapse into a declining trendline setup might see bids slip further towards 1.0750 before buyers can hit the brakes and take another run at the topside.

EUR/USD hourly chart

EUR/USD daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.