EUR/USD pinning for 1.06 as markets go risk-on post-US Retail Sales

- The EUR/USD is climbing for Tuesday after risk appetite in the broader markets returns.

- A clean beat for US Retail Sales figures is seeing investor sentiment improve, taking the USD lower.

- The Euro is getting pushed higher in the broad-market Greenback slump, heading back into 1.0600.

The EUR/USD firmly in the green for Tuesday after US Retail Sales beat market expectations and saw upside revision to previous figures, sending investor risk appetite into the ceiling and sending the US Dollar (USD) broadly lower, bolstering the Euro (EUR) and taking the EUR/USD up from the day's early low of 1.0532 and sending it within inches of the 1.0600 major handle.

Headline US Retail Sales figures for September broadly beat median market forecasts of 0.3%, printing at 0.7% and seeing an upwards revision in the previous month's reading from 0.6% to 0.8%.

US Retail Sales rose 0.7% in September vs. 0.3% anticipated

Earlier on Tuesday the EU's ZEW Economic Sentiment Survey also soundly beat expectations, coming in at 2.3, soundly beating the forecast -8 and marking in a full bounceback from the previous print of -8.9.

Market sentiment has gone full risk-on, sending the Greenback down across the board and bolstering the EUR/USD back into levels that the currency pair initially lost a hold of following last week's risk-off souring.

Coming up next on Wednesday will be European Harmonized Index of Consumer Prices for September, where the headline monthly figure is forecast to hold steady at 0.3%.

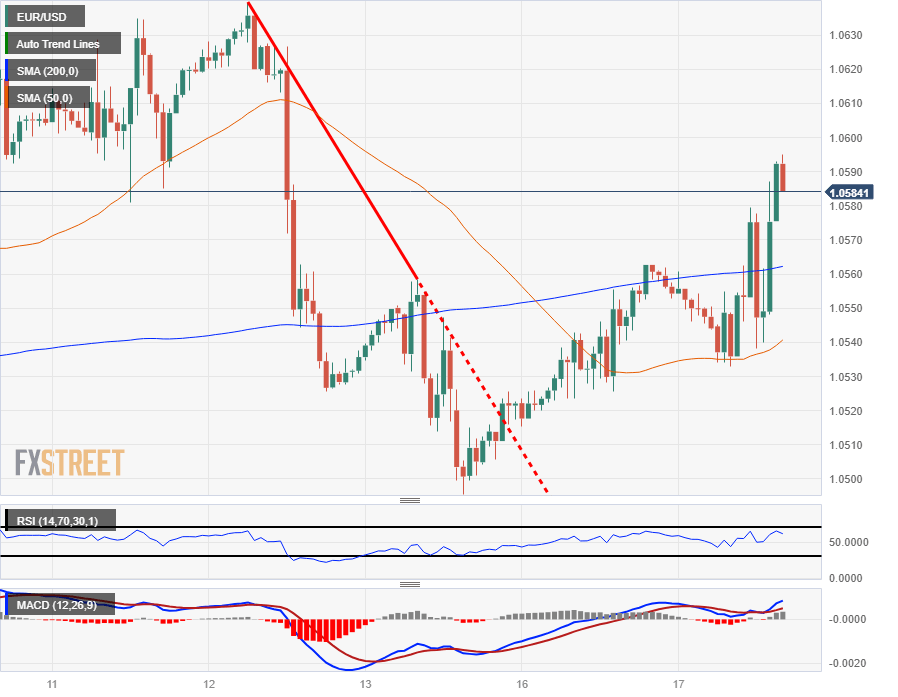

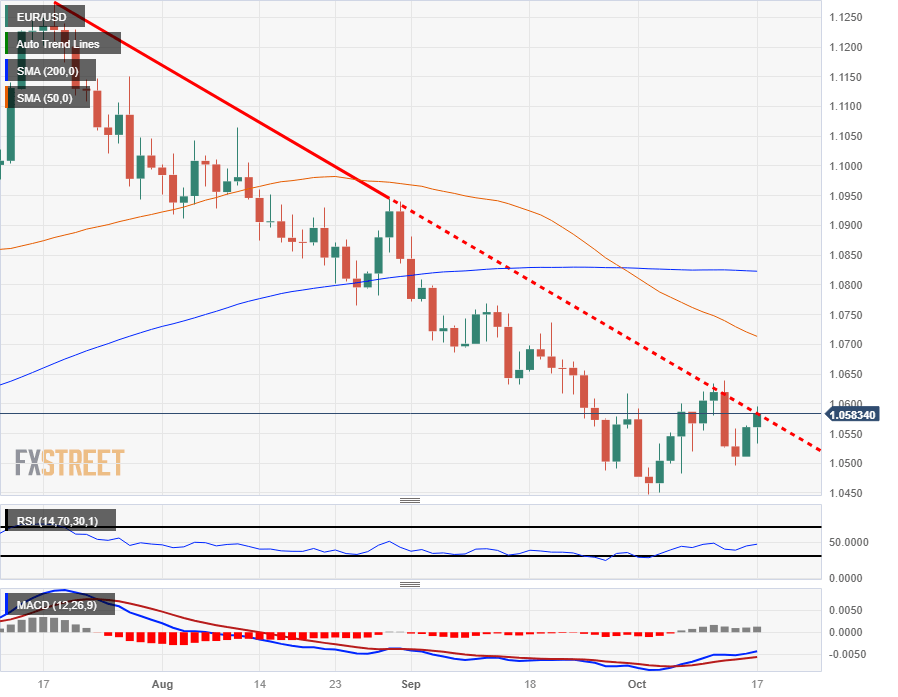

EUR/USD Technical Outlook

Intraday action for the EUR/USD sees the pair busting out of recent price levels, clearing over the 200-hour Simple Moving Average (SMA), but an overextension could quickly see near-term bids strung out in no-man's-land with little technical support.

Near-term price action is closing in on a heavy support/resistance zone from 1.0600 to 1.0620, while intraday swings are providing an intraday higher-lows support pattern.

Tuesday's reaction bid sees the EUR/USD re-challenging a descending trendline from 1.1250, and the EUR/USD remains firmly bearish, trading well below the 50-day SMA which is settling into 1.0700, forming technical resistance for any bullish breakouts.

EUR/USD Hourly Chart

EUR/USD Daily Chart

EUR/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.